Gov. Jerry Brown offers part of a historic budget bonanza to help ease California’s homelessness crisis

Reporting from Sacramento — Even in the wake of previous tax windfalls, Gov. Jerry Brown’s announcement on Friday was breathtaking: The state has collected an unexpected $9 billion in tax revenue in recent months, $3 billion more in cash than projected in January.

The money is the latest installment in a fiscal winning streak of historic proportions in California. And, as in previous years, the governor’s newly revised budget seeks to divvy it up on either short-term spending or long-term savings by putting it into government reserves.

For the record:

3:55 p.m. May 12, 2018A previous version of this article said that the UC and Cal State systems had delayed action on tuition increases for the coming academic year. Cal State officials have said they will not raise tuition. Also, an earlier version of this article said a plan by a number of mayors in California called for spending $1.5 million from the budget surplus to fight homelessness. The mayors called for spending $1.5 billion.

“This is a time to save for our future, not to make pricey promises we can’t keep,” Brown said. “I’ve said it before and I’ll say it again: Let’s not blow it now.”

Brown’s most significant proposal for spending the cash may be a $359-million boost to ease the state’s burgeoning homelessness crisis. The governor’s proposal also embraces a plan to put a $2-billion bond for homeless housing on November’s statewide ballot. The budget plan adds $312 million for mental health programs.

Get the latest updates on California politics »

The infusion of cash to help the homeless is one of only a few new proposals in the $199.2-billion spending plan, a revision of Brown’s original proposal to the Legislature in January. As was the case then, the governor continues to believe the lion’s share of the tax windfall should be socked away in the state’s rainy-day fund.

“I’ll be very cautious in this year’s budget,” he told reporters at the state Capitol on Friday.

Brown’s plan calls for topping off the reserve account at $13.8 billion by next summer, the largest in state history. Under the provisions of a 2014 ballot measure approved by voters, the fund can grow to no more than 10% of projected general fund revenues. That law also requires some of the early money be spent on repaying government debts.

A portion of the extra cash would go toward a new $1-billion effort to reduce the backlog of delayed maintenance in state departments and agencies. Almost one-third of the money would pay for projects on community college campuses, state prisons and aging river levees. In addition, the University of California and California State University systems would each receive $100 million for maintenance needs.

Brown also fired a warning shot to UC and CSU leaders in his budget. Should either college system raise tuition in the coming school year, he proposed a cap on state scholarship funds. That support, money for the Cal Grant and Middle-Class Scholarship programs, would otherwise rise automatically to meet student financial needs. UC leaders delayed action on a tuition hike while they awaited action on a state budget. Cal State officials have said they will not raise tuition next year.

As in previous years, a key debate point over the next few weeks is likely to be how to categorize much of the unexpected cash. Brown has consistently argued the windfalls should be considered temporary, and thus not used to pay for ongoing state services. Legislative Democrats have largely acceded to those demands, thereby narrowing the number of social services programs that can be boosted.

Those agreements have left some programs at or near recession-era levels. The governor insists that his administration has made significant strides toward helping Californians who live in poverty, including creating a tax credit for the working poor in 2015 and gradual increases in the state’s minimum wage.

And yet lawmakers, in budget committee hearings through the winter and spring, heard from scores of advocates who pleaded for additional funds to boost subsidized child care and cash grants for the aged and disabled. Democrats in both the Senate and Assembly are expected to insist on more long-term funding for CalWORKS, the state’s welfare assistance program, as they begin negotiations with Brown over the next few weeks.

The governor acknowledged “there will be some back and forth” in those private conversations, though he insisted there’s no way to match dollars with demands. “If you take all these needs, and there are a lot of them, it’s endless,” he said.

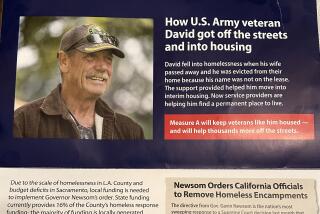

The new focus on homelessness is intended to help cities and counties that are struggling to address the steady stream of adults and families living on the streets. A federal study concludes that more than 130,000 residents of the state are homeless, a 14% increase in the last year alone.

Legislators have expressed particular frustration that a $2-billion bond to help pay for additional housing, agreed to by the governor and lawmakers in 2016, has been tied up in court and remains unspent.

Brown is now supporting a bill by Sen. Kevin de León (D-Los Angeles) to have voters sign off on the housing bond instead of waiting for a court decision. A two-thirds supermajority of lawmakers will have to agree for the bond measure to reach the ballot.

The slow pace of spending on homelessness efforts is one reason for calls earlier this year from Los Angeles Mayor Eric Garcetti and mayors from the state’s 10 other largest cities to spend $1.5 billion from the budget surplus to help local governments address the problem. State senators also have put forward a plan to spend $2 billion of the surplus on low-income housing development, with half that amount earmarked for homelessness programs.

Of the $359 million for homelessness efforts in the governor’s proposal, the state would provide $250 million in grants to cities and counties that have declared homelessness emergencies. The remaining amount is for spending increases to existing state health, emergency and social service programs designed to help homeless domestic violence victims, the mentally ill and poor senior citizens.

Garcetti and the other mayors praised the governor for his proposal but indicated they would be seeking more money.

“I look forward to working with the governor, the Legislature and mayors across California to make certain that there are enough dollars to make meaningful and lasting strides toward ending the moral and humanitarian crisis on our streets,” Garcetti said in a statement.

Several of the candidates vying to succeed Brown as governor were critical of the state’s response thus far to the homelessness crisis in a televised debate on Tuesday.

“What lacks is leadership in this state,” said Lt. Gov. Gavin Newsom, the front-runner in the race.

Brown said Friday that he welcomes additional action from whoever his successor might be. “I think that’s a good challenge,” he said of Newsom’s critique. “That will take leadership because it’s going to require changes in the laws that currently exist.”

In a nod to last year’s deadly wildfires up and down the state, Brown’s new budget also adds nearly $100 million to the budget for fire prevention. The state would increase controlled burns and boost education and training programs in fire-prone areas. California environmental officials said Thursday that the money is needed because the state’s forests are facing “a catastrophic shift” toward increased risk of major events.

“Science tells us that these trends will only be exacerbated by climate change,” California Secretary for Natural Resources John Laird said.

California’s K-12 schools and community colleges would continue to receive the largest share of tax dollars under the budget proposal, with a $2.8-billion boost compared with earlier projections. Spending is estimated to be close to $4,600 more per student than seven years ago, during the budget’s bleak times.

While experts have pointed out that both the state and the nation are overdue for an economic course correction that would slow the rate of tax collections, California’s fiscal watchers see multiple reasons for three consecutive years of better-than-expected revenue collections. There’s also the temporary surcharge on high-income earners that California voters approved in 2012 and extended in 2016.

Stock market strength has again produced sizable capital gains for the state’s most wealthy, one of the primary drivers of income tax revenue. Brown remarked on Friday that as few as 15,000 tax filers in the state provide one-quarter of the income taxes collected. When the fortunes of those Californians suffer, so does the state budget.

“Life is very giddy at the peak,” the governor told reporters. “But I’m not giddy.”

Brown’s revised budget plan marks the traditional beginning for a month’s worth of intense budget negotiations with legislative leaders. By law, the Legislature must send him a spending plan no later than June 15 — a deadline routinely ignored for most of the modern era, but strictly adhered to since voters approved a 2010 ballot measure that garnishes legislators’ pay for every day a budget is late in arriving on the governor’s desk.

Follow @johnmyers and @dillonliam on Twitter, sign up for our daily Essential Politics newsletter and listen to the weekly California Politics Podcast.

UPDATES:

3:10 p.m.: This article was updated with additional details on the governor’s budget proposal.

This article was originally published at 10:20 a.m.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.