Op-Ed: This reform of Proposition 13 is needed now more than ever

Proposition 15, the November ballot measure that addresses California’s rickety property tax system, has been in the works for five years. Its creators could have had no advance knowledge of the coronavirus pandemic. But COVID-19’s crippling of the state’s economy has underlined the importance of the initiative.

Proposition 15 would amend the state Constitution and deliver a sharp poke to one of the state’s most famous experiments in legislation via ballot measure: Proposition 13, the 1978 taxpayer-revolt initiative that stabilized state property taxes for many but also hobbled the state’s revenue base.

Proposition 15 is a partial repeal of Proposition 13, but the key word is “partial.” It applies only to commercial and industrial property, and only to holdings worth more than $3 million. If it passes, the assessment on such property would rise annually based on market value instead of being capped at a 2%-increase a year. (The tax rate would stay the same, 1% of the sale price of a property.)

This limited reform could generate proceeds as high as $12.4 billion a year, according to a February study by three USC researchers. Local communities would receive 60% of the revenue; schools would get 40%.

That money could turn out to be indispensable. Because of COVID-19, California is facing a $54-billion budget deficit over the next year. State revenues are expected to drop by a staggering $41.2 billion compared with a pre-coronavirus projection in January. Los Angeles estimates a budget shortfall up to $400 million, with concomitant cuts in city services.

Proposition 15’s deep-pocketed opponents will portray the measure as an all-out assault on Proposition 13, an attempt to raise homeowners’ property tax. But, in fact, it would have no effect on the tax bills of most Californians. The measure exempts all residential and agricultural property, and because it targets only high-value commercial and industrial property, the owners of your local café and dry cleaners will probably be unscathed as well.

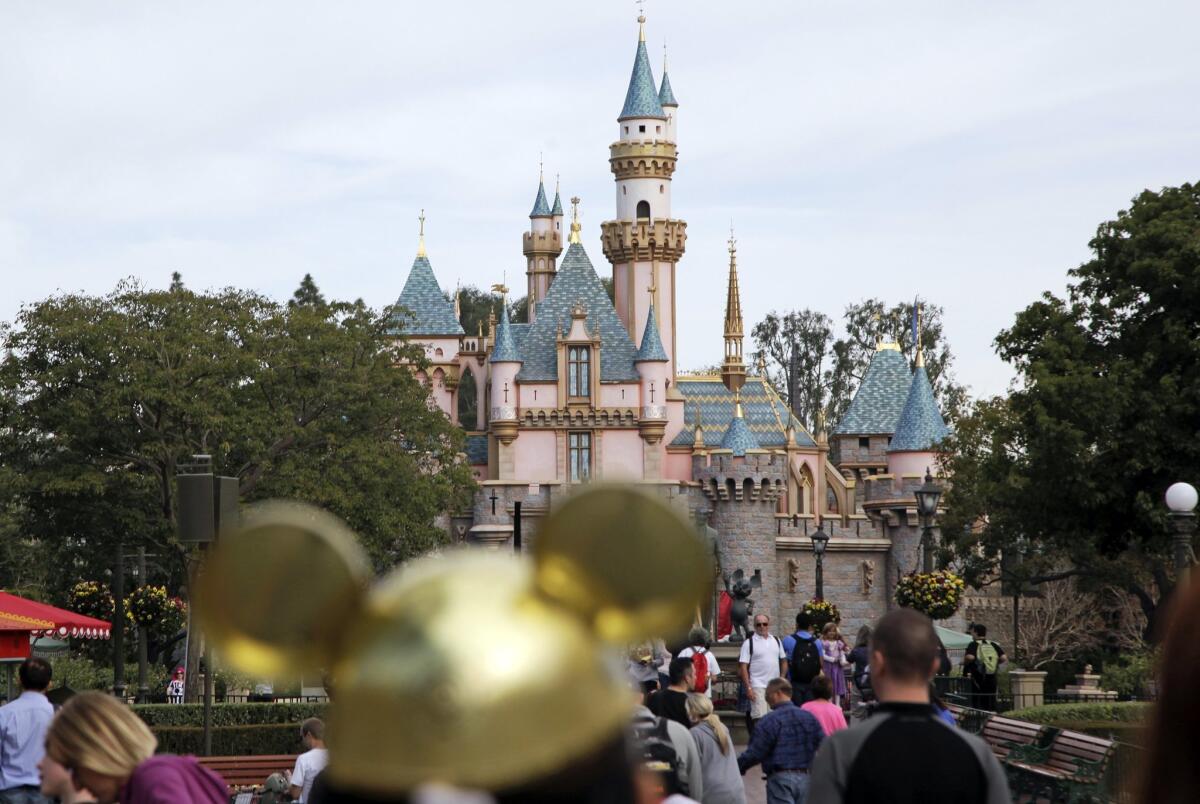

On the other hand, Disneyland, whose property tax is still based on its assessment when Proposition 13 passed, would have to pay more. In fact, the USC study found that most of the increase in state revenues would come from properties worth at least $5 million. A study released by Proposition 15 supporters this week shows that just 10% of the state’s corporate properties — that is, the biggest ones — would generate 92% of the revenue raised by the initiative.

Besides improving the state’s bottom line, passage of Proposition 15 would have a huge symbolic effect. Before 1978, California invested generously in its future, and earned big dividends for its residents. Between the 1940s and the 1970s, the state built highways, dams and aqueducts, and its educational system earned a reputation for excellence. But Proposition 13 marked a retreat from public investment. Now California’s infrastructure is outdated, the state is ranked as the fourth-most-unequal state in the union and its school expenditures-per-pupil have dropped from 14th in 1978 to 39th. Propositition 15’s passage would mark the end of an era of magical thinking: You can’t have the benefits of government without revenues to pay for them.

Most important, Proposition 15’s reforms could go a long way toward overriding some of the most pernicious side effects of Proposition 13. For example, the initiative would eliminate the competitive tax advantage that longtime commercial property owners hold over recent buyers, which are often business startups. New businesses, a key to innovation (and in the wake of COVID-19, economic recovery) would face one less major obstacle in California.

The initiative would also stimulate new housing at a time when the state desperately needs it. Under Proposition 13, properties deliver so little revenue to municipalities that cities have encouraged retail business starts instead of housing development, because more retail means more sales taxes. Proposition 15 would prompt development of vacant urban land by increasing taxes on speculators who hold onto empty properties because their tax burdens are so low.( A 2018 UC Santa Cruz study found that vacant properties with near-market- value assessments were five times more likely to be developed than properties with 1970s and early 1980s assessments.)

The initiative would also close what has been a gaping loophole in Proposition 13 that has added to its worst effects. New, market-value property assessments of commercial properties kick in under current law only when majority ownership changes. That has enabled publicly traded corporations to avoid new assessments even though their stock ownership may have rolled over many times, and it allows landowners to buy and sell and yet maintain lower assessments by dividing purchases among enough entities so that none holds majority ownership. Companies such as Chevron, Intel and IBM own land whose assessments are still based on 1975 values, while nearby properties are assessed at values as much as 50 times higher, according to the initiative’s organizers.

When Proposition 13 passed, rising real estate values were pushing California homeowners’ property taxes so high some lost their homes. It solved that problem but created others, adding to the state’s epic gap between rich and poor. Without the virus, Proposition 15 ought to have won because it is just. Now it is also urgent.

Jacques Leslie is a contributing writer to Opinion.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.