Walt Disney Co. posts record quarterly profit on success of ‘Star Wars’

Walt Disney Co. headquarters in Burbank. “Star Wars: The Force Awakens” was largely responsible for the company’s successful fiscal first quarter.

The box-office power of “Star Wars: The Force Awakens” propelled Walt Disney Co. to record profit for the fiscal first quarter, easily beating analysts’ expectations.

But the stellar results did not improve Disney’s footing on Wall Street, where shares of the Burbank entertainment juggernaut fell more than 3% to $89.10 in after-hours trading.

------------

FOR THE RECORD

An earlier version of this article said revenue for Disney’s consumer products and interactive division was up 8% to $1.9 million. It was up 8% to $1.9 billion.

------------

The drop came after the company reported a 6% decline in operating income for its closely watched media networks unit, which includes broadcast and cable networks. Concerns about the effect of cord-cutting and other changes roiling the TV business have brought Disney’s stock down about 15% since August.

See more of Entertainment’s top stories on Facebook >>

“Even though I think people realize their other businesses are doing great … the overarching TV industry issues were going to prevail [on Wall Street] no matter what,” said Robin Diedrich, an analyst at Edward Jones Research.

The Burbank company reported record net income of $2.9 billion in the first quarter that ended Jan. 2, up 32% over the same period a year earlier. Revenue rose 14% to $15.2 billion.

On a conference call with analysts, Disney Chairman and Chief Executive Robert Iger touted the company’s performance and the strength of its brands, including “Star Wars” and ESPN.

“Our results clearly show that our long-term strategic focus and investments in brands and franchises are driving remarkable value in these businesses, greatly increasing their impact on the company, and further diversifying our future growth,” he said.

Disney delivered adjusted earnings per share of $1.63, handily beating analysts’ estimates of $1.45.

The strong numbers, however, didn’t assuage investors’ concerns about a slowdown in Disney’s television business. The company indicated that ESPN lost subscribers during the quarter but did not specify how many. Iger spent much of the conference call fielding questions about the performance of ESPN, the crown jewel of the company’s TV empire.

Shares of Disney have been in a slump since August, when Wall Street jitters about cord-cutting and increasingly expensive sports rights led to a sell-off of many publicly traded media firms. Nielsen Co. said last summer that ESPN had lost about 3 million subscribers over the prior year. Earlier this year, Nielsen provided a revised estimate to clients that indicated that ESPN had lost 1.2 million subscribers in 2015.

For years, nearly 100 million homes in the U.S. subscribed to a pay-TV service. Now satellite, cable and other operators are offering slimmed-down packages, which hurts Disney because the company has long relied on having ESPN and other premium channels distributed to nearly all pay-TV homes.

Disney’s media networks unit posted operating income of $1.4 billion on revenue of $6.3 billion, which was up 8% from a year earlier. Within that unit, the cable division, which houses ESPN, recorded operating income of $1.2 billion, down 5% from a year ago. Revenue for the group was up 9% to $4.5 billion.

In its earnings report, Disney attributed the operating income decline to higher programming costs at ESPN. Disney said they rose in part because ESPN aired six college football playoff games during the quarter that were not on the books for the same period a year earlier.

In addition to subscriber losses, the high prices for sports rights have been a concern for investors. ESPN’s most important contract, NFL’s “Monday Night Football,” now costs $1.9 billion a year, a 72% increase over the previous contract that ended in 2013.

But Iger touted the content offered by ESPN and took several opportunities to champion the network. Iger’s comments about the cable business during a call with analysts last August — he mentioned “slightly less subscribers” — have been singled out as a reason for the media stock sell-off.

“In any market, we believe ESPN is well positioned to continue to thrive for many reasons,” he said Tuesday, citing strong demand for live sports programming.

Iger also noted that “in the last couple of months” there’d been “an uptick” in the number of ESPN subscribers, but he later added that the improvement “didn’t have much of an impact on this quarter.”

In his most forceful comments on the topic, Iger said that “the notion that either the expanded basic [cable] bundle is experiencing its demise or that ESPN is cratering in any way from a [subscriber] perspective is just ridiculous. Sports is too popular. And it’s not just at ESPN.”

Diedrich said that compared with Iger’s typical demeanor, “He seemed a little more adamant to defend the company — and rightly so. The results have been phenomenal across the board.”

Indeed, Disney’s three other units delivered double-digit increases in segment operating income, led by the movie studio.

“The Force Awakens” — the first “Star Wars” movie made by Disney since it acquired series producer Lucasfilm for $4 billion in 2012 — led the studio division to a $1-billion profit, an 86% increase over last year. Revenue was up 46% to $2.7 billion. The space-opera sequel crossed the $2-billion mark at the box office last week, becoming just the third film to reach that lofty plateau.

Disney’s consumer products and interactive division reported operating income of $860 million — an increase of 23%. Revenue was up 8% to $1.9 billion. The company attributed the unit’s success in part to merchandising revenue related to “The Force Awakens.”

Iger said global retail sales for “Star Wars” products exceeded $3 billion in the fiscal first quarter.

Disney’s parks and resorts group posted operating income of $981 million, a gain of 22% from a year earlier. Revenue was up 9% to $4.3 billion. Disney said the strong performance was partly because of an increase in guest spending and attendance at its domestic properties.

“I do think that the media concerns are overshadowing what I think could be a really long tail of very strong profits from the impact of ‘Star Wars,’” Diedrich said. “It will bleed over to not just the studio but also the theme parks and consumer products.”

Twitter: @DanielNMiller

Make way! Warner Bros. expands its universe with DC Super Hero Girls

Super Bowl ads whetted the appetites of viewers, who watched them again on smartphones

Viacom chief Philippe Dauman takes a swing at critics -- and stock price plummets

More to Read

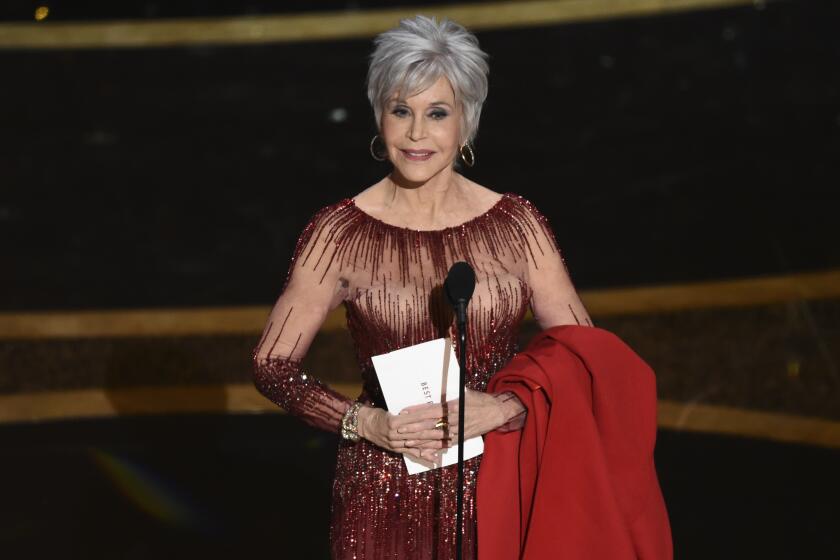

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.