Retirees sue Rancho Santiago Community College District to retain promised health benefits

A grumble sounded from inside the Rancho Santiago Community College District office building in Santa Ana shortly after the April 25 board of trustees meeting began.

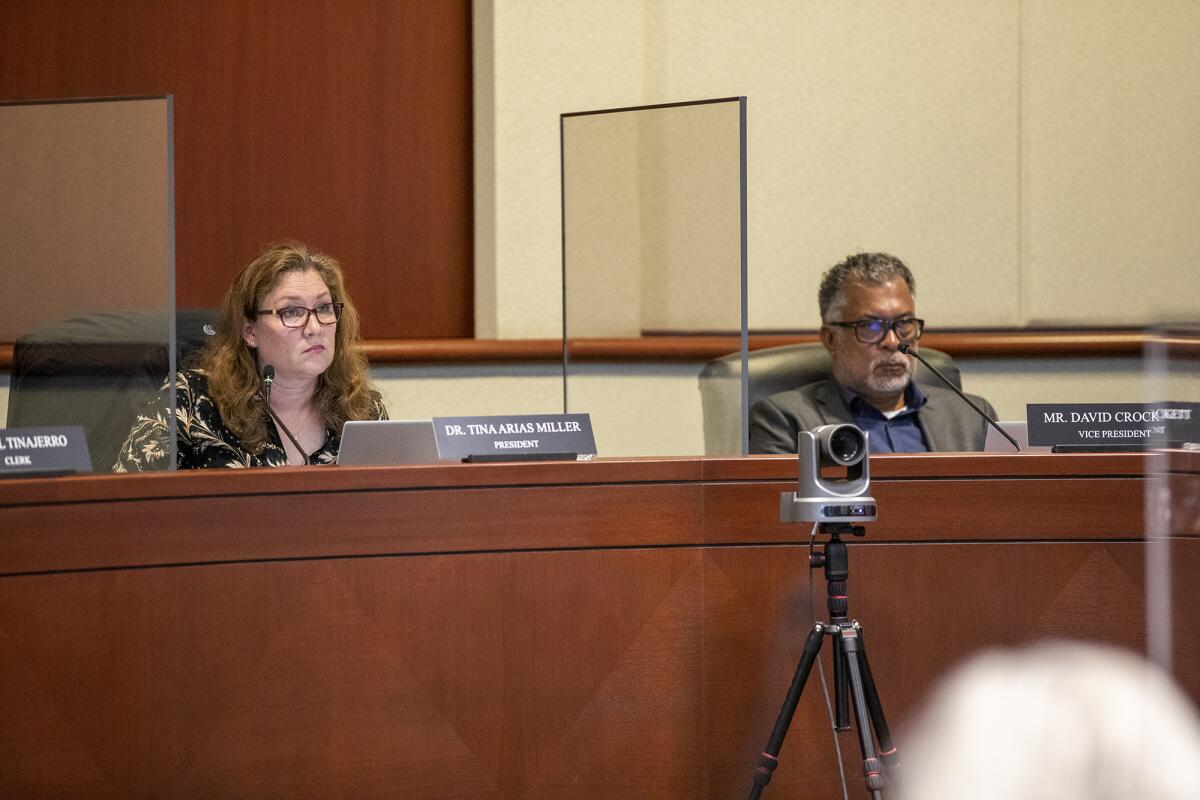

Board president Tina Arias Miller announced a 20-minute time limit for all public comments before closed session. Filling every empty seat in the audience, retirees took the minute and a half allotted in opposing the board’s move to stop providing them with the same health benefits as active employees in favor of required enrollment in Medicare and a district-funded Medicare Advantage Plan.

“At 77, I can’t start over again,” said Robert Putnam, a former philosophy professor who taught at the district. “Why are you doing this? Are we not dying fast enough?”

After the grumble came a gasp.

Karen Dennis shared with trustees that fellow retiree Nancy Brooks suffered a heart attack after speaking at the April 11 board meeting.

“Her doctor told her she absolutely could not speak before you, the board of trustees, again,” Dennis said, “because of the stress she’s going through over her medical care coverage.”

It’s been a steady drumbeat of dissent since last summer when district officials first discussed the change to retiree health benefits before trustees unanimously approved it on Aug.9, 2021.

After the latest speak-out, the board adjourned for closed session where they discussed a lawsuit filed earlier this year against the district by the Rancho Assn. of Retired Employees (RARE) that alleges the vote enabled a breach of contract.

For more than three decades, retirees who worked 15 or more years have received the same district-funded medical benefits as active employees for life or until age 70, depending on whether they started before or after May 31, 1986.

“We sought to have the court to stop the district from implementing its proposed changes,” said Matthew Gerend, an attorney representing RARE. “Unfortunately, the court did not grant that relief. The district has gone ahead and has started requiring retirees to enroll in Medicare, many of them for the first time.”

Complicating matters further, some retirees were not allowed to contribute to Medicare for a period of time while active employees since they were a part of the California State Teachers’ Retirement System.

And even when allowed a choice, they held firm to the district’s contractual obligation to provide them with the same benefits as active employees and continued not to make Medicare contributions.

Not all retirees have criticized the move since first announced.

Barry Resnick, a former president of the Faculty Assn. of Rancho Santiago Community College District, believed it a long time coming.

“For decades, the district has subsidized retiree benefits at the expense of current employees,” he said over Zoom during the Aug. 9 meeting. “By requiring eligible retirees to enroll in Medicare like every other district, public and private company in the country, there will be a savings annually in the multimillion-dollar range.”

Resnick further claimed the benefits so generous that they scared many health insurance companies from even bidding with the district and left current employees with unaffordable options for family coverage.

Vice Chancellor of Human Resources Cheng-Yu Hou addressed early criticisms. During the Aug. 9 meeting, he stated that the district had conversed with, among others, the California School Employees Assn. about the proposed change at the time.

“If you look closely at the language, the district is not in violation of the CSEA contract,” Hou said. “CompanionCare insurance fulfills the district’s obligation as it bridges retirees for the costs beyond Medicare coverage.”

He also claimed that the district sought to cover any Medicare late enrollment penalties.

But a month after the board approved the change, retirees sent trustees an angry open letter.

“To do this without going through the proper steps of labor negotiations or the board’s own protocol for changes to board policy is improper,” the Sept. 8 letter read. “But to do this retroactively to existing retirees is unconscionable.”

Retirees argued that the district had amassed more than $40 million over decades to continue funding their medical benefits postemployment. They did so, in part, by way of paycheck contributions leveraged by the district in critical salary and benefit negotiations throughout the years.

But when such arguments did nothing to persuade the district to reverse course, retirees took their fight to court, especially as the district changed the conversation away from Medigap insurance to a Medicare Advantage Plan administered by Retiree First.

“We’ve always offered a Medicare Advantage Plan,” Hou told TimesOC.

“I know there’s complications in terms of retirees wanting us to stay with the CompanionCare plan offered by the Alliance of Schools for Cooperative Insurance Programs, or ASCIP,” he added. “John Didion, sitting in my shoes, worked for ASCIP right after he retired from the district. He’s the one that’s leading this retiree group.”

Didion, who previously served as executive vice chancellor of Human Resources and Educational Services at the district, denies any improprieties.

“I do consult with ASCIP,” he said. “It has no connection at all with health benefits. To say that anybody at ASCIP has such a conflict of interest — that is pretty farfetched.”

A lawsuit filed on Jan. 10 alleges that the district’s move to compel retirees to enroll in Medicare was illegal.

“The change in coverage will have dire consequences for retirees,” the suit read. “Retirees will be required, for the first time, to pay the lion’s share of the costs for their healthcare, if they can afford it at all.”

It pointed to the example of Carol Lehrer, a district retiree who receives antibody infusions every four weeks to treat an Immunoglobulin deficiency. Her current health insurance covers 100% of the $14,000 medical bill for each infusion. The suit alleges that the treatment isn’t a Medicare-eligible expense and without the means to cover out-of-pocket costs, she harbors grave concerns for her health in retirement.

“Medigap plan or Medicare Advantage Plan, either way it’s a breach of contract,” Gerend said. “The district had been promising these people for more than 30 years that they would fund their health insurance premiums in the same plan as active employees.”

Hou claimed that the district’s contracts hadn’t been properly administered by predecessors.

“The majority of the retirees that show up to meetings are faculty,” he said. “The faculty collective bargaining agreements are very clear that at the age of the 65 they’re to be given a supplemental plan. I don’t know how else to interpret that.”

Aside from that, Hou added that the district is compelling retirees to enroll in Medicare to protect dependents from enrollment penalties should their spouses pass away, something that cuts into cost-savings benefits from the move.

Since the court filing, retirees and their supporters have attended board meetings to voice their displeasure with the district’s decision. Pete Maddox, a former district trustee, hadn’t addressed the board in 25 years but decided to offer a history lesson on March 28.

Near the end of his trustee tenure from 1990-97, the chancellor at the time asked the board to abandon the Unfunded Liabilities Fund, which would have impacted the benefits now in question.

“We gave our word to the faculty that we would not do that — and to the staff,” Maddox said. “We reaffirmed lifetime health benefits for them and their families.”

With less than 90 days before the implementation of a custom Medicare Advantage Plan that the district claims will “meet or exceed” retirees’ current coverage, it doesn’t appear likely that trustees will repeat history.

“The district is able to go ahead and implement its changes,” Gerend said, “but if we prevail in litigation, that will all have to be undone.”

Updates

12:46 p.m. April 28, 2022: This story has been updated with additional reporting, including comment from the district, clarifying the positions of both proponents and opponents of the change in insurance coverage.

All the latest on Orange County from Orange County.

Get our free TimesOC newsletter.

You may occasionally receive promotional content from the Daily Pilot.