Workers go on strike at all Big 3 Detroit automakers for the first time in history

About 13,000 auto workers set up picket lines at three plants after contract talks over wages and benefits broke down late Thursday.

DETROIT — Nearly 1 in 10 of America’s unionized autoworkers went on strike Friday to pressure Detroit’s three automakers into raising wages in an era of big profits and as the industry begins a costly transition from gas guzzlers to electric vehicles.

By striking simultaneously at General Motors, Ford and Chrysler owner Stellantis for the first time in its history, the United Auto Workers union is trying to inflict a new kind of pain on the companies and claw back some pay and benefits workers gave up in recent decades.

The strikes are limited for now to three assembly plants: a GM factory in Wentzville, Mo., a Ford factory in Wayne, Mich., near Detroit, and a Stellantis Jeep plant in Toledo, Ohio.

The workers received support from President Biden, who dispatched aides to Detroit to help resolve the impasse and said the Big Three automakers should share their “record profits.”

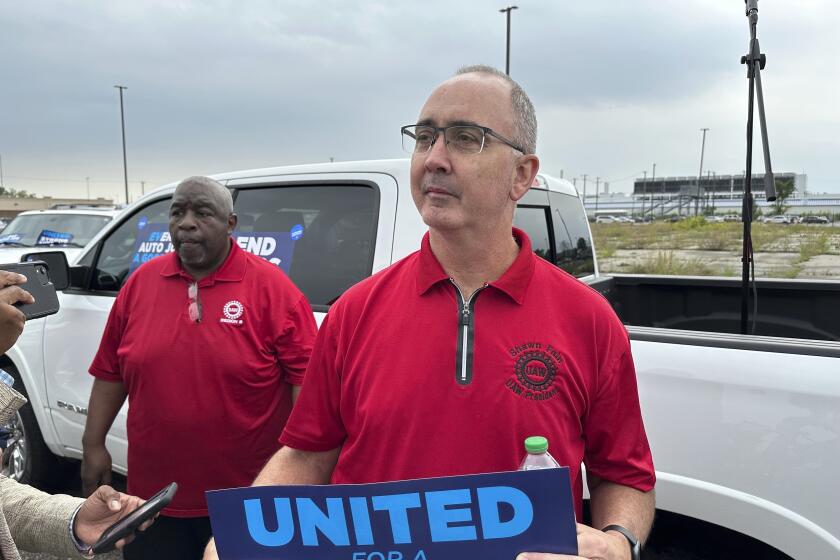

Union President Shawn Fain said workers could strike at more plants if the companies don’t come up with better offers. The workers are seeking across-the-board wage increases of 36% over four years; the companies have countered by offering increases ranging from 17.5% to 20%.

Workers out on the picket lines said they hoped the strikes didn’t last long but added that they were committed to the cause and appreciated Fain’s tough tactics.

“We didn’t have a problem coming in during COVID, being essential workers and making them big profits,” said Chrism Hoisington, who has worked at the Toledo Jeep plant since 2001. “We’ve sacrificed a lot.”

Still, Hoisington said she hopes the strike ends quickly so she doesn’t have to tap her savings to buy a house. “Hopefully this doesn’t last long or else I’m going to have to spend my down payment on groceries,” she said.

In its previous 88-year history, UAW had always negotiated with one automaker at a time, limiting the industrywide effects of any possible work stoppages. Each deal with an automaker was viewed as a template, but not a guarantee, for subsequent contract negotiations.

Now, roughly 13,000 of 146,000 workers at the three companies are on strike, making life complicated for automakers’ operations, while limiting the drain on the union’s $825-million strike fund.

If the contract negotiations drag on — and the strikes expand to more plants — the costs will grow for workers and the companies. Auto dealers could run short of vehicles, raising prices and pushing customers to buy from foreign automakers with nonunion workers. It could also put fresh stress on an economy that’s been benefiting from easing inflation.

The new negotiating tactic is the brainchild of Fain, the first leader in the union’s history to be elected directly by workers. In the past, outgoing leaders picked their replacements by choosing delegates to a convention.

But that system gave birth to a culture of bribery and embezzlement that ended with a federal investigation and prison time for two former UAW presidents.

As usual, the media and politicians are blaming the possibility of an auto strike on the auto workers union, but company managements are the guilty parties.

The combative Fain narrowly won his post last spring with a fiery campaign against that culture, which he called “company-unionism,” which he said sold out workers by allowing plant closures and failing to extract more money from the automakers.

“We’ve been a one-party state for longer than I’ve been alive,” Fain said while campaigning as an adversary to the companies rather than a business partner.

David Green, a former local union leader elected to a regional director post this year, said it’s time for a new way of bargaining. “The risks of not doing something different outweigh the risks of doing the same thing and expecting a different result,” Green said.

During his more than two-decade career at General Motors, Green saw the company close an assembly plant in Lordstown, Ohio, that employed 3,000 workers. The union agreed to a series of concessions made to help the companies get through the Great Recession. “We’ve done nothing but slide backward for the last 20 years,” Green said, calling Fain’s strategy “refreshing.”

Carlos Guajardo, who has worked at Ford for the last 35 years and was employed by GM for 11 years before that, said he likes the new strategy.

“It keeps the strike fund lasting longer,” said Guajardo, who was on the picket line in Michigan on Friday before the sun came up.

The strikes will probably chart the future of the union and of America’s homegrown auto industry at a time when U.S. labor is flexing its might and the companies face a historic transition from building internal combustion automobiles to making electric vehicles.

The walkouts also will be an issue in next year’s presidential election, testing Biden’s claim to be the most union-friendly president in American history.

Frustration, fears about the future and a high degree of mistrust continue to shape the script of Hollywood’s strikes by the WGA and SAG-AFTRA.

The limited-strike strategy could have ripple effects, GM Chief Executive Mary Barra said in an interview Friday on CNBC.

“A lot of our assembly plants also have contiguous stamping plants that may serve other plants,” Barra said. “We’ve worked to have a very efficient manufacturing network, so yes, even one plant is going to start to have impact.”

SEIU United Healthcare Workers West said nearly 60,000 workers in California had approved a possible strike, teeing up what could be the biggest strike by healthcare workers in U.S. history.

Even Fain has called the union’s demands audacious, but he maintains that the automakers are raking in billions and can afford them. He scoffed at company statements that costly settlements would force them to raise vehicle prices, saying labor accounts for only 4% to 5% of vehicle costs.

In addition to general wage increases, the union is seeking restoration of cost-of-living pay raises, an end to varying tiers of wages for factory jobs, a 32-hour week with 40 hours of pay, the restoration of traditional defined-benefit pensions for new hires who now receive only 401(k)-style retirement plans, pension increases for retirees and other items.

Breaking News

Get breaking news, investigations, analysis and more signature journalism from the Los Angeles Times in your inbox.

You may occasionally receive promotional content from the Los Angeles Times.

Starting in 2007, workers gave up cost-of-living raises and defined benefit pensions for new hires. Wage tiers were created as the UAW tried to help the companies avoid financial trouble ahead of and during the Great Recession. Even so, only Ford avoided government-funded bankruptcy protection.

Many say it’s time to get the concessions back because the companies are making huge profits and CEOs’ pay packages are soaring.

Looming in the background is the historic transition to electric vehicles. The union wants to make sure it represents workers at joint-venture electric vehicle battery factories that the companies are building so that members have jobs making vehicles of the future.

Top-scale assembly plant workers make about $32 an hour, plus large annual profit-sharing checks. Ford said average annual pay including overtime and bonuses was $78,000 last year.

The Ford plant that’s on strike employs about 3,300 workers. The Toledo Jeep complex has about 5,800 workers and GM’s Wentzville plant has about 3,600 workers.

Hotel strikers have endured violent incidents involving security personnel at three hotels in L.A. and Orange counties, the union said in a complaint.

The union didn’t go after the companies’ big cash cows, which are full-size pickup trucks and big SUVs.

Automakers say they’re facing unprecedented demands as they develop and build new electric vehicles while at the same time making gas-powered cars, SUVs and trucks to pay the bills. They’re worried that labor costs will rise so much they’ll have to price their cars above those sold by foreign automakers with U.S. factories.

As autos writer for the L.A. Times, Russ Mitchell gets a lot of questions about electric car buying. Here’s his guide to choosing the right EV for you.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.