Op-Ed: The social justice case for canceling college debt

Student debt should never have become a national crisis. No one wanted this, no one intended this.

The situation is likely to get worse. Given huge university budget shortfalls caused by the pandemic, institutions such as the University of California seem poised to raise tuition — which means students will have to borrow even more to pay the higher cost.

At the same time, the economic downturn and reduced job prospects for new graduates mean that millions of borrowers cannot afford to pay. While the 41 million people with federal loans have been given a temporary reprieve from payments until the end of January, with economic recovery very unclear, student loan debt has become a top cause of anxiety among millennials. So it’s not surprising that calls for reducing the repayment burden have grown loud indeed.

The 1965 Higher Education Act, which established the federal student loan program, enabled millions to get a college education. The goal of that landmark act was to improve access for all students. The paradox is that restoring the promise of higher education access now requires canceling debts. Countering inequality demands taking precisely that step.

Back in 1965, the lawmakers who created the federal student aid structure focused on providing grants, not loans. Over several decades — with the expansion of student loans — the law has helped to make college more attainable. The Education Department estimates that this fall, there were more than 16 million undergraduate students, more than double the number in 1970. And that population is far more diverse than it was when the law was passed.

But that great promise has become less and less viable. With debt becoming the dominant form of financing, getting a college education is more out of reach for poor students, who are disproportionately Black and Latino.

College debt imposes burdens on students who complete their degree, reshaping career possibilities and delaying life milestones like getting married, buying a home and having children. Students who do not get a degree face starker obstacles, since they won’t benefit from higher earning potential connected to a degree.

Some sociologists have described this phenomenon as a case of “predatory inclusion” — a promise of access to a benefit that turns out to be less than valuable, or even burdensome, to the beneficiary. Our current crisis, with more than 40 million borrowers owing more than $1.5 trillion and the prospect of a generation of young people financially hobbled, forces the question: How did we get here?

First, federal grants, known as Pell Grants, have not increased to keep pace with the skyrocketing price of a college education. In the late 1970s and 1980s, those grants were sufficient to cover most or even all of a student’s college costs. The maximum Pell Grant this year is $6,345; the College Board estimates that first-time, full-time undergraduates attending public universities in-state must come up with more than $14,000 to cover tuition, fees, room and board — after any grant aid.

Second, tuition at public colleges and universities, which educate the vast majority of college students, has actually risen more quickly than tuition at private, nonprofit institutions, the College Board has found (though public schools are still cheaper).

Finally, wages have not risen sufficiently for all workers to keep higher education as attainable. At the same time, the earnings gap between those with a college education and those without has widened. Faced with rising costs and the knowledge that college was necessary to get on a higher earning path, more students inevitably turned to loans to finance their educations. And changes in the law in the early 1990s, like excluding the value of a primary home when determining eligibility for some loan programs, made it easier for more people to borrow.

The bottom line is students and their families now shoulder a bigger share of the cost of college even as costs have risen. The effect is to make investing in higher education more risky for students who rely on loans. Students from less privileged backgrounds who enroll in college are less likely to complete a course of study. But they would still have to repay any loans. This dynamic may deter the risk-averse from pursuing higher education at all — a perverse outcome and the opposite of the lofty aim of the Higher Education Act.

Eliminating or reducing the loan burden would help millions of students, but particularly Black and Latino graduates, who make slower progress on repayment, because they tend to receive lower wages — another manifestation of structural racism. Reducing loan obligations would especially help students who don’t end up with a degree.

Most borrowers don’t owe the eye-popping amounts so often in the news; about one-third of borrowers owe less than $10,000, according to the Education Department, and close to half owe less than $20,000. And students who owe less than $5,000 are the most likely to default on loans, the Urban Institute has found. The federal Consumer Financial Protection Bureau has observed that these borrowers are also least likely to benefit from existing debt relief options.

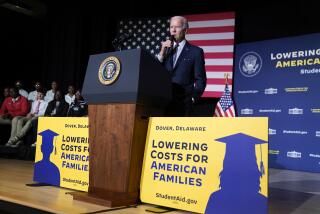

At this point, the student debt crisis is no longer an individual problem, but a societal one. It needs to be addressed through the lens of social policy. Sens. Elizabeth Warren and Charles Schumer have proposed canceling up to $50,000 of each borrower’s debt through executive action, without legislation. President-elect Joe Biden proposed a more modest $10,000 of “immediate cancellation” and increasing Pell Grant amounts to correct that cost misallocation problem going forward so that paying for college is less risky. These proposals would be in addition to fixing programs that already exist, such as the Public Service Loan Forgiveness program, and pave the way for a broader redesign of public higher education finance.

It is easy to forget that the whole student loan program was created by lawmakers who saw higher education as a public good that created more informed citizens, more productive workers, stronger drivers of innovation and national economic progress. Focusing on debt as an individual obligation and education as something of value only to the student misses that point.

Cancellation of debt would be a triple win for the incoming administration. Not only would it earn the gratitude of younger voters, it would also enable them to spend more money and bolster the economy. And who knows what good ideas they’ll be free to pursue to get us out of the mess we’re in.

Jonathan D. Glater is a professor of law at UCLA School of Law.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.