Column: Political Road Map: To know whether California’s budget will balance, watch this month’s tax collections

Here’s a nifty, if not mind-blowing, way to think about all the tax dollars showing up right now in Sacramento: Over the past week, California collected about $8 billion in state income taxes — more money in just a handful of days than New Mexico’s general fund receives in an entire year.

And yet, the sobering reality is that we need a lot more.

By this time next week, advisors to Gov. Jerry Brown will have the final pieces of the puzzle needed to craft the revised budget plan he’ll submit to the Legislature in about three weeks, with an enacted budget due by June 30.

Income taxes are the primary fuel of state government, and no month fills the tank quite like April. Californians are expected to pay $14 billion in income taxes this month, more than one-eighth of the fiscal year’s total take.

While these dollars count toward the budget that lawmakers enacted last year, they still have a major impact on this year’s negotiations. Even before the month began, the state Department of Finance reported that total revenues were $1.15 billion ahead of the official forecast.

Compare that to Brown’s January prediction of a $1.6-billion deficit by next summer and you start to see how simplistic snapshots of tax revenue often spark intense political debates.

It’s also why watching April’s daily income tax collections has become an annual ritual at the state Capitol. Budget politics can be completely upended by this one month, the biggest tax-collecting month of the year. In 2006, a $450-million spring income tax windfall was attributed to the sale of stock options by as few as 14 executives at Google. Unexpected boom times for the budget also arrived after Facebook went public in 2012.

But in other years, April laid bare the downside of the revenue roller coaster. And when high-income taxpayers failed to earn big money on Wall Street investments, there were often angry clashes over the inevitable budget cuts. The feast-or-famine nature of how Tax Day treats the wealthy helped Brown persuade voters to strengthen the state’s rainy day fund in 2014. Now, a portion of high-income earners’ tax windfalls must be socked away for future use or debt payments.

Political Road Map: California voters have put a lot of state budget choices on autopilot »

The new rules make the political wrangling over California’s budget a bit more tricky, as politicians and interest groups quarrel as much over the future as the here and now. Some lawmakers argue that Brown is being too cautious about the California economy, and insist more programs can be better funded because a whole year’s worth of revenues will come in higher than predicted by a relatively cautious governor.

Still, the uncertainty that comes with heavily relying on Californians’ paychecks and dividends explains why some pent-up desire remains to broadly revise the tax system. The personal income tax became the top dog in California’s budget a long time ago, as property tax growth was capped and the economy shifted away from the kinds of goods that are sold with sales taxes. Income taxes now make up about two-thirds of the general fund, shouldering the cost of everything from parks to prisons.

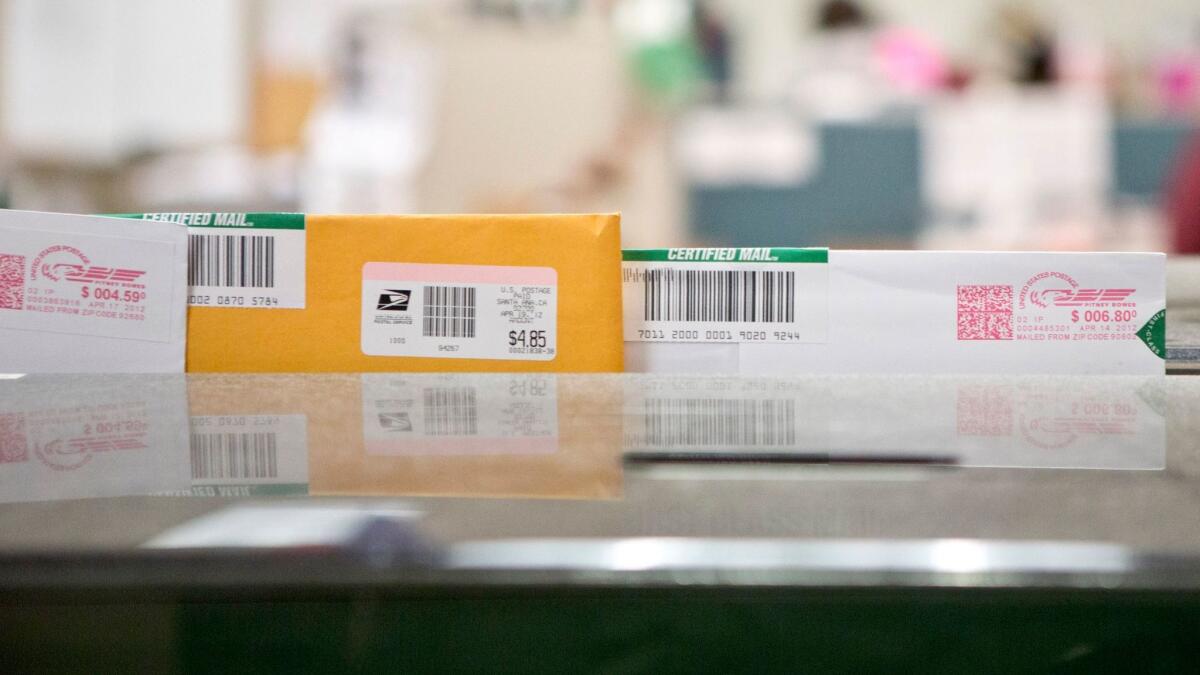

But tax reform is a hard sell — unpopular with voters when times are bad, and unpopular with lawmakers at times when budgets are relatively easy to balance. And though no one expects any huge fights over the spending plan that will be put together starting next month, the best hint of what’s to come lies inside thousands of envelopes waiting to be opened this week at the state Franchise Tax Board.

Follow @johnmyers on Twitter, sign up for our daily Essential Politics newsletter and listen to the weekly California Politics Podcast

ALSO:

Political Road Map: What does the state spend more money on, prisons or schools?

Political Road Map: School spending is on the rise, so why will some districts be cutting budgets?

Updates on California politics and government

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.