Senate passes fix to COVID-19 payroll loan program after businesses complain about changing rules

WASHINGTON — Following complaints from business groups about changing rules and confusing guidelines, the Senate on Wednesday unanimously approved a fix to the popular Paycheck Protection Program program, which was created to help small businesses survive during the COVID-19 pandemic.

Earlier in the day, the U.S. Chamber of Commerce urged the Pandemic Response Accountability Committee — tasked with overseeing trillions of taxpayer dollars provided by Congress to prop up the economy — to push for more clarity and consistency in the program. Others warned that some business owners were worried that they may not qualify under revised rules to have the loans forgiven, as originally promised.

Chamber officials pointed out that the Treasury Department has changed the rules and guidance governing the loans repeatedly during in the past eight weeks.

“Businesses, individuals and state and local governments should be held to account for complying with the rules and guidance as they existed at the time of their action, not as subsequently modified,” said Neil Bradley, the chamber’s chief policy officer.

Under the new Senate fix, which had previously been passed by the House, many of the business owners’ concerns will be addressed. It will give businesses up to 24 weeks to spend the money before having to pay it back. The previous regulations written by Treasury and the Small Business Administration gave them just eight weeks to spend the money, or be required to pay the loan back.

The fix also relaxes a requirement that 75% of the loan go toward payroll, lowering the threshold to 60%.

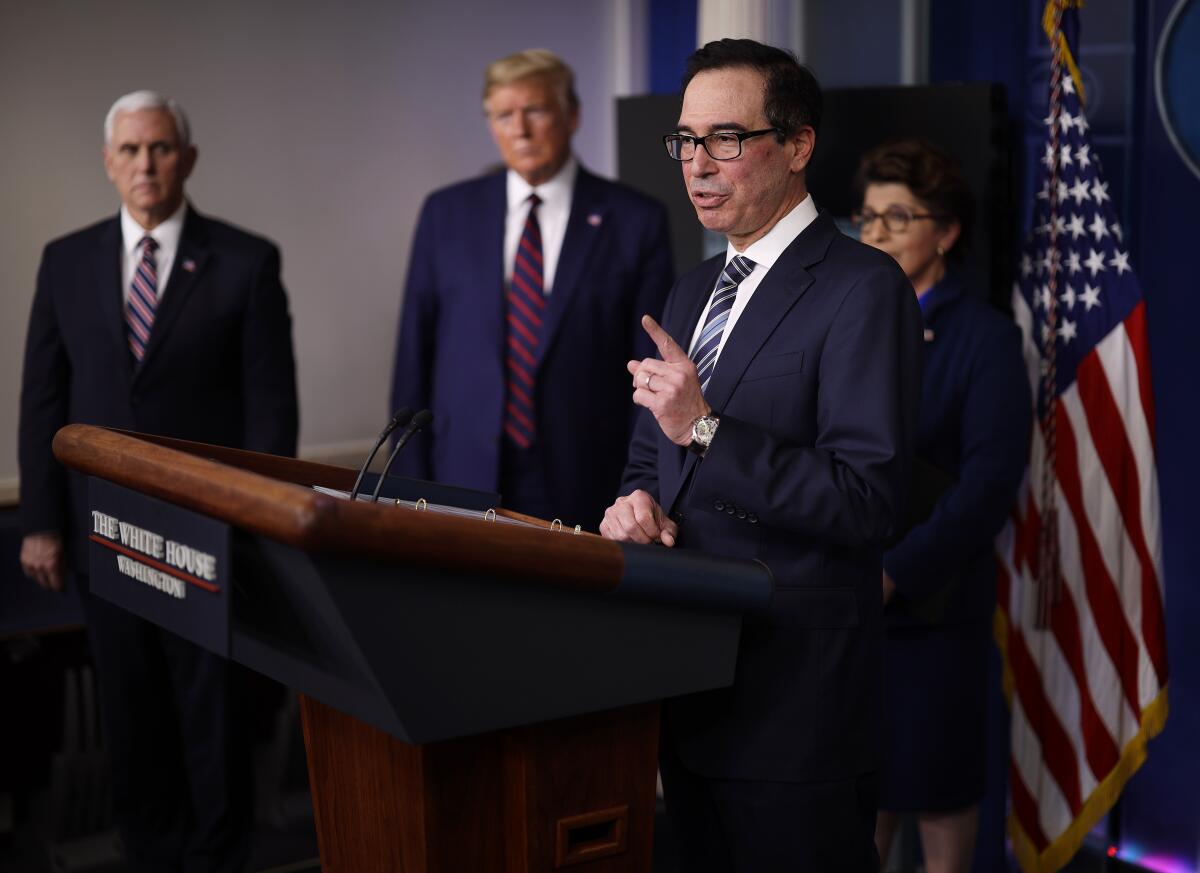

The bill next goes to President Trump for his signature.

More than two months after it was created to monitor the more than $2 trillion flowing into the economy because of the CARES Act, the committee held its first public organizing meeting Wednesday to get feedback from state and local governments, businesses, nonprofits, health experts and government watchdog groups.

Bradley urged the committee to remember when conducting its oversight that businesses, “had to make decisions in the same volatile uncertain complex and ambiguous environment” as the government did, and had to move quickly to participate in the newly created loan program without fully knowing what the rules would be and how much they might be adversely affected by the economic shutdown.

Public outrage that some large, publicly traded companies received loans worth tens of millions of dollars prompted the Treasury Department to write new rules and issue a warning that any loan of more than $2 million would be audited to determine if the company actually needed the loan, and the audits could potentially result in criminal charges.

Tony Wilkinson, president of the National Assn. of Guaranteed Government Lenders, pleaded with the committee to step in on the popular PPP loans, saying in his 30-year career he has seen nothing like the chaotic rollout of the loan program by the Treasury and Small Business Administration.

The guidance from the agencies was “fragmentary” and “let lenders fend for themselves” in crafting the application process, and in some cases was contrary to what Congress explicitly outlined as the parameters for the loans, Wilkinson said.

“Is it any wonder why borrowers and lenders are questioning whether Treasury has set everyone up to fail?,” Wilkinson said. “And you wonder why lenders have become seriously concerned about their PPP participation? And you wonder why borrowers of all sizes have been returning their loans out of a fear of their own government?”

A rush of early applications initially resulted in the Small Business Administration processing more than a million loans worth a combined $350 billion in just 14 days. Interest in the second round of aid — $310 billion that was quickly passed by Congress in April — has waned, with $120 billion still not allocated. As of May 30, 4.4 million loans have been made between both rounds of the program for a total of $510.2 billion.

The loans are supposed to be forgivable if the business maintains its staff for eight weeks. But the guidelines for having the loan be forgiven weren’t published until weeks after many businesses took the loans. Recipients and Small Business Administration Inspector General Mike Ware have sounded the alarm over a requirement that 75% of the loan go to payroll expenses, rather than rent or other overhead costs, and that the total amount must be spent within eight weeks. In a report released May 8, Ware warned that thousands of loan recipients will not be able to meet that standard, which was not required by Congress under the CARES Act.

Wilkinson told a story of a small business that helps veterans suffering from post-traumatic stress disorder that received a $27,000 loan and worried that it may not qualify for loan forgiveness. The business owner, who faced the prospect of closing and still being required to pay back the loan, referred to the program as a “devil knocking on the door when we were down, and unfortunately we let him in,” Wilkinson said.

Tim Delaney, president of the National Council of Nonprofits, also expressed dismay at the “moving goal posts” governing the loans.

“What will be we be held against? Because when we signed the document on a certain day, that’s what ought to apply, as opposed to these moving standards,” Delaney said.

The committee has begun ramping up its oversight activities, but still lacks a leader. It had selected acting Defense Department Inspector General Glenn Fine to take the helm, but he became ineligible to serve when President Trump nominated a permanent replacement.

Justice Department IG Michael E. Horowitz, who is tasked with selecting the leader, holds the position in an acting capacity. A spokeswoman for Horowitz has not responded to repeated questions about when a new chair will be chosen.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.