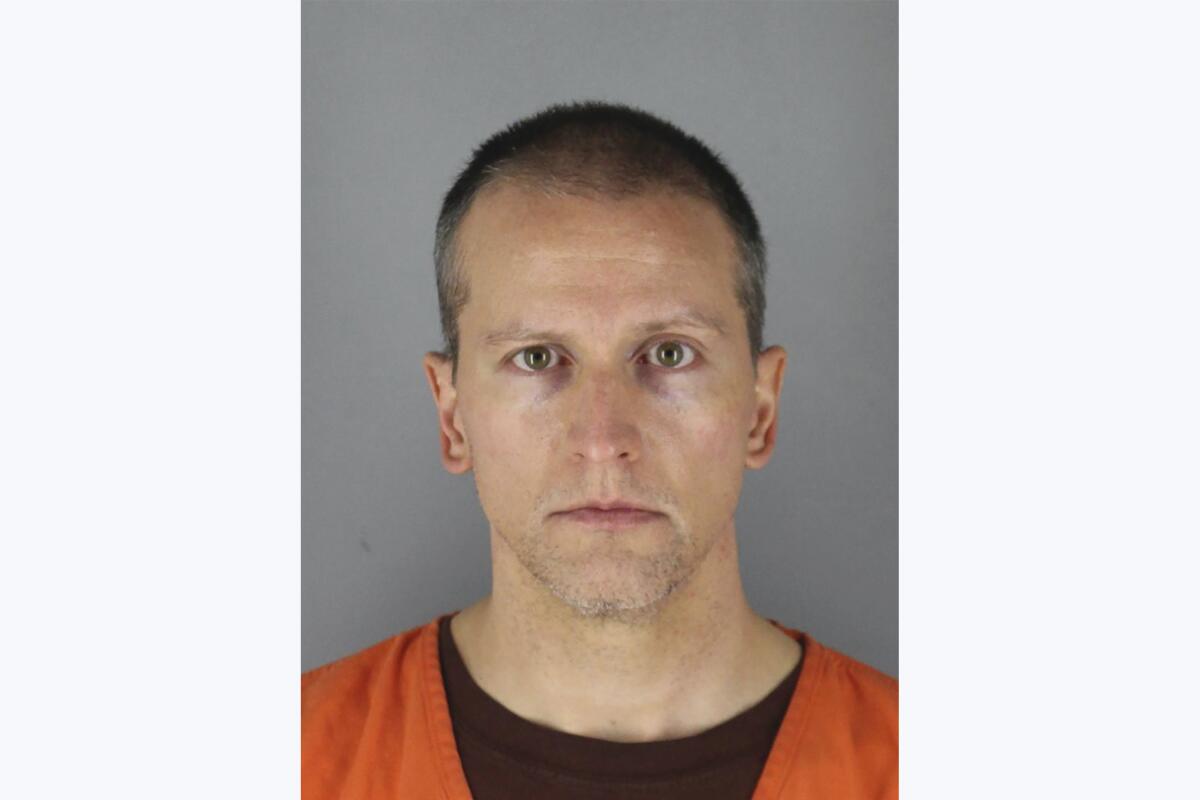

Derek Chauvin, ex-officer charged in George Floyd’s death, faces 9 tax-evasion counts

MINNEAPOLIS — The former Minneapolis police officer charged with murder in the death of George Floyd has now been charged with multiple felony counts of tax evasion as well, according to criminal complaints alleging that he and his wife didn’t report income from various jobs, including more than $95,000 for his off-duty security work.

Derek Chauvin and his wife, Kellie May Chauvin, were each charged Wednesday in Washington County with six counts of aiding and abetting the filing of false or fraudulent tax returns in the state of Minnesota and three counts of aiding and abetting failure to file state tax returns.

The complaints allege that, from 2014 through 2019, the Chauvins under-reported their joint income by $464,433. With unpaid taxes, interest and fees, they now owe $37,868 to the state.

Imran Ali, a Washington County prosecutor, said the charges relate only to tax irregularities in the state of Minnesota, not federal taxes or taxes in Florida, where the couple has a second home. He said the amount of unpaid taxes could increase, as the investigation is ongoing.

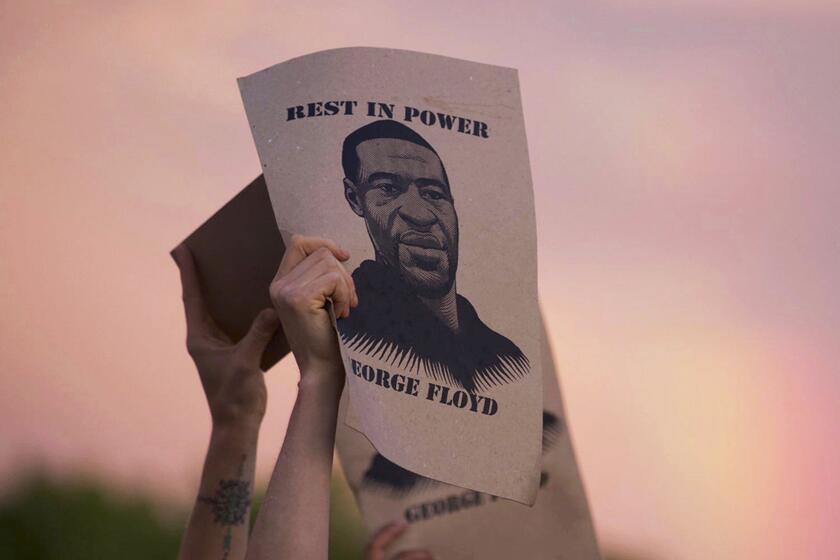

Floyd died May 25 after Chauvin pressed his knee against Floyd’s neck for nearly eight minutes as Floyd pleaded for air. Chauvin is charged with second-degree murder, third-degree murder and manslaughter. He and three other officers who were at the scene were fired.

Chauvin is in custody on the charges in the Floyd case. Kellie Chauvin, who filed for divorce after Floyd’s death, was not in custody Wednesday.

Body-camera footage from two police officers involved in George Floyd’s arrest captured a panicked and fearful Floyd pleading with officers before his death.

Online court records did not list attorneys for either in the tax evasion case, and a call to Kellie Chauvin did not go through. Her divorce attorney did not return a call seeking comment. Eric Nelson, Derek Chauvin’s attorney on the murder charges, had no comment Wednesday.

The investigation began in June, after the Minnesota Department of Revenue received information about suspicious tax filings by Derek Chauvin. The agency started an internal cursory review, then opened a formal investigation after determining that the Chauvins did not file state taxes as required.

The investigation ultimately found that the Chauvins did not file state tax returns for 2016, 2017 and 2018, and did not report all of their income for 2014 and 2015. When tax returns for 2016 through 2019 were filed in June of this year, the Chauvins did not report all of their income in those years either, the complaints said.

The complaints said that, as a police officer, Chauvin could work off-duty security jobs and was required to pay taxes on that income. From 2014 through 2020, Chauvin worked off-duty security at several locations.

Minneapolis woman recalls run-in with officer charged in George Floyd killing: ‘I lived to complain’

The woman detained by Minneapolis police officer Derek Chauvin in 2007 remembers being “dragged” away from her crying newborn and yelping dog. Chauvin was disciplined over the incident.

He worked at El Nuevo Rodeo restaurant nearly every weekend from January 2014 through December 2019, the complaints said. By averaging out his pay of $220 a night over his work schedule at that business, investigators believe he earned about $95,920 over six years that the Chauvins did not report as income.

Kellie Chauvin is a real estate agent and also operates a photography business under the name KC Images. Bank records reviewed by investigators show that she or the business received 340 checks totaling $66,472.75 which were not reported as income in 2014 and 2015, the complaints said.

The complaints allege that the Chauvins also failed to pay proper sales tax on a $100,000 BMW purchased in Minnesota in 2018. Prosecutors say they bought the car in Minnetonka but listed their Florida address as their home address. While the couple lives primarily in Minnesota, Kellie Chauvin told investigators they changed their residency to Florida because it was cheaper to register a car there. They allegedly paid lower sales taxes than they would have paid in Minnesota.

The complaints also say the Chauvins sold a rental home in Woodbury in 2017 and took a deduction on depreciation to lower their income taxes, but did not properly apply the deduction toward the purchase price of the home when they calculated capital gains tax, resulting in lower taxes being paid.

News Alerts

Get breaking news, investigations, analysis and more signature journalism from the Los Angeles Times in your inbox.

You may occasionally receive promotional content from the Los Angeles Times.

According to the charges, the Chauvins were sent “request for missing return” letters in the fall of 2019, warning them that they had not filed state taxes for 2016 and could be subject to criminal penalties if their tax returns were not filed.

When interviewed by investigators, Kellie Chauvin said she knew she had to file tax returns every year, but she had not done so because “it got away from her,” according to the complaints.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.