Disney may try to get even bigger to compete with merged AT&T-Time Warner

With a market capitalization of $150 billion, the Walt Disney Co. is an entertainment behemoth.

But the Burbank-based company could soon find itself in an unfamiliar position: dwarfed.

If regulators approve AT&T’s $85.4-billion acquisition of Time Warner Inc., the combined company would be far bigger than Disney and boast top-tier assets such as DirecTV, HBO and Warner Bros. That has spurred some industry observers to speculate on whether Disney might need to pursue a significant acquisition of its own in order to continue thriving in a rapidly changing media business.

“We are talking about huge scale economies,” said Laura Martin, an analyst at Needham & Co. “There is even a question as to whether Disney will be big enough at $150 billion to compete on its own.”

The company is no stranger to making bold deals.

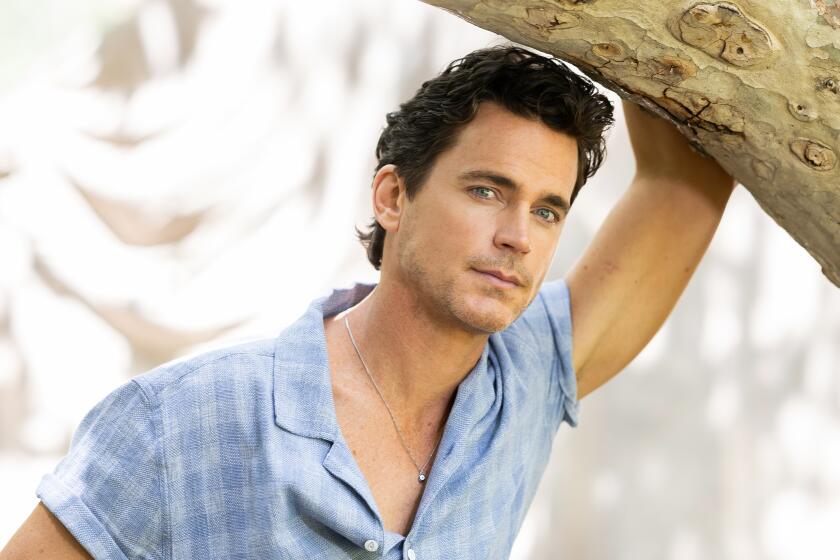

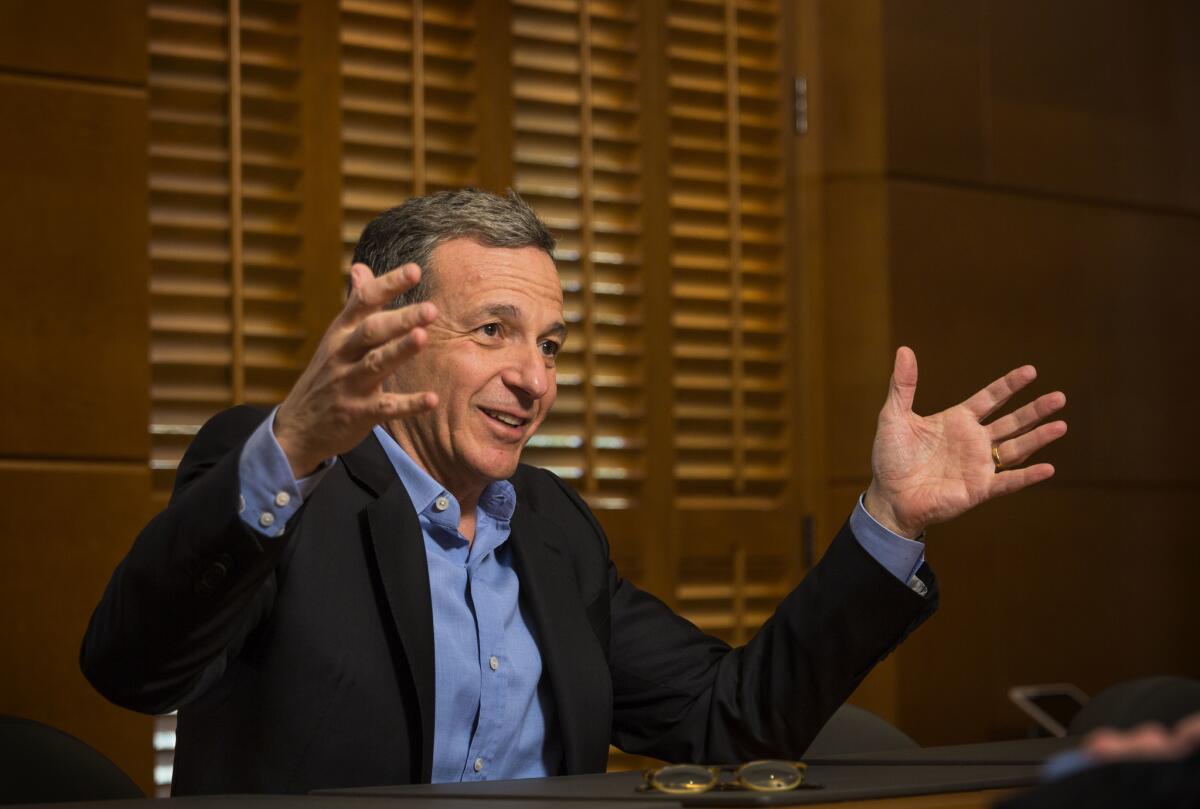

Disney’s growth during Chief Executive Robert Iger’s roughly decade-long run atop the company has been fueled in part by the purchase of content-focused firms, such as Marvel Entertainment.

Analysts and investors said that if Disney were to make a sizable acquisition, it could continue its strategy of buying companies rich in intellectual property — and not make a play for a traditional distributor, such as a cable TV provider.

“This is not the type of thing Bob Iger would do,” said Scott Krisiloff, chief investment officer at Avondale Asset Management, which is not an investor in Disney. “I think Disney is smarter than that.”

Recent activity suggests that a major move — perhaps in the technology arena — is a possibility for Disney. Earlier this year, the company’s $1-billion investment in video-streaming firm BamTech signaled its interest in beefing up its tech credentials.

Although Disney now dominates Hollywood, it could risk losing its position if it doesn’t strengthen its foothold in the growing digital ecosystem. At a time when younger people aren’t watching movies and TV shows the way their parents once did, companies like Disney need to make sure they have the ability to reach their audiences via new distribution platforms.

And there has been speculation about other prospective deals between Disney and tech-focused firms.

In September, Disney considered making an offer for Twitter Inc., which has seen its business stagnate. Ultimately, Disney did not move forward with a bid for the social media company, whose commitment to free speech has earned it a reputation as a haven for online harassment, making it a cultural mismatch for squeaky-clean Disney in the eyes of some observers.

“The fact that they even contemplated Twitter kind of indicates to me that if the right digital or content asset comes along, they are going to try to take a very serious look at it,” said Tuna Amobi, an S&P Capital IQ analyst.

Earlier this month — after the possibility of a Twitter deal began to fade — media reports and analysts seized on rumors that Disney could be eyeing a potential purchase of streaming giant Netflix. The companies already do business together: Netflix is the home of several original Disney television shows, including Marvel’s “Jessica Jones,” and offers many of the company’s films.

“If they did make any move into distribution, Netflix would be the way to do it,” Krisiloff said. “That’s something I could see Disney doing.”

But Disney has not said it is interested in buying Netflix, which is valued at $55 billion. And Amobi was skeptical that Netflix, whose stock price has soared over the last month after a strong third-quarter earnings report, would want to sell. Still, he said, such a deal could “make strategic sense” for Disney.

Disney did not respond to requests for comment. A spokesman for Netflix said it does not “comment on rumors or speculation.”

Under Iger, Disney has been transformed by three major deals: The purchases of Pixar Animation Studios for $7.4 billion in 2006, Marvel for $4 billion in 2009 and Lucasfilm for $4.06 billion in 2012. The acquisitions netted Disney franchises such as “The Avengers” and “Star Wars,” which are now being pumped through its various businesses and have helped the company generate record profits in recent years.

“What Bob Iger has done well is basically recognize what Disney does so well and place those bets accordingly,” said Jason Moser, an analyst with the Motley Fool.

When Disney has bought or invested in companies for their technology assets, the deals have been far smaller than its contest-focused purchases. In August, Disney said it would pay $1 billion for a 33% interest in BamTech, which developed Major League Baseball’s popular online video service and handles similar efforts for HBO and the National Hockey League, among others.

“We were [a] big believer in using technology to reach more people and to reach people where they are today and clearly we’ve seen dramatic increases in digital mobile media,” said Iger while discussing the BamTech deal at a conference last month.

BamTech has been tapped by Disney to create and distribute a new ESPN-branded, multisport subscription streaming service sold directly to consumers.

Moser said he didn’t think making a landmark deal on the scale of the AT&T-Time Warner pact was in the best interest of Disney as it tries to solve issues at ESPN. The BamTech acquisition was seen in part by analysts as a way for Disney to address issues at the sports network, which has lost 9 million TV subscribers since 2013, according to Nielsen data.

“One of the biggest challenges for them is to figure out what the next step is for taking Disney over the top,” Moser said. “The biggest item on [Iger’s] to-do list is to figure out the ways to monetize ESPN via distribution.”

Disney, which generated revenue of $52.5 billion in fiscal 2015, is now seen as too big to be acquired by all but a handful of companies. But more than a decade ago, it was the target of a mega-merger that ultimately failed. In 2004, cable provider Comcast Corp. stunned investors by offering $54 billion for Disney.

Disney rejected the bid, and Comcast, against the backdrop of much hand wringing on Wall Street, abandoned its efforts to acquire the company soon thereafter.

About five years after Comcast failed to purchase Disney, it finally zeroed in on a media and entertainment titan, announcing its intent to buy a majority stake in NBCUniversal in 2009. At the time, there was significant concern over the implications of the deal for consumers and their pocketbooks. It was eventually approved by the U.S. Federal Communications Commission in 2011.

The AT&T-Time Warner deal could create a new company with a market capitalization of more than $300 billion and is therefore expected to receive intense scrutiny by regulators. Competitors have already weighed in on the matter — including Disney.

On Saturday, a Disney spokeswoman told several news outlets that “a transaction of this magnitude obviously warrants very close regulatory scrutiny.”

See the most-read stories in Entertainment this hour »

Follow @DanielNMiller on Twitter for film business news.

Times staff writer Meg James contributed to this report.

To read the article in Spanish, click here

ALSO:

If AT&T swallows Time Warner, who might be gobbled up next?

Wall Street worries that regulators will sink AT&T-Time Warner deal

The rise of the small screen is what’s driving AT&T’s $85.4-billion deal for Time Warner

AT&T says it plans to keep top Time Warner managers

The AT&T-Time Warner deal would be a disaster for the public interest

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.