Column: Republicans attacking student loan relief as a taxpayer burden got their own degrees on taxpayers’ dime

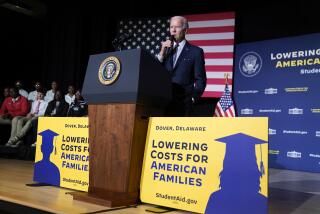

President Biden’s student loan relief proposal, including a freeze on payments through the end of the year and forgiveness of $10,000 to $20,000 in loan balances, has elicited predictable cries of outrage from Republicans.

They’ve been assailing the plan as an undue burden on American taxpayers.

There isn’t much to say about this argument, aside from this: They have some nerve.

We can say so because some of the loudest voices attacking the proposal are those of GOP senators and representatives who got their own university degrees courtesy of huge subsidies from taxpayers.

‘A slap in the face to working Americans.’

— Description of Biden’s student debt relief by Sen. Mitch McConnell (R-Ky.), graduate of two public universities in his home state.

They’re graduates of public state universities, generally in the era when in-state tuition at those institutions was far, far lower than it is today, even accounting for inflation. Who picked up the tab back then? Taxpayers, that’s who.

Put it all together, and one can see that the Republican chorus against student loan relief ranks as one of the most stupendous outpourings of sanctimonious, hypocritical claptrap in recent memory.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

But let’s not speak in generalities. Let’s look at specifics.

Start with House Minority Leader Kevin McCarthy (R-Bakersfield), who called the student relief plan “Biden’s debt transfer scam” and said it will fall upon “hard-working Americans.”

In 1989, when McCarthy received his undergraduate degree from Cal State Bakersfield, tuition was less than $1,300 a year, thanks to financial support from, yes, hard-working Californians.

Is canceling student debt inflationary? No, it’s good for the economy.

Adjusted for inflation, that would be about $2,800 today. Actual tuition at Cal State today is $5,742, more than twice as high.

Move on to Rep. Doug LaMalfa (R-Richvale). LaMalfa is one of my favorite California political hypocrites — he’s the guy who bellied up to the taxpayer trough with other family members to collect more than $5.5 million in federal crop subsidies while voting to cut food stamp benefits for low-income Americans.

LaMalfa tweeted that Biden’s plan “only transfers that >$300 billion payment to blue-collar workers.” LaMalfa received an agriculture degree from Cal Poly San Luis Obispo sometime in the early 1980s.

Back then, tuition at Cal Poly came to about $380 a year, obviously subsidized by blue-collar workers, among others. (We know this because a 1980 graduate, Steve Deas, has set up a scholarship allowing recipients to pay 1980 rates.)

Tuition at Cal Poly San Luis Obispo for California residents this year is $10,194.

California Republicans aren’t the only recipients of largesse from taxpayers of yore grousing about the effect of higher education subsidies on the taxpayers of today.

Senate Minority Leader Mitch McConnell (R-Ky.) calls Biden’s plan “student loan socialism” and “a slap in the face to working Americans.” McConnell received his bachelor’s degree in 1964 from the University of Louisville, a public municipal university at the time (it became part of the state university in 1969), and law degree from the University of Kentucky. Tuition at Louisville was $330 a year when McConnell was there, or about $3,200 in today’s money; it’s now $6,162 for state residents.

How about Sen. Charles E. Grassley (R-Iowa), who tweeted that Biden’s plan is “UNFAIR”? (Emphasis his.) His tweet stated, “Ppl making up to $125,000 or a couple making up to $250,000 are getting student loans paid for by everyone else who didn’t go to college or paid their own loans.”

Grassley received his undergraduate degree from Iowa State Teachers College (now the University of Northern Iowa) in 1955. Tuition during his time there was $40 per quarter, or $160 per year, about $1,775 in today’s money. Tuition for Iowa residents today is $9,411, or more than five times as much.

There are too many GOP complainers to go into their financial histories in detail, but the number of them who have attacked Biden’s program as “socialist” or “unfair” and so on but enjoyed educations subsidized by their home-state taxpayers is striking.

Canceling student debt isn’t unfair to those who have already paid off their loans. And it isn’t a giveaway to the rich, either.

A partial list would include Rep. Jim Jordan of Ohio (Ohio State University), Rep. Kevin Brady of Texas (University of South Dakota, when he was a resident), and Rep. Jim Banks of Indiana (Indiana University).

Among the sponsors of the Stop Reckless Student Loan Actions Act in April, which aimed to prohibit the president from suspending payments on student loans and canceling indebtedness, were Sens. Roger Marshall of Kansas (Butler Community College, Kansas State, University of Kansas medical school) and Bill Cassidy of Louisiana (Louisiana State University, undergraduate and medical school).

The sponsors of a more recent Republican bill that cited canceling student debt as among “harmful economic policies” by the Biden administration that have “exacerbated inflation and led to skyrocketing prices” include Reps. Patrick McHenry of North Carolina (North Carolina State University) and Jason Smith of Missouri (University of Missouri).

The tuition rates all these politicians paid as in-state students aren’t easy to retrieve from the mists of time, but we can draw some conclusions from averages of public higher education institutions going back more than a half-century.

The data, compiled from public sources by the Education Data Initiative, a team of independent researchers, show that in 1969-70, tuition and fees at public four-year universities totaled an average $358, or $2,440 in 2020 dollars.

As Paul Campos of the University of Colorado Boulder observes, the average remained at around $2,500 on an inflation-adjusted basis through the mid-1980s. For millions of working families, that was not an especially heavy lift.

A rapid increase in tuition and fees, far more than inflation, placed even public universities out of reach for millions of families — unless they took out tens of thousands of dollars of interest-bearing loans.

The harvest is the student loan crisis, in which 45 million borrowers currently owe a total of about $1.8 trillion today. Some are still paying off their student loans as they approach retirement.

Many have deferred economy-boosting investments such as homebuying, or delayed starting a family. Biden properly sees delivering relief to many of these borrowers as imperative.

Those complaining about Biden’s plan forget how the burden of paying for college has changed over the decades.

For example, tuition at the University of California, surely the gold standard in public higher education, was free from its founding in the 1860s until 1970. Among the graduates from that era were former governor and U.S. Chief Justice Earl Warren, former Los Angeles Mayor Tom Bradley and the distinguished diplomat and civil rights leader Ralph Bunche.

After 1970, however, California, like other states, began to withdraw financial support from public university systems, placing an ever-heavier burden on students through tuition and fees. Today, California’s general fund provides a mere 11% of UC’s core budget.

Here’s why you should be in favor of student loan reform, even after you struggled to pay yours off.

As recently as 2000, the University of California says, state funding for UC, including Cal Grant student aid payments, amounted to $18,840 per student, or 72% of the total cost of education. In 2020-21, the state share had shriveled to $6,450, or 35% of the cost. Students and their families, obviously, have taken up the slack. Tuition and fees for state residents come to $14,796 at UC Berkeley and $13,804 at UCLA.

The budgets of public universities started soaring in the 1970s, in part because they hired more administrators at higher salaries. Higher education institutions’ spending per student nearly doubled in inflation-adjusted terms from $16,155 per student in 1978 to $31,700 in 2018.

That should place the GOP bellyaching in context: It’s another example of its old “I got mine, too bad about you” approach to public policy.

Ask the same complainers to pay back to their taxpayers the assistance they received for their education, and they’d look at you as if you were an alien from outer space.

As for the Republicans’ argument that Biden’s debt forgiveness plan shifts the cost of higher education to the working class, it may sound plausibly unfair at first glance. Fundamentally and realistically, however, it’s nonsense.

To the extent that the forgiveness is covered out of the federal budget, it will be paid for through income taxes (either directly or over time, via debt service on federal borrowing).

Who pays federal income taxes? For the most part, the wealthy, not the working class. As the Tax Foundation documents, the top 10% of households — those with taxable income of more than $145,000 — pay 70% of all federal income taxes and the top 5% ($208,000 and more), pay 60%.

The bottom 50% of households, who report $41,000 or less in taxable income, pay only 3.1% of federal income taxes (but a much larger share of payroll taxes, which aren’t affected by student loan forgiveness).

That helps explain why Republicans are so exercised about Biden’s plan, which would concentrate financial relief on middle- and working-class families.

The Republicans don’t care about them, except as pawns in a political battle; they care about their patrons, the rich. It’s the latter who will pay for the student loan relief. Should they have our sympathy? Not after they received an enormous handout via the Republican tax cuts of 2017.

What gets overlooked in all the discussion of the student debt crisis is the value of higher education, access to which is ostensibly the goal of America’s clumsy financing system. Republicans obviously understand that value, since so many of them sought support from their home state taxpayers to acquire it.

They just want today’s generation of students and their families to pay full-price, unlike themselves.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.