Column: Here’s why the arguments against canceling student debt make no sense

The debate over the cancellation of student debt has been going on for so long in America that reiterating the arguments pro and con no longer seems necessary.

What may not be so well understood, however, is how incoherent the opposition arguments are. So we’ll focus on that.

First, a quick tour of the student loan landscape.

The alternative to cancelling student debt is to wait 20 years and then cancel it after you’ve ruined someone’s life. The government’s not going to be repaid either way.

— Marshall Steinbaum, Jain Family Institute

To begin with, the total amount of outstanding student loans for higher education has exploded over the last two decades. The sum owed by more than 45 million borrowers stands at about $1.8 trillion today, up from about $300 billion in 2000.

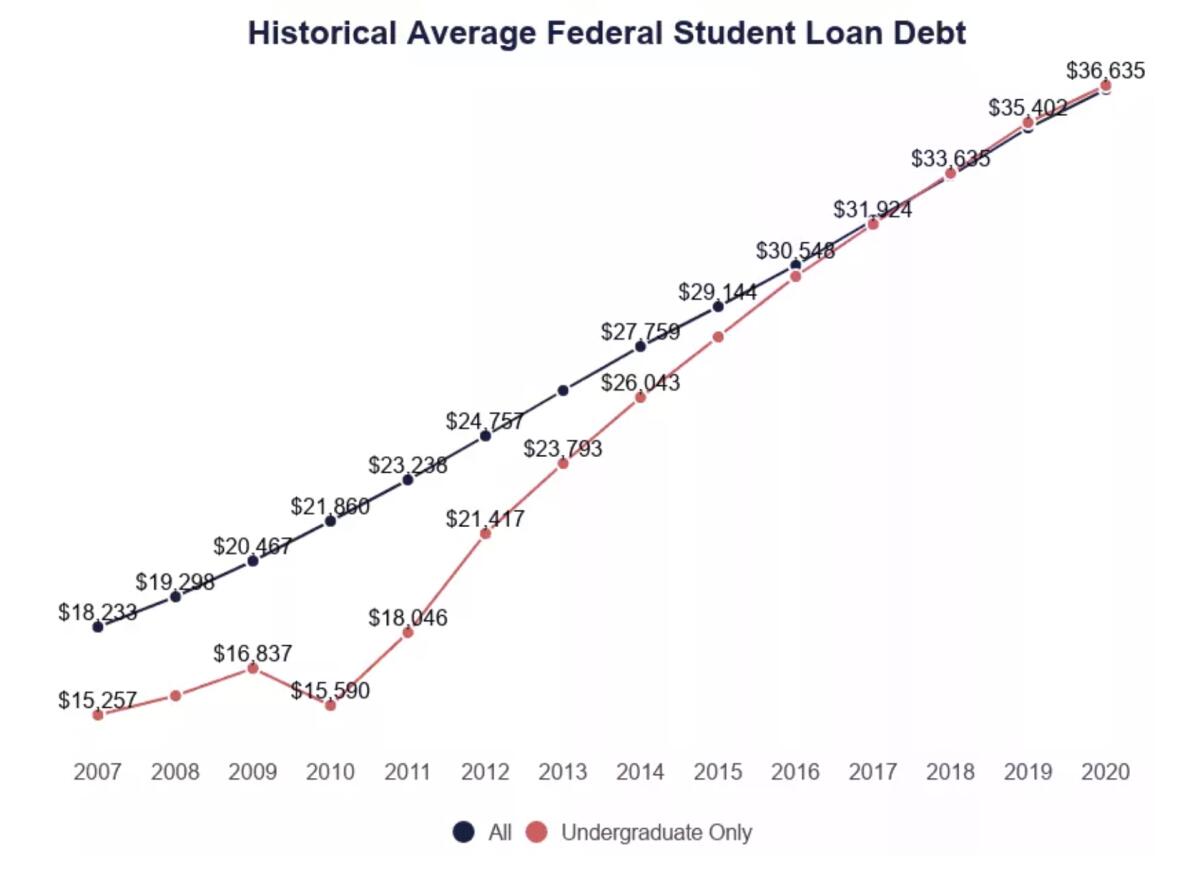

The average balance owed by students on the day they graduate has soared faster than the general rate of inflation, to more than $36,000 in 2020 from about $18,200 in 2007, according to EducationData.org. That includes graduate and professional school graduates.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Had the amount grown since 2007 at the same pace as the consumer price index it would be only $26,000 today. For undergrads, balances have grown even faster — from about $15,250 in 2007 to about $30,000 in 2020. Even students at public universities are graduating with sizable debt obligations, averaging more than $26,300.

That many borrowers struggle to repay their loans is obvious. Federal data show that more than a third of all borrowers owe more on their loans 12 years after graduation than they originally borrowed due to the compounding of interest. In this category as in virtually every other, Black students are burdened the most — 66% of them owe more after 12 years than on commencement day.

Obligations on this scale not only are a drag on economic growth — households burdened by high student debt tend to delay or forgo homeownership and face difficulties in starting a family or building up savings — but also mock Americans’ most cherished assumptions about the value of higher education.

There should be nothing controversial about canceling student debt

“The whole premise of the main higher education industry is that a college degree pays off,” says Marshall Steinbaum, an expert in higher education finance at the Jain Family Institute. “A substantial cancellation would belie that idea because why would we cancel all this debt when we said your incomes would go up enough to repay it?”

With these factors simmering on the front burner, pressure on the Biden administration to cancel sizable balances of student debt has intensified.

The Trump and Biden administrations already gave borrowers a great deal of relief by placing all federally backed student loans (well more than 90% of the total) in forbearance during the pandemic, that is since March 2020. From then through this August, borrowers don’t have to make principal payments on those loans and interest doesn’t accrue on the unpaid balances.

Analysts at the Committee for a Responsible Federal Budget, an aerie for deficit hawks, have estimated that the repayment pause was tantamount to granting the average borrower $5,500 in debt cancellation as of May 1. For some reason, the committee thinks this is scandalous.

Anyway, during his presidential campaign, President Biden endorsed canceling up to $10,000 in debt per borrower. Democrats in Congress, notably Sen. Elizabeth Warren of Massachusetts and Senate Majority Leader Charles E. Schumer of New York, are pressing for cancellation of as much as $50,000.

Now let’s look at the most common arguments against student loan cancellation and examine why they don’t hold water.

First up is the argument that canceling existing debt would be unfair to all those who already paid off their loans. As I’ve explained in the past, this is the argument from pure selfishness and a formula for permanent governmental paralysis.

It’s a favorite among conservatives and those whose comfortable affluence makes them insensitive to the burdens of others. Back in 2020 GOP operative Matthew Dowd remarked in a since-deleted tweet, “I paid for my college by working and i took out student loans which I paid back in less than ten years by scrimping on other things. Why is it fair that we just cancel all student loan debt?”

Similarly, in responding to a survey of economists conducted that year by the University of Chicago, David Autor of MIT commented, “Alongside my kids’ student loans, I’d like the government to pay off my mortgage. If the latter idea shocks you, the first one should too.”

The truth, of course, is that in a healthy society government policy moves ahead by taking note of existing inequities and striving to address them. Following the implications of the “I paid, why shouldn’t you” camp to their natural conclusion means that we wouldn’t have Social Security, Medicare or the Affordable Care Act today.

Those programs were all designed to relieve Americans of what Franklin Roosevelt called “the hazards and vicissitudes of life.” Is it really sensible to say that we shouldn’t have them because before their enactment seniors were left to starve and suffer illness without assistance, and some families needed to buy health coverage in an individual market that was closed to those with medical conditions or grotesquely overpriced?

Here’s why you should be in favor of student loan reform, even after you struggled to pay yours off.

As Warren responded during her 2020 presidential campaign to a voter who raised this objection, “Look, we build a future going forward by making it better. By that same logic, what would we have done, not started Social Security because we didn’t start it last week for you or last month for you?”

That we’re hearing this argument more these days may have something to do with general economic inequality. As economist Benjamin Friedman has written, “America has made progress mostly when living standards for the majority of the nation’s citizens are advancing.... The opposite has been true when incomes have stagnated or fallen.”

The latter environment, Friedman observed, produces “intolerant, anti-democratic and ungenerous behavior — racial and religious discrimination, antipathy toward immigrants, lack of generosity toward the poor.”

Sound familiar?

It’s proper to remember that higher education was not always as expensive or economically exclusive as it is today. Tuition at the University of California was free from its founding in the 1860s and reaffirmed in the state’s 1960 master plan for public higher education, which acknowledged the university’s role as a driver of economic growth.

Raising the instructional costs for students, the master plan said, would negate “the whole concept of wide-spread educational opportunity made possible by the state university idea.”

Free tuition disappeared in 1970, when an “education fee” — tuition by another name — was instituted at $150 a year. The system and state never looked back. UC tuition today is $13,104 for residents and $44,130 for nonresidents, and constitutes the “largest single source of core operating funds” for the university.

While it lasted, free tuition at UC was a source of immeasurable intellectual wealth for the state. Among those who partook of the system were former governor and U.S. Chief Justice Earl Warren, diplomat Ralph Bunche, the late L.A. Mayor Tom Bradley, and writer Maxine Hong Kingston, all children of low-income families.

Let’s bring back the idea of a free UC education

If UC were to reinstitute free tuition — a change that would cost about $5.3 billion based on this year’s university budget — would all those who had to pay for their UC education think they had been rooked? Or would they look ahead to the gains for the state more generally?

The second major argument against debt cancellation is that it would disproportionately benefit the rich. The foundation of the argument is that wealthier households carry more debt than low-income households, so they would gain more from reducing their balances. In other words, cancellation would be regressive.

This notion has been effectively debunked by scholars at the Brookings Institution and the Roosevelt Institute. Those from the latter calculate that “the largest share of debt cancellation dollars goes to people with the least wealth.”

Specifically, the average person in the 20th to 40th percentiles for household assets would receive “more than four times as much debt cancellation as the average person in the top 10%, and twice as much debt cancellation as people in the 80th to 90th percentiles.”

(For reference, according to the Federal Reserve, average net worth for households in the 20th to 40th percentile range is about $6,368 to $67,470; the 80th percentile starts at $558,200 and the 90th at $1.2 million.)

The Roosevelt Institute’s experts observe that the notion of a big giveaway to the wealthy is based on calculating the effect of cancellation only on borrowers at every wealth level, rather than basing the calculation on all households.

That makes cancellation appear to be regressive because “high-income and high-wealth households that carry student debt tend to carry it in large quantities.” Most of those households, however, have no student debt, so the benefits of cancellation to rich households overall are relatively small.

A federal magistrate has blocked the U.S.

Under Warren and Schumer’s proposal, the Roosevelt Institute says, estimated debt cancellation of $50,000 would come to only $562 per person, including non-borrowers, in the top 10% of households. But it would come to $17,366 per person for all Black households and $12,617 for white households in the bottom 10% for net worth.

Andre Perry and Carl Romer of Brookings, in collaboration with Steinbaum, demonstrated last year that student debt cancellation would help to narrow the wealth gap between Black and white households.

In part that’s because Black families are more likely than white families to finance their higher education with debt. As a result, student loans become yet another obstacle to wealth creation by Black families, as is seen by the fact that “Black people with a college degree have lower homeownership rates than white high school dropouts.”

White families have greater capability than Black families to fund tax-advantaged college savings accounts such as 529 accounts from current income, another factor that forces Black families into college debt.

The most overlooked factor in student debt is that some portion of it is destined to be forgiven anyway, just not immediately or all at once. Those are balances subject to income-driven repayment plans, in which about one-third of all borrowers are enrolled. Those plans set payments at a given percentage of the borrower’s income and provide for cancellation of any remaining balance after 20 or 25 years (depending on the program and the nature of the loan).

IDRs, as they’re known, have been around since the 1990s. They aren’t more popular because they haven’t been adequately marketed and are still optional; advocates say they should be made the default choice for all borrowers. Because the required payments often are not enough to cover accruing interest, the loan balances tend to increase over time until the cancellation date is reached — a prospect that may discourage some borrowers from signing up.

Yet the implications of IDRs is almost universally overlooked in the student debt debate.

These plans are “de facto student debt cancellation,” Steinbaum told me. With IDRs, he notes, “the alternative to canceling student debt is to wait 20 years and then cancel it after you’ve ruined someone’s life. The government’s not going to be repaid either way.”

That should place the debate on a different footing. Government policy aimed at steering more borrowers into income-driven repayment amounts to an acknowledgment that its loans will be, and should be, canceled. So why wait? Let’s do it now.

The longer the debate drags on, the longer the student debt overhang will widen the gap between rich and poor and Black and white, and the more the value of higher education will come into question. That won’t be good for anybody.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.