A top California official pushed hard for a $600-million mask deal. Fraud claims followed

SACRAMENTO — In the frantic first weeks of the COVID-19 pandemic, three companies promised California officials that they could secure millions of protective masks in exchange for $1.6 billion in no-bid government contracts. Each effort ended badly for the state.

Two years later, lawsuits stemming from the failed contracts provide a glimpse into the dealmaking — including how California Controller Betty Yee, a two-term Democrat with no formal role in the contracting process, worked behind the scenes to help a pair of political operatives land a deal that turned out to be one of the state’s most flawed.

The $600-million contract with Blue Flame Medical LLC, a healthcare supplies startup, was later flagged as a case of possible fraud, and the state was forced to claw back its massive upfront payment. But Yee’s involvement with the effort never became public, even after the deal collapsed and state lawmakers demanded a full accounting of what had happened.

Over the course of a pivotal week in March 2020, Yee provided Blue Flame’s co-founder with private advice on how to negotiate an advance payment and discouraged him from disclosing how much the company would pocket from the deal, according to text messages documented in a lawsuit involving the contract.

“I will see to it that the wire happens first thing this morning,” Yee wrote to John Thomas, a longtime Republican strategist who founded Blue Flame with GOP fundraiser Mike Gula, in a text message on March 26, 2020.

Hours later, the state wired Blue Flame a down payment of $457 million. The company’s internal records, disclosed as part of a lawsuit, show that it stood to turn a profit of $134 million by charging the state 20% to 30% markups.

“Sweet mother of God,” Gula wrote in an email to Blue Flame’s lawyer after calculating the company’s potential windfall, one of hundreds of documents included in a lawsuit the company filed against its bank, Chain Bridge, for triggering the fraud concerns. Chain Bridge then sued JPMorgan Chase, the state’s bank. In February, JPMorgan, one of the world’s largest banks, sued the state to recover its costs in untangling the deal.

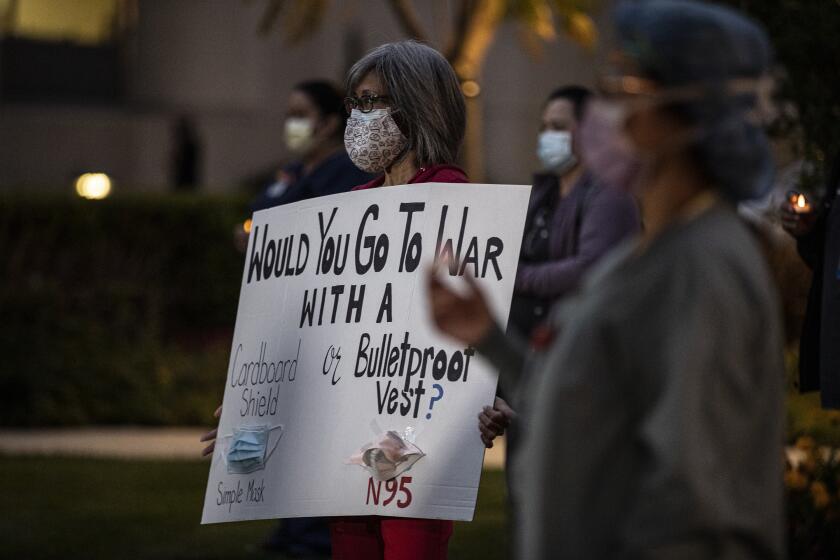

California lawmakers asked for more details Monday following criticism about the state’s vetting process for masks and other protective gear.

Two other massive COVID-19 mask deals also remain mired in lawsuits.

Court documents reveal that a settlement was reached between the state and Advoque Safeguard, a Santa Clara company that failed to deliver most of the N95 masks it was contracted to make, while 10 million masks that did arrive were later recalled for failing to meet federal filtration standards. State officials said the company, which faces three lawsuits stemming from its other mask deals, has yet to make any of the agreed-upon payments.

In a third case, Alabama company Bear Mountain alleges that California officials improperly canceled an $800-million mask contract that was promoted by an influential Sacramento lobbyist.

The agreements were among many no-bid contracts intended to help California officials quickly buy lifesaving supplies, a process allowed under Gov. Gavin Newsom’s proclamation of a state of emergency due to COVID-19.

“No-bid contracts are subject to all kinds of problems,” said Larry Gerston, a political commentator and professor emeritus at San Jose State. “They are subject to foolish things. You have to wonder how many things we don’t know about.”

Like many vendors that ended up securing a California government contract, Blue Flame looked for inroads with political insiders. The company offered cash commissions and retainers to lobbyists, strategists and medical sales representatives, according to records contained in the lawsuit.

Yee’s political fundraiser initially made the introduction to Thomas, according to a deposition of Rick Chivaro, chief counsel to the state controller’s office. Court documents identify the fundraiser as Stephanie Daily Smith, a Democratic political consultant based in San Diego County. Yee, through her office, and Daily Smith declined to comment.

As the state’s paymaster, Yee is tasked with carrying out the final details of spending taxpayer dollars. Her office issues checks for the state of California and can raise concerns about whether funds are being spent wisely. The job of vetting and selecting who receives state contracts largely falls to a different California government office, the Department of General Services.

Subscribers get exclusive access to this story

We’re offering L.A. Times subscribers special access to our best journalism. Thank you for your support.

Explore more Subscriber Exclusive content.

But in a series of text messages written between March 20 and March 27, 2020, and made public in the Blue Flame lawsuit, Yee went out of her way to advocate for the company — after Thomas began by telling her he had 100 million N95 masks at the Port of Long Beach that his company could “move to you guys today.”

Hours later, Thomas said, “We’ve almost sold all of this first shipment,” but he promised that 100 million masks would arrive each week. Yee then said she had made the governor’s office aware of his offer. The next day, Thomas thanked Yee for her “help birddogging this,” to which she responded by saying, “Got it. Will press governor’s folks.”

The text messages show that the state controller promised to step up her efforts to convince Newsom’s office to make the deal after Thomas warned that California was losing even more supplies to quicker buyers.

In his deposition last year, Thomas said Blue Flame did not sell any of the 100 million masks he claimed to have at the port, despite what he had told Yee.

In one text message, Thomas wondered whether he should disclose Blue Flame’s profits to state officials as a way “to ease everyone’s concerns” about price gouging. Yee, the gatekeeper to the state treasury, warned against doing so.

“If you share info with State, it may ... become a matter of public record and make headlines,” Yee texted Thomas. “If this is proprietary info, keep it that way.”

As concerns rose over the pace of negotiations, Yee suggested how Thomas should word his request to Newsom administration officials for Blue Flame to be paid in advance — telling him to do so “without invoking my name.” Thomas took Yee’s suggestion, sending a near-verbatim request, text messages show.

“Prepayment is not a problem for my office under the emergency declaration,” Yee assured Thomas in one text, referring to Newsom’s COVID-19 order.

Four days after Yee suggested a cash advance, the state wired $457 million to Blue Flame’s bank, amounting to an upfront payment of 75%. “We got it!!! Thank you!!!!” Thomas texted Yee afterward.

But the large payment triggered a warning by Chain Bridge Bank officials of a potential scam, given that Blue Flame had opened its account with the bank the day before. Amid the bank’s concerns, state officials asked for the wire to be reversed a few hours later.

California is paying more than 300% above list prices for some coronavirus masks, state data show.

With the deal in jeopardy, Thomas again turned to Yee.

“Hi Betty, sorry to bug you but I have an issue that I need your help with,” he wrote. “Can you call me when you have a moment?”

This time, the state controller — elected in 2014 and reelected in 2018 — didn’t immediately respond. The next day, she told Thomas to instead communicate with state procurement officials and “please cease to keep me in the loop; it is not helpful. ... You have a credibility issue now that you need to solve. Good luck.”

In seeking to explain Yee’s role, Chief Counsel Chivaro said in a lawsuit deposition that “the controller was merely trying to ensure that we had the face masks that we needed and other PPE to protect the nurses and the doctors that were handling these COVID cases.

“Her job was not to vet Mr. Thomas in any way, shape or form,” Chivaro said of Yee.

In a statement to The Times, Blue Flame officials placed the blame on the fraud warning issued by Chain Bridge Bank.

“There is no doubt in our mind that Blue Flame Medical would have fully delivered all 100 million masks to California had it not been for the reckless and negligent actions of Chainbridge Bank,” the company said in its statement.

Other deals made in the early spring of 2020 to secure protective masks were also problematic.

One day after the Blue Flame deal fell apart, California signed an $800-million contract with Bear Mountain, a company led by former Alabama Atty. Gen. Troy King. That contract was canceled less than six weeks later, after state officials said the company failed to deliver most of the masks.

The deal was aided by Paul Bauer, a Sacramento lobbyist who, at the time, worked for the prominent government relations firm Mercury Public Affairs — before departing soon after questions were raised about the contract.

Bear Mountain executives alleged in their December 2020 lawsuit that the state abruptly canceled its contract without warning and refused to accept millions of masks they had secured. The state has insisted that Bear Mountain missed its first deadline, then initially delivered just 2% of what was required.

“While COVID-19 ravaged the state, for weeks, Bear Mountain continued to miss deadlines and the few deliveries it made fell far short of its contractual obligations,” attorneys for the state wrote in the lawsuit.

“These were massive contracts for tons of money,” said Jon Coupal, president of the Howard Jarvis Taxpayers Assn. “It’s hard to Monday morning quarterback this, but it’s entirely appropriate to go back and look at how much was spent and the decision-making process.”

The Bear Mountain deal collapsed as Newsom was facing criticism over an even larger deal to purchase masks: a $1-billion contract with China-based auto manufacturer BYD. The company’s efforts were beset with delays in April and May 2020, resulting in BYD having to reimburse the state $247.5 million after initially failing to obtain federal certification of its N95 masks.

Concerns have emerged that Newsom has committed $990 million — without briefing lawmakers — on masks to prevent the spread of the coronavirus.

Ultimately, BYD delivered, state officials said; the company accounts for 85% of the 300 million N95 respirators California has purchased to date.

“We were having to sift through a lot of sketchy people, but there were good actors too, and the state came out of it, for the most part, in a good place,” said Brian Ferguson, a spokesman for Newsom’s Office of Emergency Services.

In the case of Advoque, the company touted its California roots and its price point, offering to manufacture nearly 100 million N95 masks at $2.25 each — far below the $5 to $12 state officials were paying others, as suppliers and middlemen cashed in on the global shortage.

But the deal quickly faltered.

Advoque was supposed to deliver 40 million masks by July 31, 2020, but only 6 million arrived. On Sept. 10, company officials alerted the state that there were issues with its masks. They had failed federal filtration tests, and the company’s certification was revoked, meaning the masks could “no longer be manufactured, assembled, labeled, sold, or distributed as a NIOSH approved product,” according to a press release from Advoque at the time, referring to the National Institute for Occupational Safety and Health.

California officials issued a recall for all of the company’s masks sent to healthcare workers and essential employees, who rely on the high filtration standards for protection.

Advoque agreed in 2021 to repay $18.7 million to taxpayers. By last month, when the final installment was due, the state had not received any money from the company.

Due to Advoque’s “failure to make timely payments, the state served a notice of default,” Monica Hassan, deputy director of the Office of Public Affairs at the Department of General Services, told The Times.

In a statement, the company said, “Advoque Safeguard is continuing to work with the State of California to reach a solution that is in the best interests of the State and its citizens.”

Three companies are suing Advoque, alleging that they too were sold faulty N95 masks. Two of the lawsuits allege that Advoque paid millions to its executives instead of reimbursing customers. Some companies cited California’s massive contract with Advoque as an impetus for their own contracts.

“California’s deal to buy $90 million worth of Advoque’s N95 masks was a stamp of approval,” said Joel Reese, a Dallas lawyer representing Titus Group Inc. in a case against Advoque. “Now we are wondering how Advoque obtained that stamp of approval.”

Four months before the Advoque deal fell apart, the same question asked by Reese was raised by California legislators during a lengthy public hearing that examined the collapse of the Blue Flame contract. Top state officials did their best to explain what happened and why.

Yee’s role, however, was never mentioned.

Times staff writer Hannah Wiley and librarian Jen Arcand contributed to this story.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.