Column: How the Supreme Court could kill a wealth tax before it’s been tried

It’s getting harder and harder to pretend that the U.S. Supreme Court is much more than an instrument to protect the wealth of America’s corporations and its richest citizens.

The latest signal is the court’s decision to take a once-obscure tax case known as Moore vs. United States. On its face, the case involves the objection by Charles and Kathleen Moore, Washington state residents who have objected to a $15,000 tax bill they received as investors in a small Indian corporation.

But there’s much more at stake. The conservative anti-tax advocates backing the Moores are hoping to use the case to stifle the nascent movement in favor of a wealth tax on the richest Americans.

The Moore litigation...may be a stalking horse to block billionaire and wealth taxes, which have been proposed, but not yet enacted.

— Reuven Avi-Yonah and Steven Rosenthal, Tax Policy Center

They’re explicit about that goal.

“As efforts to design new federal tax systems with potentially troubling constitutional infirmities continue to pick up steam,” the conservative Manhattan Institute warned in one of two friend-of-the-court briefs it has filed to support the Moores, it’s up to the court to “clarify the limits of Congress’s taxing power before the train has begun rolling unstoppably down the hill.”

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

The anti-tax gang’s targets are proposals — by Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.), among others — to levy taxes on assets with accumulated value but undistributed gains, such as art, collectibles, real estate and stock and bond holdings that haven’t been sold.

Warren’s proposal, which she aired in 2019 during a brief campaign for the presidential nomination, would have imposed a 2% tax on household net worth above $50 million and an additional 1% on fortunes of more than $1 billion. She estimated that it would bring in $2.75 trillion in revenue over 10 years.

“The Moore litigation ... may be a stalking horse to block billionaire and wealth taxes, which have been proposed, but not yet enacted,” wrote tax experts Reuven S. Avi-Yonah and Steven M. Rosenthal for the Tax Policy Center of the Urban Institute and Brookings Institution.

The lawsuit doesn’t turn so much on whether income can be taxed, but on how to define “income.” The specific issue is whether it must be “realized” to become taxable. In other words, whether the definition applies only to income that has been paid out to recipients as something akin to cash.

The billionaire owner of the Oakland A’s ripped off his home-team fans and is staging a ripoff of Las Vegas, showing that civic leaders never learn that stadium subsidies never pay off.

The plaintiffs and their supporters maintain that this was the understanding implicit in the 16th Amendment, which was ratified in 1913 and cleared the way for the income tax.

The government disputes that interpretation. In its filings, it points out that nowhere in the 16th Amendment is the concept of “realization” mentioned. Indeed, the amendment refers to “incomes, from whatever source derived.” Previous rulings by the Supreme Court and appellate courts have held that income doesn’t have to land in a recipient’s pockets to be taxed.

In an oft-cited 1940 Supreme Court opinion, for example, Justice Harlan F. Stone described the concept of realization as an “administrative convenience,” and didn’t mean that a taxpayer could “escape taxation because he did not actually receive the money.” Any other interpretation, Stone implied, would invite large-scale tax evasion by allowing taxpayers to give away their right to a taxable payout by giving it away before pocketing it.

Indeed, that has long been seen as a flaw in our capital gains tax law. As the late tax expert Ed Kleinbard was fond of observing, the capital gains tax is our only genuinely voluntary tax because it’s levied only when capital assets such as stocks, bonds and real estate are sold — and a taxpayer can defer that occurrence indefinitely, even beyond death, while taking advantage of the asset by means such as borrowing against it.

Under current rules, a capital asset bequeathed to an heir is revalued to its price at the time of the original owner’s death, extinguishing all tax liability incurred up to that point, forever. That tax break has helped create dynastic fortunes worth billions of dollars and is what motivates wealth tax advocates such as Sanders and Warren to capture the owed tax now, not later or even never.

Curiously, the immediate target of the Moore lawsuit is a Republican tax law — the Tax Cuts and Jobs Act passed by the GOP Congress and signed by President Trump in 2017. In general, the act delivered tax breaks to corporations and the wealthy estimated to be worth more than $1.5 trillion over 10 years.

One provision wiped out all taxes on dividends taxpayers received from foreign companies controlled by Americans. The idea was to encourage Americans to bring home investment gains they had parked overseas — “stateless income” that Kleinbard estimated to be worth $1 trillion.

Hedge fund billionaire Ken Griffin made a $300-million gift to Harvard, his alma mater. It’s the kind of faux-generosity the ultra-rich rely on to avoid paying their fair share of taxes.

As a transitional step, the act imposed a one-time tax on those foreign earnings, albeit at a gratifying cut rate of only 9%, well below the top income tax rate of 39.6%. The Moores reported a gain of $132,512 from their investment in the Indian company, KisanKraft, paid $14,729 and filed their lawsuit, with the assistance of the Koch-affiliated Competitive Enterprise Institute, to obtain a refund.

Their argument is that the one-time tax, known as the Mandatory Repatriation Tax, is unconstitutional. They say that’s because it’s not an income tax permitted by the 16th Amendment, since the taxpayers received no actual income. That’s the claim that the Supreme Court will consider after oral arguments scheduled for Dec. 5.

If the court overturns only the repatriation levy, that would cost the Treasury an estimated $340 billion — the sum it expects to collect over the 10-year period from 2018 to 2027. The court could also move more broadly to invalidate a host of provisions on unrealized income in the corporate and business tax systems, which could cost trillions of dollars.

To even casual observers, it looks as if the fix is in for the Moores among the Supreme Court’s conservative majority. Start with Justice Samuel A. Alito Jr. He was interviewed twice by one of the lead lawyers for the Moores, David B. Rivkin Jr., for two Wall Street Journal op-eds, including one that amounted to an unapologetic tongue-bath for the justice.

That article’s headline called Alito “the Supreme Court’s plain-spoken defender”; its text praised him for “a candor that is refreshing and can be startling” and essentially gave him 2,500 words to defend his rulings and ethics. Alito rebuffed demands from Democratic senators, among others, that he recuse himself in the Moore case, writing that Rivkin conducted the interviews “as a journalist, not an advocate.”

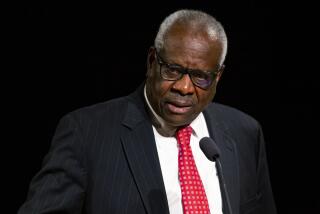

Then there are Paul Singer and Harlan Crow, billionaires who notoriously have been vacation pals of Alito and Justice Clarence Thomas and “have their fingerprints all over this case,” as former Democratic congressional aide Alex Aronson and Bob Lord, a tax advisor to Patriotic Millionaires, an organization representing philanthropy-oriented plutocrats, commented in Slate.

Singer and Crow are major supporters of the Manhattan Institute, a right-wing think tank that has filed two friend-of-the-court briefs with the Supreme Court on the Moores’ side. Singer is the institute’s chairman, and Crow’s wife, Kathy, is a member of its board of trustees.

Canceling student debt isn’t unfair to those who have already paid off their loans. And it isn’t a giveaway to the rich, either.

The Moores’ lawyers depict them as small investors who were “inspired” by KisanKraft’s effort to “empower subsistence farmers in India” by providing them with tools. “They never sought or expected a penny of income” from their $40,000 investment in 2006, according to the Manhattan Institute brief. Sure, the company made a profit, but “that was never the point” for the Moores. They “had no say in its operations,” the brief says.

Is that so? Moore is listed as a member of the company’s board of directors, so he has had at least a putative say in its operations. Nor is he a random plaintiff. He’s the son of Thomas Gale Moore, an economist connected with the Competitive Enterprise Institute and emeritus fellow of the conservative Hoover Institution, who is known for (among other things) the 1998 Cato Institute-published book “Climate of Fear: Why We Shouldn’t Worry About Global Warming.”

As for whether the Moores actually realized any income from their investment, public accounts of KisanKraft document that Moore sold shares in three tranches in 2019 to reduce his stock holdings to about 9.9% of the company from 12.9%. It isn’t clear from the accounts whether these stock sales were made at higher share values than his investments.

The Supreme Court’s critics are steeling themselves for what could be a far-reaching decision presumptively invalidating any wealth tax. The Constitution restricts the court to ruling only on actual “cases” and “controversies” — that is, on concrete harms affecting real people, not conjectural issues that might occur in the future.

Unfortunately, this Supreme Court has been regularly crossing that line. That happened this summer when the court issued a landmark ruling establishing the right of a Christian website designer in Colorado to refuse to work on same-sex wedding websites. As the New Republic reported, the plaintiff had not actually received an order from a same-sex couple — there was no actual controversy, but simply her concern that if she refused such an order, she would be violating state law.

The same flaw was present in the court’s ruling striking down the Biden administration’s student loan relief program in June. The red states that brought that case cited the harm suffered by a Missouri student loan agency from the debt relief. That agency, however, had refused to join the lawsuit, and in fact its financial situation would have been improved by the student loan relief.

Then there’s the abortion drug case that the court has ruled on, at least on an intermediate basis. The plaintiffs who brought the case to a federal court in Texas and to the spectacularly conservative 5th Circuit Court of Appeals are classic straw men — they’re antiabortion organizations and antiabortion doctors who haven’t shown that they have suffered concrete harms because patients, not their own, have used the pill.

The wealth taxes that anti-tax crusaders want the court to invalidate don’t actually exist in the federal tax system. That means that the Supreme Court, if it chooses to rule on the concept of a wealth tax as the groups backing the Moores hope, would actually be legislating, which the Constitution forbids. That hasn’t stopped the court in the recent past, however, and it may not stop it now.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.