Opinion: Wall Street predators destroyed Toys ‘R’ Us. Now they’re coming for Simon & Schuster

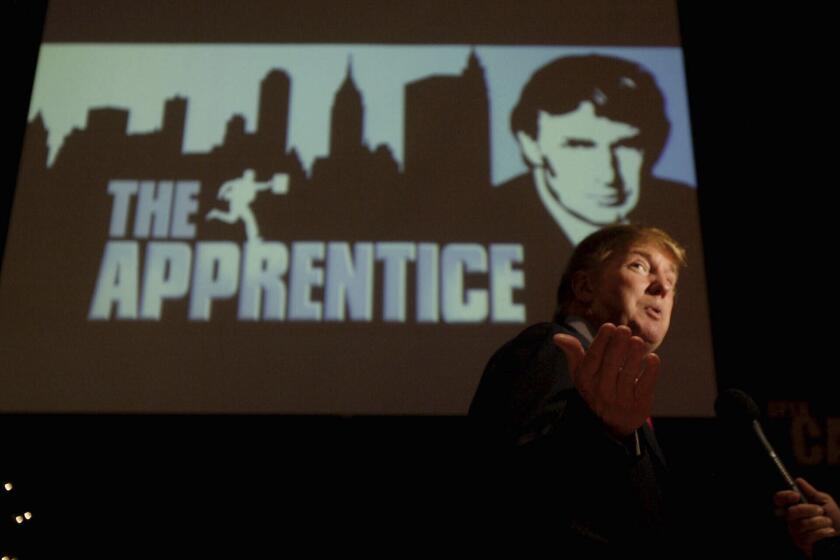

The venerable publishing house Simon & Schuster will soon be owned by one of the nation’s biggest private equity firms, KKR. For a glimpse of their future — and tips on how to fight back — Simon & Schuster authors and employees might want to chat with the former workers of Toys ‘R’ Us. There are 33,000 of them, and their company was driven into bankruptcy five years ago by a clutch of Wall Street firms led by KKR.

That’s a common script. Private equity is a 40-year-old Wall Street creation that thrives on cost-cutting, wealth extraction, short time horizons, and financial engineering. It bought, sold, and liquidated its way through the American retail sector years ago, and is now jumping into traditional book publishing, a business that demands patience, an appetite for risky new authors and deft marketing. Can Simon & Schuster survive, as KKR is infamously known, the “barbarians at the gate”?

The economic forces upending traditional journalism can be countered by a strategy to ‘replant’ struggling newspapers back into communities.

The private equity model is to loot and flip, not to invest or run companies well — an ominous history for any acquisition, but especially for a business requiring long-term commitments, like book publishing. That said, there are policy options for change, from Washington to Sacramento, and models for workers to fight back.

Private equity firms raise money from pension funds, endowments and wealthy individuals and use a slice of that money plus a lot of leverage to buy companies that are then saddled with the debt. The Simon & Schuster transaction will leave the publisher $1 billion in hock, ratcheting up pressure to repay the debt — and turn a profit.

Those former Toys ‘R’ Us employees can attest to how that goes. When a group led by KKR bought Toys ‘R’ Us for $6.6 billion in 2005, it used $5 billion in debt. Then it kept squeezing. The new owners eliminated positions and offloaded responsibilities onto other employees, while pressuring workers to sign up customers for high-margin sweeteners like credit cards and “payment protection plans.”

After a few years of joining the Kindle cult, I am back to my old bibliophile ways. I do this not just out of compulsion, but aspiration.

KKR and its partners sold off Toys ‘R’ Us real estate, pocketed the money and forced the retailer to lease back its buildings. Along the way, KKR and the other firms paid themselves $250 million in “management fees” and big bonuses to hand-picked executives — right before Toys ‘R’ Us entered bankruptcy.

KKR’s story tracks the march of private equity through the American economy. Retail proved lucrative for KKR and other private equity firms, but 52,000 workers paid the price in California alone.

Healthcare has also proved a juicy target; KKR bankrupted Envision Healthcare, a staffing service for emergency rooms, with a heavy debt load. KKR, Blackstone and others have contributed to the housing crisis through their ownership of single-family homes, further excluding, especially, Black Americans from homeownership. An investigation of KKR ownership of care facilities for disabled people revealed appalling conditions, including at its California locations, part of a broader problem of private equity in the care economy.

I write as a way of seeking connection, even though having no control over how my work is interpreted can, at times, make me feel even more alone.

Wall Street is no stranger to the creative industries. Blackstone, a private equity rival to KKR, has wrangled with recording artists over its ownership of companies that pay royalties. If KKR seeks a bigger slice of the income pie at Simon & Schuster — as opposed to growing the pie with new authors and titles — pressure on authors could go the same way.

Because debt both lubricates the private equity machine and raises pressure to slash costs and curb investment, any solution must realign incentives so that executives who load up a company with debt end up responsible for it. The Stop Wall Street Looting Act, introduced in 2018, would pierce the liability shield between private equity firms and the companies they purchase, giving creditors recourse to recover debt from Wall Street dealmakers.

Other measures could curb the worst abuses. Proposals in Congress would eliminate tax deductions for big corporate landlords to reduce incentives to bid up the cost of housing. Measures by health industry regulators could limit reimbursements to private equity-owned providers to deter harmful ownership forms. More states could also pass mandatory severance laws — New Jersey has led the way — to cushion the impact of mass layoffs. Minnesota’s state attorney general, Keith Ellison, is suing a private equity-owned home rental company for failing to maintain its properties.

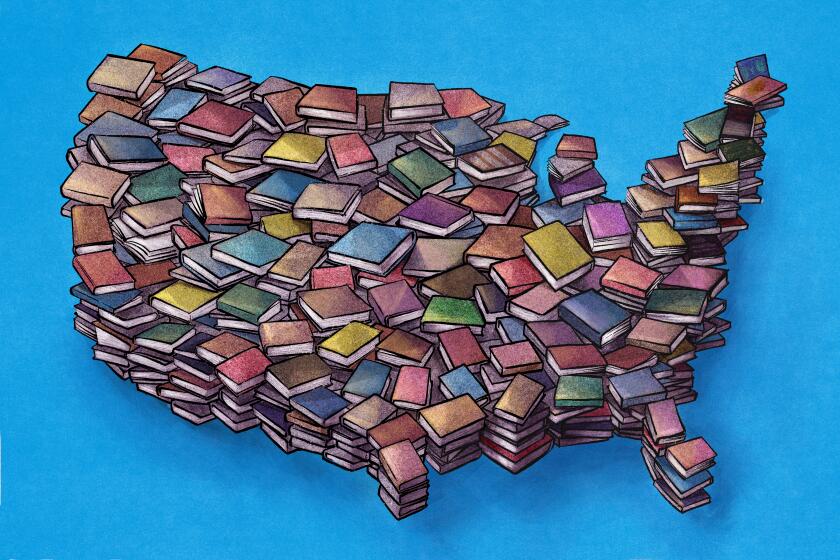

Over five years, I read 1,001 novels to hear the voices that fill this country. These books showed me that the places of American fiction can’t be divided into blue or red states.

And workers can fight back. Former employees of Toys ‘R’ Us won a $20-million severance fund after its bankruptcy through an astute mix of people power and political pressure. Tenants are organizing in San Diego to combat abuses by Blackstone, which has tried to outflank rent stabilization laws by driving existing tenants out through eviction or neglect.

Don’t worry about the folks at KKR. Its founders, Henry Kravis and George Roberts, are each worth about $11 billion after long careers on Wall Street. But based on their track record, the outlook for Simon & Schuster, publisher of important authors like Ernest Hemingway, Siddhartha Mukherjee and Doris Lessing, darkened considerably this week.

Aliya Sabharwal is a campaigns manager for private equity at Americans for Financial Reform and a former organizer of laid-off Toys ‘R’ Us employees.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.