Column: Should we raise unemployment to fight inflation? No, we need to protect jobs no matter what

If economic history teaches us anything, it’s that when times get tough, working men and women get targets painted on their backs.

Current events give us a perfect illustration. The U.S. is at or close to full employment with an unemployment rate of a historically low 3.6%, but inflation has been rising. So the argument that the remedy to higher prices is higher joblessness is being heard more and more often.

The most distilled iteration of this argument comes from former Treasury Secretary Lawrence Summers, who put it this way in a June 20 speech in London, as reported by Bloomberg:

Labor costs are dampening—not amplifying—price pressures.

— Josh Bivens, Economic Policy Institute

“We need five years of unemployment above 5% to contain inflation — in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment.”

Summers said these were “numbers that are remarkably discouraging relative to the Fed Reserve view,” which is that tools in the Fed’s arsenal such as an increase in short-term interest rates might be enough to stage a “soft landing” for the economy — a reduction in inflation without provoking a recession.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Translating Summers’ statistics into hard figures is a little tricky, because the unemployment rate doesn’t measure only the number of people unemployed. The unemployment rate of 3.6% in May was the lowest since the late 1960s.

In June 2013, the last pre-pandemic month when the unemployment rate was 7.5%, some 11.8 million Americans were unemployed, 5.8 million more than last month, according to the Bureau of Labor Statistics. About 144 million were working, compared with 158.4 million last month.

So Summers is talking about 5.8 million to 15 million Americans reduced to joblessness in order to bring down inflation.

Are inflation fears unreasonable? It depends on how you’re spending your money.

Summers’ words have garnered great attention not just because of his position as a former Obama appointee, but because he warned that fiscal policies early in the Biden administration would ignite higher inflation.

He appears to have been prescient then, it’s felt, so perhaps he’s correct now. (Whether Summers was right or wrong or perhaps right for the wrong reasons is a topic of debate in the economist community.)

Yet there are significant flaws in the explicit equating of higher employment with higher inflation.

Summers himself, during an appearance in May at Northwestern University, cautioned against overconfident generalizations about the economy.

Asked, “Do we need to get out of the hot labor market completely in order to bring inflation down?” he replied, “One of the things that I’ve learned over time is it’s best to think in terms of what’s most likely and what seems probable to you. All absolute statements about these things are foolish.”

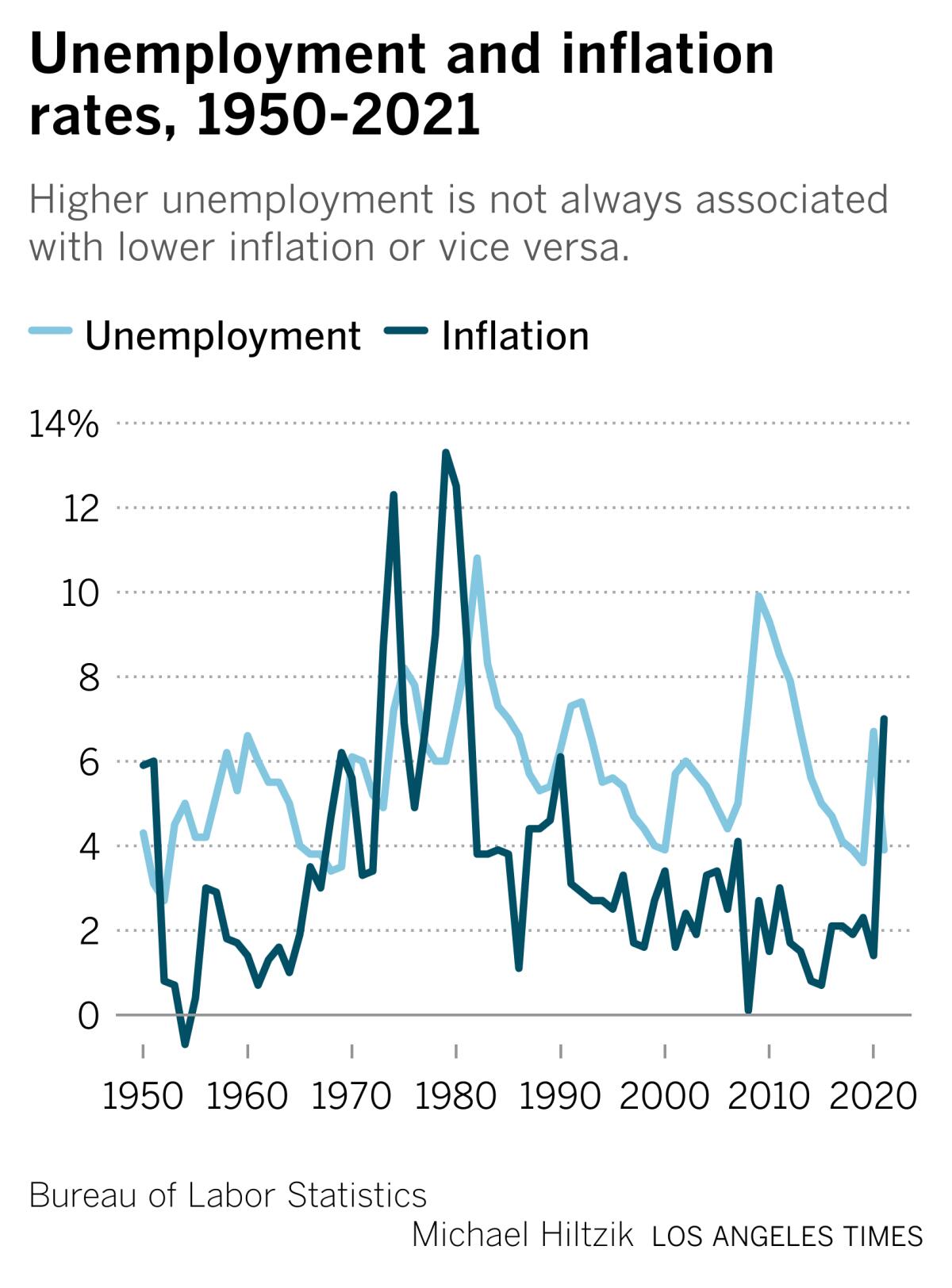

A low unemployment rate correlates roughly with high inflation — and high unemployment with low inflation — but imperfectly.

The unemployment rate settled between 4.7% and 3.9% from 1997 through 2000, while inflation ran between only 1.6% and 3.4%. In 1974, unemployment rose to 7.2%, yet inflation hit 12.3%. In 1978-1980, unemployment soared from 6% to 7.2%, while inflation rose as high as 13.3%.

Those were the “stagflation” years, brought to an end by the bitter medicine of interest rates higher than 20% delivered by then-Fed Chairman Paul Volcker.

During the last decade, as unemployment drifted down from 9.3% in 2010 to 3.9% in 2018, inflation remained well under control, falling as low as 0.7% in 2015.

It’s true that factors other than employment and wage gains affected prices during all those periods, but that merely underscores the variety of pressures that can drive prices higher or lower.

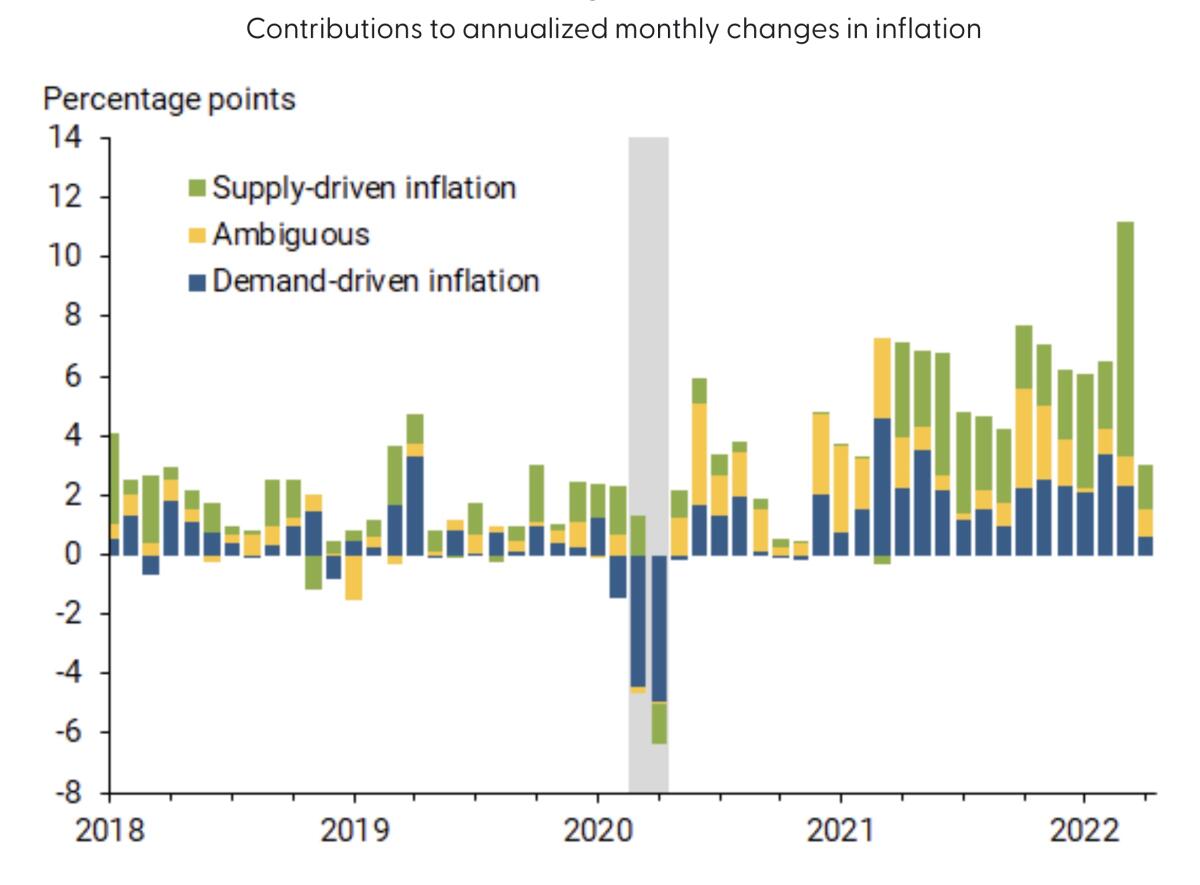

Today’s inflation, as it happens, appears to derive less from excessive demand from consumers, as would be a reflection of full employment and its consequent upward pressure on wages, than from supply chain blockages such as shortages of raw materials and merchandise. In economists’ jargon, it’s more “cost-push” than “demand-pull” inflation.

David Weil would have enforced federal labor law leading the Labor Department’s Wage and Hour Division, so Republicans killed his nomination.

Indeed, in an economic analysis published Tuesday, Adam Hale Shapiro of the Federal Reserve Bank of San Francisco demonstrated that supply constraints, including “labor shortages, production constraints, and shipping delays,” as well as the war in Ukraine, account for more than half of the recent run-up in inflation, and higher demand only for about one-third.

Labor economists also question the narrative that higher wages are driving inflation, and consequently that bringing wages down through higher unemployment makes sense as a policy approach. Traditionally, wages grow about 1% a year faster than consumer prices — that’s an artifact of improving standards of living over time.

In the last year, however, “nominal wage growth ... has lagged far behind inflation,” Josh Bivens, research director at the labor-supported Economic Policy Institute, wrote last month. That means “labor costs are dampening — not amplifying — price pressures.”

Indeed, the Bureau of Labor Statistics in its most recent report stated that hourly earnings rose by 5.2% for all employees, and by 6.5% for production and nonsupervisory employees, during the year that ended in May. Over the same period, the consumer price index rose by 8.6%, with the largest contribution coming from energy costs, including gasoline and fuel oil prices.

“In short, non-wage factors are clearly the main drivers of inflation,” Bivens observed. Taking steps to quell inflation by rolling back employment would cause unnecessary hardship for millions, with little gain to show for it.

Using job losses to manage inflation arises from what economists know as the Sacrifice Ratio — ostensibly the relationship between unemployment and inflation.

By the reckoning of former Obama economic advisor Jason Furman, in recent decades the ratio has been 6 percentage points — a 6% rise in unemployment over a year tends to bring down inflation by a single percentage point, as would two years of 3% increases, etc., etc.

Summers’ calculation of the relationship was somewhat looser, though every bit as mechanistic as one would expect an economist’s tool to be.

Among other issues, it places the entire burden of reducing inflation on unemployment, even though inflation is a multi-factoral phenomenon. It also treats the relationship between unemployment and inflation as an almost immutable constant.

This approach harks back to pre-Depression policy, when working men and women were regarded as just another economic input and downturns were valued as necessary medicine to preserve the financial well-being of the bondholding class.

It was the era when the prescription for an economic downturn offered by Treasury Secretary Andrew Mellon, one of the richest men in America, was “liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” as Herbert Hoover described Mellon’s argument in his own memoirs.

Gasoline prices are still below their historical peak, adjusted for inflation, but no one can say how high they’ll go.

Mellon held, as Hoover recounted, “that even a panic [that is, a depression] was not altogether a bad thing. He said: ‘It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.’”

(Hoover, to his credit, was appalled by the “untold amount of suffering” that Mellon’s approach might cause.)

Signs are beginning to emerge, if slowly, that the factors pushing prices higher since late last year are beginning to ease. Crude oil prices on the New York Mercantile Exchange fell during Thursday’s trading to below $104 per barrel, down from their March 8 peak of $123.70. Gasoline prices have begun to follow suit, albeit not at the same pace.

Housing starts have slipped and wage gains have moderated. Retailers have reported slower sales and some, stuck with excess inventories of merchandise, have signaled that generous discounts are in the wings.

Federal Reserve Chairman Jerome H. Powell, who has become the face of the Fed’s policy of raising interest rates sharply to cool the economy, has hinted that a second sharp interest rate increase of three-quarters of a percentage point may or may not be necessary next month.

Instead of austerity, Congress opted for fiscal stimulus. The decision saved America from a recession.

That view was echoed by Patrick Harker, president of the Federal Reserve Bank of Philadelphia, who said Wednesday that signs of moderation may warrant a smaller interest-rate boost in July and that conditions that will guide the Fed’s policies in September and beyond are even murkier.

“Let’s see how the data turns out in the next few weeks,” Harker told Yahoo Finance.

History, in short, counsels caution in applying remedies for inflation. The limited tools available to the Federal Reserve are especially feeble when prices are driven by the external factors at work today.

“Inflation is like an illness,” Sen. Elizabeth Warren (D-Mass.) lectured Powell during his appearance Wednesday before the Senate Banking Committee, “and medicine needs to be tailored to the specific problem.”

Under Warren’s questioning, Powell acknowledged that the Fed’s interest rate increase would do nothing to bring gasoline or food prices down. As Warren observed, however, “rate increases make it more likely that companies will fire people and slash hours to shrink wage costs.”

That doesn’t necessarily mean that the Fed shouldn’t judiciously use the powers it has been granted to fight inflation. But it does mean that placing the livelihoods of working men and women at risk, as though they’re the people responsible for inflation, is exactly the wrong approach.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.