Senate appears poised to pass GOP tax bill as leaders make final tweaks

Reporting from Washington — The Republican tax plan inched closer to Senate passage Thursday, but encountered new challenges after some dramatic, last-minute negotiations to win over GOP holdouts concerned about a new congressional analysis that estimated the package would add $1 trillion to the nation’s deficit.

Republicans and the White House sorely need a legislative victory to reflect their first year of control in Washington, and a landmark tax bill — which would dramatically lower the corporate rate and double the standard deduction for individuals — would provide that win.

If passed during a vote planned for Friday, the sweeping Senate tax bill would next need to be reconciled with a House version, a process leaders hope to expedite in a matter of days. Then both the House and Senate would need to pass the revised measure before sending it to President Trump’s desk.

Yet even many Republicans who support the $1.5-trillion package expressed resignation ahead of the vote, concerned about the cost and details of a package that experts say benefits corporations and the wealthy, and the way the legislation is being rushed through Congress without a broad range of hearings and the usual debate.

At one point Thursday evening, it appeared three Republicans — Sens. Bob Corker of Tennessee, Jeff Flake of Arizona and Ron Johnson of Wisconsin — were considering joining Democrats in a motion to send the bill back to committee, a move that would have almost certainly dashed GOP hopes of passing a bill this year.

The three are worried the tax cuts will pile onto the national debt.

Proponents of the bill promise that the costs, estimated to increase the deficit by $1.5 trillion over 10 years, will be offset by the economic growth spurred by the tax cuts. But even after accounting for such growth, a report released Thursday by the Joint Committee on Taxation estimated that the GOP bill would still increase the deficit by $1 trillion.

Democratic Sen. Ron Wyden of Oregon, who pushed for the report to be released before the vote, said it “ends the fantasy about magical growth and claims [that] the tax cuts pay for themselves.”

Corker had been pushing to include a trigger that would reverse some tax breaks if the economy doesn’t grow enough. But many senators and outside conservative groups opposed the trigger, and under Senate rules, it was determined such a provision could not be included in the bill.

After tense, hurried and at times acrimonious negotiations on the Senate floor Thursday, the three men relented, putting the vote back on track. In return, Senate leaders agreed to include a provision, still under debate late Thursday, that would require as much as $350 billion in new taxes at a certain point in the future to offset any increase in the deficit. Senators said the tax hikes could come in phases. But the details remained unclear ahead of the final vote.

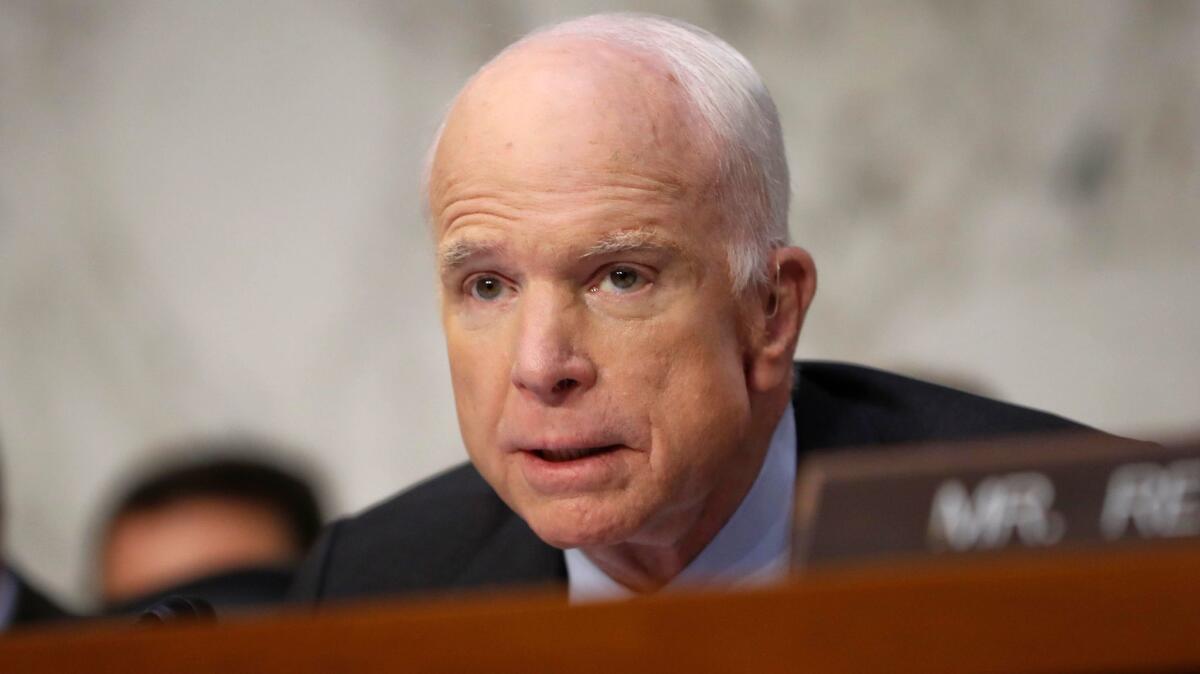

For much of Thursday, momentum for the bill had been rising. An endorsement from Sen. John McCain (R-Ariz.) ended speculation that the independent-minded Republican could upend his party’s hopes for a year-end accomplishment, much the way his opposition helped kill the GOP’s Obamacare repeal earlier this year.

Similarly, support from Sen. Lisa Murkowski (R-Alaska) and encouraging words from Sen. Susan Collins (R-Maine), both of whom had also opposed the healthcare repeal, gave the bill a boost ahead of voting.

“This is not a perfect bill, but it is one that would deliver much-needed reform to our tax code, grow the economy and help Americans keep more of their hard-earned money,” McCain said.

Just hours before the Senate vote, GOP leaders were still revising the plan, without support from Democrats and behind closed doors. Senators were preparing to offer numerous amendments Thursday evening, though few were expected to be approved.

Republicans can only lose two votes from their 52-seat majority and still pass the bill with Vice President Mike Pence breaking a tie.

Murkowski came on board after an agreement was reached to include a provision she sought to allow oil and gas drilling in part of the Arctic National Wildlife Refuge for the first time in years.

Others continued trying to shape the bill as the Senate debated.

“I am not committed to vote for this bill,” Collins said at a breakfast meeting with reporters. “Because who knows what’s going to happen on the Senate floor.... But I am encouraged.”

The package would slash corporate rates to 20%, a level not seen since the Great Depression, and initially reduce individual brackets, though studies show the benefits would flow mainly to wealthier Americans rather than lower- and middle-income households.

The corporate rates would become permanent, while the individual rate cuts would expire in 2025.

One amendment sought by Sens. Marco Rubio (R-Fla.) and Mike Lee (R-Utah) would increase the bill’s proposed 20% corporate tax rate to 22% to provide $180billion over the decade to make a proposed $2,000 child tax credit fully refundable for low-income Americans.

But lifting the proposed 20% corporate rate — the foundation of the GOP plan — has been strongly opposed by the White House and groups backed by the billionaire Koch brothers.

“Reducing America’s high corporate tax rate from 35% to 20% is key to driving the economic growth,” leaders of Americans for Prosperity, Freedom Partners and other Koch-aligned groups wrote in a letter to senators. “The proposed Rubio-Lee amendment would deviate from that framework.”

Johnson also planned to offer an amendment to eliminate the ability of corporations to continue deducting state and local income and sales taxes — a write-off that individual filers will have to forgo. Elimination of that write-off would hit residents of California and other high-tax states the hardest.

Democrats were resigned that the bill appeared headed toward passage, despite their efforts to halt it.

“My new rule is: The faster a bill goes through, the worse it is,” said Sen. Angus King, the Maine independent who caucuses with Democrats and had offered the amendment to send the bill back to committee to come up with the money to fully pay for the cuts.

“The process is preposterous. The bill is terrible,” he said. “That’s exactly the problem of not having hearings — there’s no real analysis of [what] the consequences, particularly the unintended consequences, are going to be.”

After King intervened to talk with Corker and other Republicans during the standoff on the Senate floor, the Republican whip, Sen. John Cornyn of Texas, could be overheard arguing that King’s move was “designed to kill the bill.”

Meanwhile, the Treasury Department’s inspector general said it had launched an inquiry into whether the department hid an analysis of the Republican tax bill — or even did one at all.

Treasury Secretary Steven T. Mnuchin had indicated his department would produce an analysis proving that the economic growth stimulated by the bill’s large tax cuts would offset lost revenue.

But no analysis has been released. Sen. Elizabeth Warren (D-Mass.) wrote to Treasury Inspector General Eric M. Thorson on Thursday asking for an inquiry after a New York Times article said members of the Treasury’s Office of Tax Policy, which would do such an analysis, said they were not working on one.

“Either the Treasury Department has used extensive taxpayer funds to conduct economic analyses that it refuses to release because those analyses would contradict the Treasury Secretary’s claims, or Secretary Mnuchin has grossly misled the public about the extent of the Treasury Department’s analysis,” Warren wrote. “I am deeply concerned about either possibility.”

Rich Delmar, counsel to the inspector general, said Thursday that the office had launched an inquiry and that it was a “top priority.”

A spokeswoman for Mnuchin did not immediately respond to a request for comment.

Times staff writers Jim Puzzanghera and Sarah D. Wire in Washington contributed to this report.

Twitter: @LisaMascaro

ALSO:

Is this small-town congressman from New Mexico tough enough to win Democrats the House majority?

More coverage of politics and the White House

UPDATES:

4:40 p.m.: This article was updated after a vote was scheduled for Friday, following a flurry of last-minute negotiations.

1:25 p.m.: This article was updated with additional details and endorsements of the tax bill.

This article was originally published at 8:50 a.m.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.