Column: Are Republicans who got pandemic debt relief hypocrites for complaining about student debt relief? Yes

You may have noticed over the last few days that the political world is in an uproar over President Biden’s dispensing of student debt relief.

It’s not so much that Biden implemented the relief program at all; what got politicians and pundits in a tizzy was that he called out the GOP naysayers in the House by pointing out that many of them had received business loans via the pandemic-era Paycheck Protection Program, or PPP, that had never been paid back.

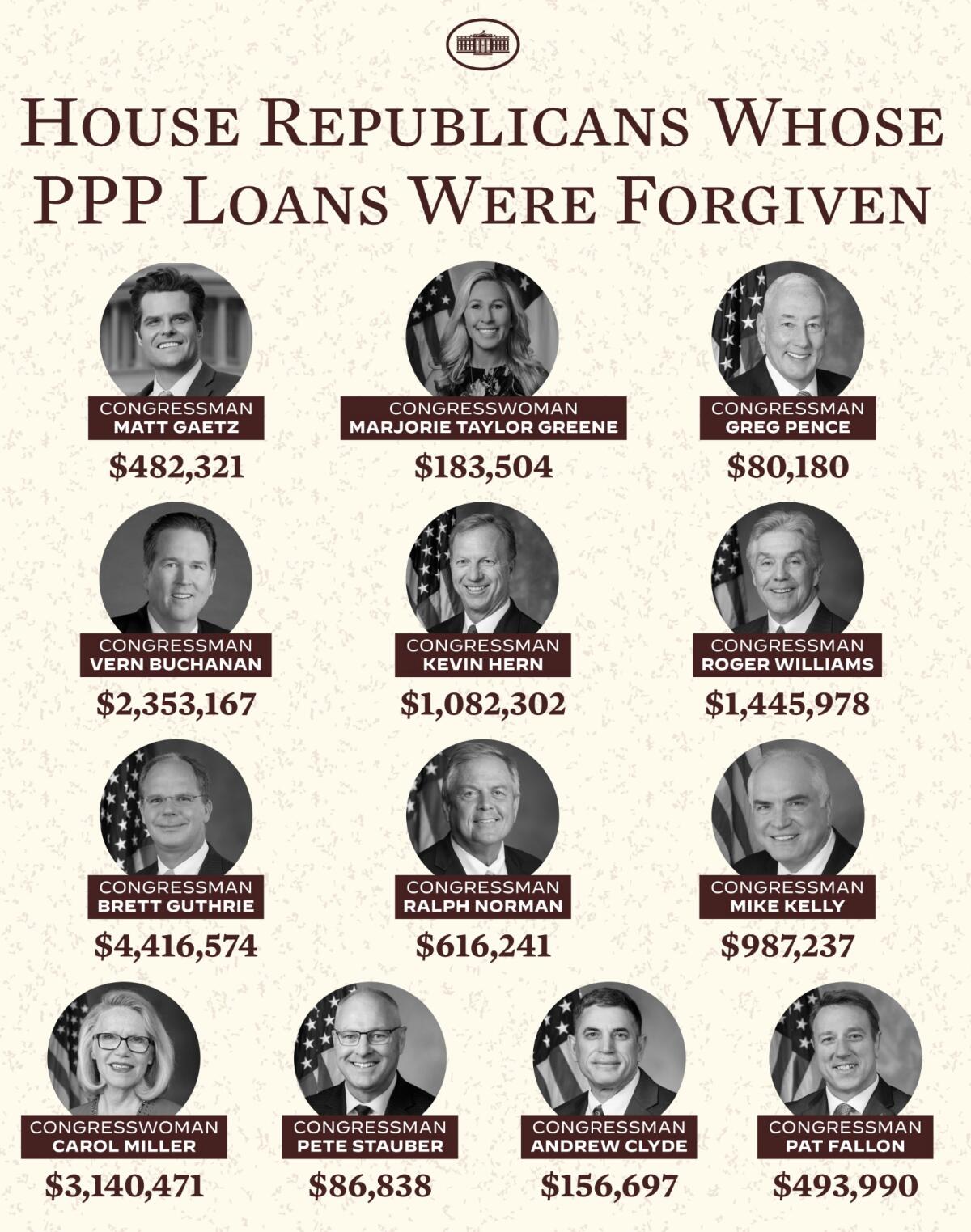

The White House tweeted out the forgiven PPP balances of 13 GOP House members critical of student loan relief, under the heading, “This you?”

The PPP helped people remain employed while the government literally shut down much of the economy,. Only an intellectual clown would compare that to what Biden is doing now with student loans.

— Rep. Ralph Norman, R-S.C., recipient of $616,241 in pandemic relief

That’s a really unfair comparison, the argument goes, because the PPP loans were never intended to be paid back. Under the program’s terms, the loans would be forgiven if the money was used to support the workers of a small business that had been forced to close or curtail operations because of pandemic restrictions.

In other words, it’s said, the PPP money was never expected to be repaid. By contrast, student loans were taken out in full expectation that they would be repaid — if not for the handouts being distributed by the White House.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

“The PPP helped people remain employed while the government literally shut down much of the economy,” Rep. Ralph Norman (R-S.C.), tweeted back in 2022, the first time Biden made this purportedly invidious comparison. “Only an intellectual clown would compare that to what Biden is doing now with student loans.”

Norman received $616,241 from the PPP, according to the White House.

There’s something to be said for the distinction made by the PPP-pocketing student relief critics, but not nearly as much as they claim. More on that in a moment.

This is just another example of how our political press is incapable of telling the forest from the trees, or how it’s perennially distracted by a shiny object. (Insert your own pertinent metaphor here.)

In this case, the shiny object is the idea that it’s Biden who is the hypocrite for comparing the PPP loans to student debt. This misses the bigger picture of how America’s economy is structured to benefit corporations and the wealthy — that is, the patrons of the Republican political establishment — at the expense of average Americans. The pundits who are flaying the White House for making the connection are merely buying a GOP talking point.

Not only right-leaning commentators are committing this error. Not a few progressive-minded writers are complicit. Here, for instance, is Jordan Weissmann of Semaphor, usually a percipient analyst of economics and finance: “The thing about this talking point is that I know everybody in the White House, including the [communications] shop, is smart enough to know how disingenuous it is.”

Inflation is down sharply, employment is holding steady and GDP is growing. But Americans are still blaming Biden for a lousy recovery.

Let’s take a closer — and a broader — look.

The comparison between student debt relief and the PPP loans first emerged in 2022, when Biden first announced his plan to forgive up to $20,000 in student debt for households with incomes of up to $125,000. The White House then issued a series of tweets targeting GOP critics of student debt relief whose PPP loans had been forgiven.

The Supreme Court invalidated Biden’s original proposal in 2023. Chief Justice John G. Roberts Jr. wrote for a 6-3 conservative majority that although the law gave the secretary of Education the authority to “waive or modify” the terms of student loans, the White House had gone too far.

After that, the administration implemented a new program, the SAVE plan, that limited monthly repayments on student debt for most borrowers to as little as 5% of their income and ended payments for borrowers living near or below the federal poverty standard. After as little as 10 years, the balance on loans originally totaling $12,000 or less will be permanently forgiven.

The issue erupted again a few days ago when Biden announced new features of his student relief program. They included waiving some accrued interest for borrowers whose balances had grown higher than their original debt, generally because their payments hadn’t covered the accumulated interest — an issue that affects more than one-third of all student borrowers, and two-thirds of Black borrowers.

For the record:

12:22 p.m. April 17, 2024An earlier version of this column incorrectly identified Rep. Andrew S. Clyde (R-Ga.) as a Democrat.

Critics, again mostly Republicans, weighed in again with tendentious lectures on social media about the moral imperative of meeting one’s obligation to pay back a loan.

Rep. Andrew S. Clyde (R-Ga.), for instance, tweeted that Biden’s latest initiative, which will relieve student borrowers of about $7.4 billion in principal and interest, would “transfer millions more in student debt onto the backs of hardworking taxpayers.” Clyde called it “nothing more than a desperate attempt to buy votes with Americans’ hard-earned money.”

Clyde’s $156,597 PPP loan was forgiven.

That brings us back to the hypocrisy issue. It’s true that students who took out education loans are expected to repay them, and that businesses that took out PPP loans were led to believe that they would be forgiven — as long as they were used to support their payrolls through business closings and cutbacks.

But things are not so simple. Critics of Biden’s plan argue that the PPP loans were designed to address an acute economic disaster, which isn’t the case with student loans.

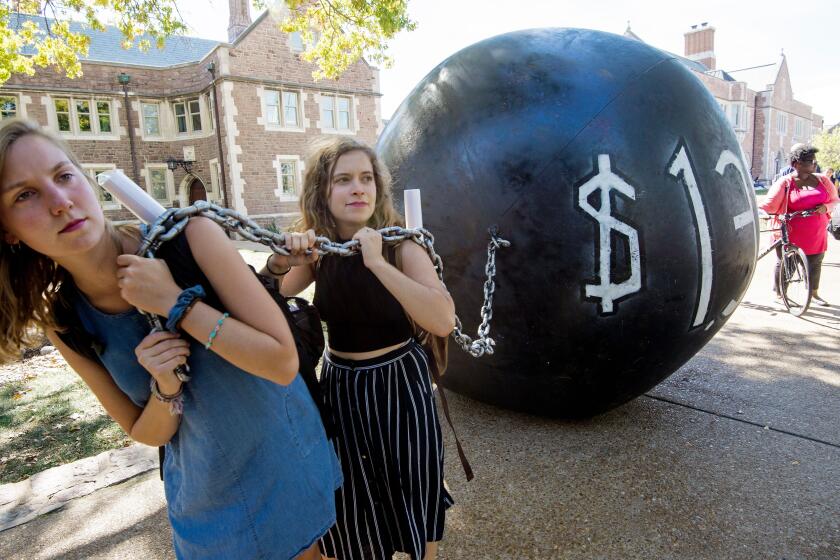

The student loan burden, however, has become an economic disaster. The total amount of outstanding student loans for higher education has ballooned over the last two decades to almost $1.8 trillion today, up from about $300 billion in 2000. Those loans are carried by about 43 million borrowers.

Conservatives says student debt relief is too expensive, but a new Congressional Budget Office estimate shows it’s a pittance.

The burden has grown in part because the cost of higher education has exploded. That’s so even at public institutions: In 1970, the average tuition at public four-year universities was $358, or about $2,958 in today’s money. Since then, public university tuition and fees have grown to the point that working families can’t afford them without borrowing.

At UCLA and UC Berkeley, those annual costs come to $13,401 and $14,395 for state residents, respectively. It’s proper to note that the University of California was free to Californians until tuition charges were introduced under Gov. Ronald Reagan in the 1970s. Among the beneficiaries of the old system were former governor and U.S. Chief Justice Earl Warren, diplomat Ralph Bunche, L.A. Mayor Tom Bradley, and writer Maxine Hong Kingston, all children of low-income families.

Public university students today accumulate an average of $32,637 to receive a bachelor’s degree. The overall average of student debt reached $37,600 in 2022, more than double the average in 2007.

The economic implications of this burden are inescapable. Households burdened by high student debt often delay or forgo homeownership and face difficulties in starting a family or building up savings. The debt load also contradicts Americans’ cherished assumptions about the value of higher education.

“The whole premise of the main higher education industry is that a college degree pays off,” Marshall Steinbaum, an expert in higher education finance at the Jain Family Institute, told me in 2022. When some people are still paying off their student loans as they approach retirement, that premise loses some of its oomph.

As for the PPP, it was nothing like the unalloyed boon that its GOP defenders portray. The members of Congress who snarfed up loans by the six or seven figures (Rep. Brett Guthrie (R-Ky.) tops the list of those called out as hypocrites by Biden with $4.4 million in forgiven loans) are beneficiaries of a program they themselves voted for.

Of the 13 on Biden’s list, three (Marjorie Taylor Greene and Clyde of Georgia and Pat Fallon of Texas) hadn’t yet been elected when the PPP came up for a vote in April 2020; another, Mike Kelly of Pennsylvania, didn’t cast a vote. All the others on the White House roster voted in favor. The measure passed the House 388 to 5. Representatives and senators could have exempted themselves from the PPP benefits, but they didn’t. Then they lined up for the goods.

Republicans who got their COVID loans forgiven claim it’s immoral not to pay your debts.

Were the PPP funds invariably used as they were supposed to? There’s reason to be skeptical. Greene, who received a $182,300 PPP loan in April 2020 for her family construction business, donated $250,000 to her own congressional campaign the following June and August. The government subsequently forgave $183,500, including interest.

Did any of those donations come from the PPP? We’ll never know, because days before Biden took office, the Small Business Administration deleted almost all the database red flags designating potentially questionable or fraudulent loans subject to further review. That’s according to the Project on Government Oversight, a watchdog group that based its findings on a government database.

As many as 2.3 million loans, including 54,000 loans of more than $1 million each, thus may have received a free pass. The red flags included signs that a recipient company had laid off workers or were ineligible to participate in the program.

The SBA’s inspector general’s office later disclosed that it had “substantiated an unprecedented level of fraud activity” in the PPP program, but said the mass closeout, as well as the SBA’s habit of forgiving loans before reviewing them for potential fraud, would hamper the agency’s ability “to recover funds for forgiven loans later determined to be ineligible.”

A larger problem in the haste by politicians and pundits to flay Biden for his defense of student loan relief is that their view is too narrow. As I reported in 2022, many of the politicians wringing their hands over how student loan relief burdens ordinary taxpayers received their higher education courtesy of ordinary taxpayers — by attending public institutions at a time when they were overwhelmingly tax-supported.

That’s not all. Republican fiscal policies are almost invariably aimed to benefit corporations and wealthier Americans. The 2017 tax cuts are a perfect example. The richest 20% of Americans received nearly 64% of the tax benefits. The top 1% received a reduction in their average federal tax rate of 1.5 percentage points, worth an average $32,650 a year; the lowest-income 20% got a tax rate reduction of 0.3 of a percentage point, worth $40 a year.

Student debt relief, however, overwhelmingly favors low-income borrowers. According to a 2022 study done for Sen. Elizabeth Warren (D-Mass.), $10,000 in student debt cancellation would reduce the share of people with debt by one-third among the lowest-income 20% and by one-fourth for households among the next 20%. But it would make almost no difference for the richest 10%.

Debt cancellation also would reduce racial gaps in household economics. A $10,000 debt reduction would zero out loan balances for 2 million Black families, the study said, reducing the share of Black individuals with student loans to 17% from 24%.

In other words, student debt relief is a boon for the most economically vulnerable American households. That can’t be said of the PPP program, and certainly not for the GOP tax cuts.

The debate over whether it’s “fair” to juxtapose student debt relief with the millions pocketed by GOP representatives and their patrons is, indeed, a story of hypocrisy. But the hypocrisy is not where our political press has claimed to find it. They should pay attention to what really drives conservatives to hate student debt relief so much.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.