Prop. 5 offers tax breaks for older home buyers, but could shortchange schools and cities

Reporting from Sacramento — After Robert Holland’s knee surgery a few years ago, he’s had a harder time climbing the stairs in his trilevel home in the Tujunga neighborhood of Los Angeles.

Holland, a retired stagehand, wants to move from his residence at the foot of the San Gabriel Mountains to a one-story place nearby with a yard large enough to raise a goat and a couple of chickens.

For the record:

2:10 p.m. Oct. 12, 2018An earlier version of this article incorrectly said the president of California Professional Firefighters is Brian Ellis. It is Brian Rice.

But one big thing is holding him back: taxes. Holland purchased his home in 1995 and owes $4,500 this year in property taxes. If he buys a new house where he wants, his tax bill will more than double.

“It’s a matter of the quality of life,” he said, chuckling about his dilemma about whether to move. “I’m 63. I’m thinking what do I got, 20 good years left?”

The California Assn. of Realtors has a solution to Holland’s problem. It’s sponsoring Proposition 5, a statewide initiative that would provide property tax benefits for homeowners 55 and older as well as the severely disabled and natural disaster victims if they move to a new home.

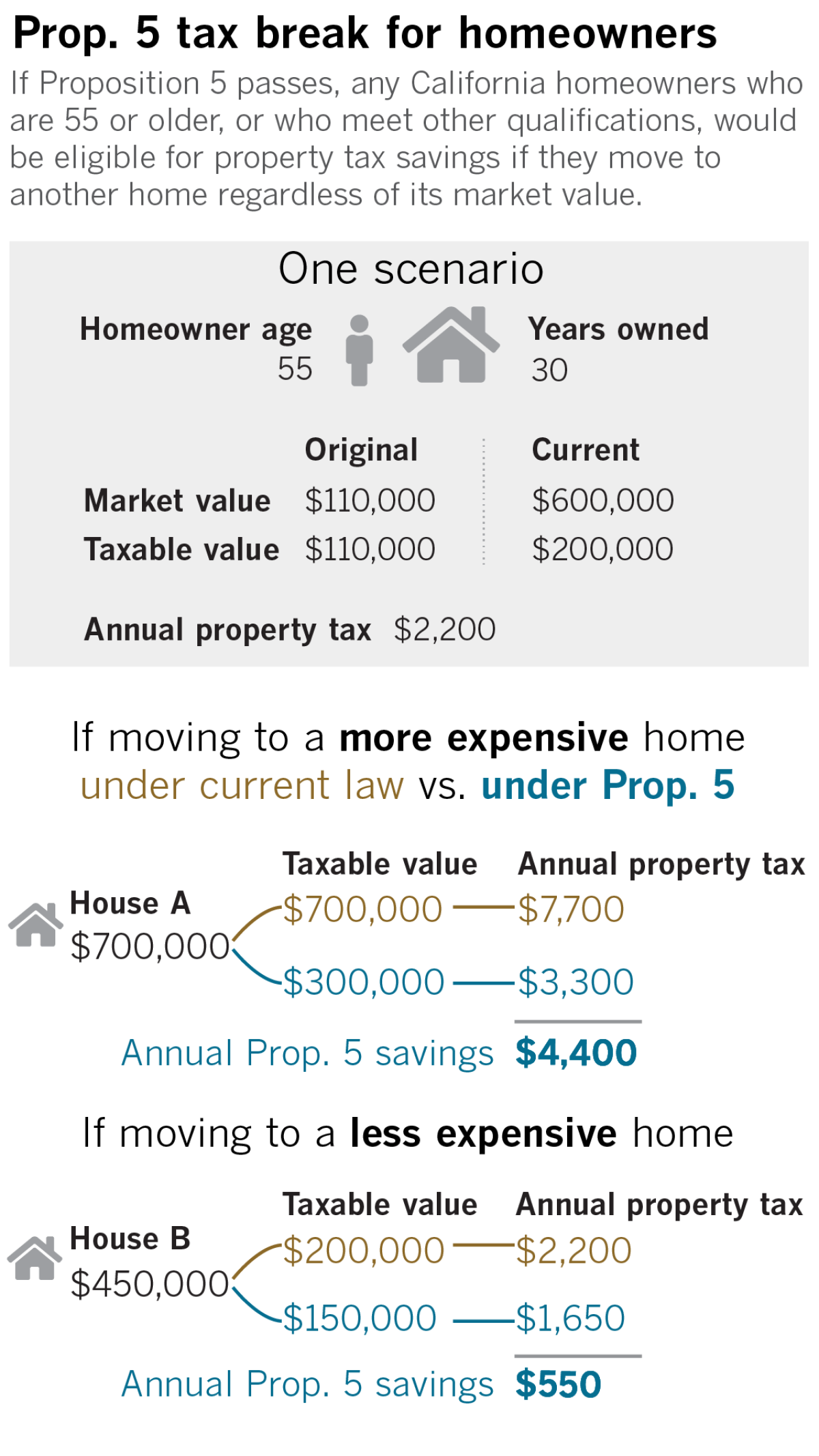

Under the measure, qualifying homeowners would no longer have to pay property taxes based on the purchase price of their new home. Instead, they’d pay based on a combination of their new and old home values, lowering their property tax payment. The Realtors’ group, which has raised $13 million for the campaign, contends that the tax breaks are needed to help older residents and could free up larger homes that young families could use.

But a host of Proposition 5 opponents — including economists, local governments and labor unions — argue that older homeowners already receive disproportionately large property tax benefits in California. They say that providing additional breaks will exacerbate those disparities while costing cities, counties and schools billions of dollars a year.

Fernando Ferreira, an economist at the University of Pennsylvania’s Wharton School who has studied California’s property tax system, called Proposition 5 “completely nonsensical.”

“Right now, you’re giving a gigantic tax break to older homeowners who live in the best houses in the richest parts of the state,” Ferreira said. “This new proposition unfortunately will just perpetuate this inequality.”

Proposition 5 builds off the property tax system inaugurated 40 years ago when Californians passed Proposition 13, which limits property taxes to 1% of a home’s taxable value, based on the year the house was purchased. The 1978 ballot measure also restricts how much that taxable value can go up every year, even if a home’s market value increases much more.

Homeowners receive more benefits the longer they remain in their homes because their tax bills stay restricted even as their home’s market value goes up. But residents could face a spike in tax payments if they move to a new home.

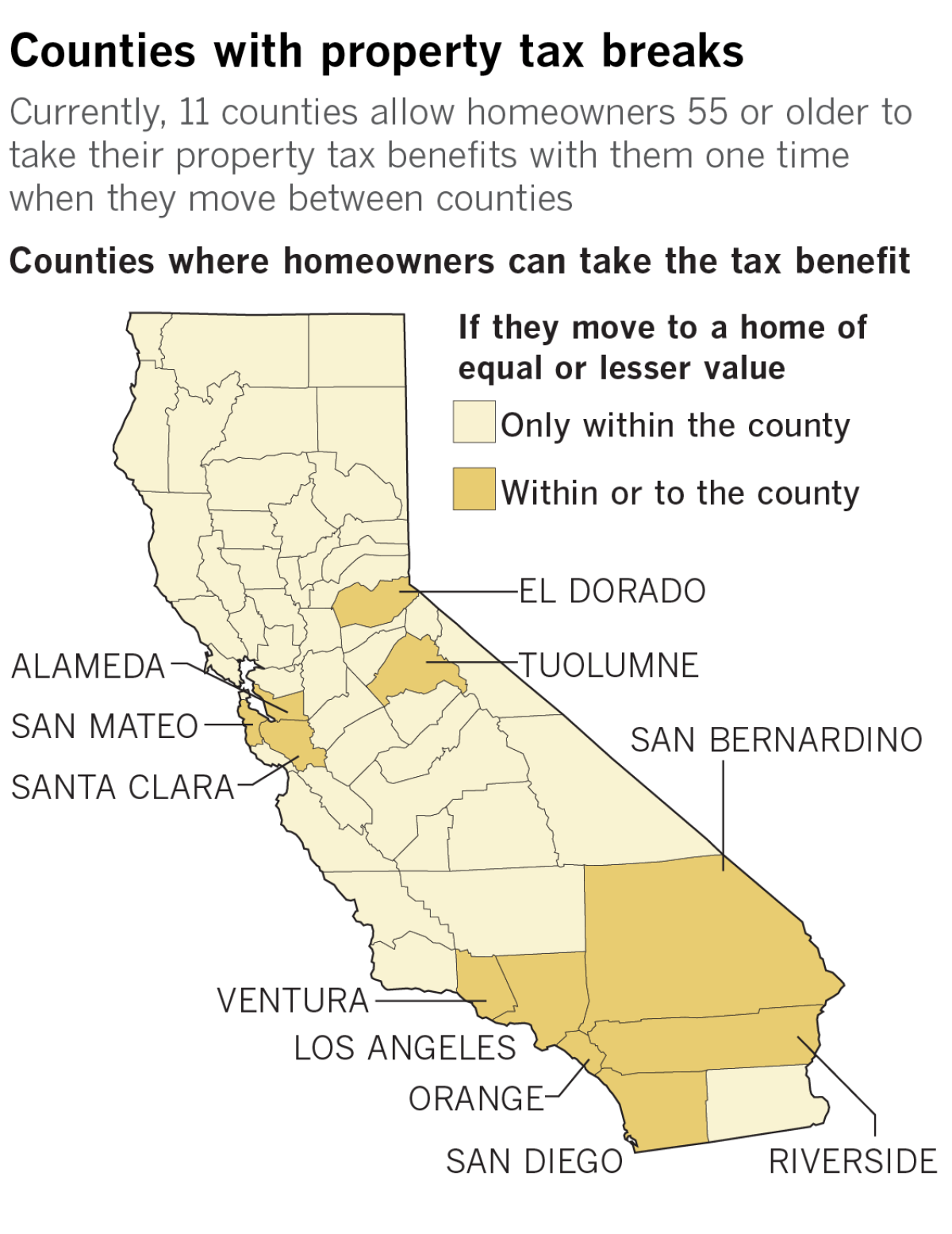

Homeowners who are 55 or older currently have a one-time opportunity to retain their existing tax benefits if they move to a home of equal or lesser value within the same county. They can do the same when moving between Los Angeles and 10 other counties.

Proposition 5 would further ease the tax burden by allowing the same group of older homeowners to blend the taxable value of their old house with the purchase price of any new home — even if it’s more expensive — reducing the property tax payment they’d otherwise face. The rules under Proposition 5 would extend to every county in the state and homeowners could take advantage an unlimited number of times.

The initiative would boost home sales among older Californians, said Steve White, president of the California Assn. of Realtors. More than 70% of California homeowners 55 and older did not move during a 14-year period ending in 2013, according to a Realtors’ analysis of U.S. Census data.

“This addresses the problem of seniors and disabled Californians being frozen in their own homes,” White said.

Those who could take advantage of the new benefits, however, are much wealthier and whiter than the average Californian, according to a study of Proposition 5 by the California Budget and Policy Center, a nonprofit that advocates for the working poor. The median household income of $77,000 for potential beneficiaries is nearly 15% higher than the statewide median, the study found. And nearly two-thirds of eligible heads of household are white compared to less than half of the overall population.

Under Proposition 5, homeowners could pay less in property taxes than they do in their current houses if they move.

For example, take a qualifying homeowner who owns a home with a taxable value of $200,000 that is worth $600,000 on the market. That person would pay roughly $2,200 in property taxes now. If the homeowner moves to a new $450,000 house — more than the current home’s taxable value but less than its market value — the new home’s taxable value would decrease under Proposition 5. The annual property tax bill would go down to $1,650, a savings of $550.

Michelle J. White, an economist at UC San Diego who has written about California property taxes, called that part of the initiative “a giveaway” to longtime homeowners who have seen large gains in their home values while their taxes have been kept stable.

“It’s hard to believe they’re even proposing that you pay less than your low property taxes now,” White said. “But that’s what they’re doing.”

The measure wouldn’t just benefit older homeowners, but their children as well. California’s property tax system allows heirs to inherit their parents’ low property-tax payments when they inherit their homes. Proposition 5 would increase the advantages under the inheritance tax break for newly purchased homes.

But local governments and schools would lose a combined $2 billion a year in property tax revenue over time, according to the official financial analysis of Proposition 5 by the state’s nonpartisan Legislative Analyst’s Office.

Because those costs are so high, the Realtors’ group has looked for alternatives to Proposition 5. After gathering signatures to put the initiative on the ballot this year, the Realtors lobbied the Legislature for a deal. The group wanted to replace Proposition 5 with a separate measure that included the same tax breaks for older homeowners, but eliminated the inheritance tax break for vacation and rental properties, and clamped down on businesses that avoid higher property taxes when they buy commercial real estate.

Lawmakers didn’t bite. Now the Realtors’ association is trying to put the broader version of the initiative on the 2020 ballot.

White, president of the Realtors’ group, said the 2020 measure would address inequities in the state’s property tax system while also increasing revenue. He said his organization planned to pursue the initiative two years from now no matter the outcome on Proposition 5.

A coalition of California labor unions, including those representing service workers, teachers and firefighters, and other backers have raised $2.4 million to campaign against Proposition 5.

Brian Rice, president of California Professional Firefighters, said the lost property tax revenue from Proposition 5’s passage would hit local budgets hard.

“You’re not talking about cutting paper clips or pencils and papers,” Rice said. “That kind of money, it leads to layoffs.”

Each year, about 85,000 homeowners older than 55 move to different houses in California, according to the legislative analyst’s report. The analyst estimated that Proposition 5 could increase that number by tens of thousands each year.

Holland said that he could afford to move to a new place without Proposition 5, but the initiative would make his decision easy.

His wife, Lorie, is also retired, after working for defense contractor Northrop Grumman, and Holland said Proposition 5 is needed given the couple’s fixed incomes and how costly it is to pay taxes in California. He doesn’t believe that moving to a new house that’s slightly more expensive than what he can sell his for should come with a large tax increase.

“Now, I’m being penalized,” Holland said. “All that I’m seeing is that the state of California wants my money.”

Coverage of California politics »

Twitter: @dillonliam

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.