Help is now available for more Californians who are behind on their mortgages

Good news for homeowners who’ve been enduring bad times financially: The state is now offering to cover more Californians’ mortgage debt.

This week, the California Mortgage Relief Program announced that it would extend help to two new groups of homeowners who are delinquent on their mortgages for pandemic-related reasons. These are significant additions that will make aid available to thousands more households — all told, an estimated 90,000 homeowners may be eligible.

The program is now offering help to households earning as much as 150% of their county’s median income, up from the original 100%. For a family of four in Los Angeles County, the new limit is $178,650, according to the program’s calculator.

Relief is also available to homeowners with qualifying incomes who started falling behind on their mortgages this year, as well as those who missed only one mortgage payment in 2020 or 2021 but then missed at least one more in 2022. Previously, applicants had to have missed at least two mortgage payments before Dec. 27, 2021, to obtain help.

The program will pay a qualified homeowner’s mortgage debt in full, provided it was no more than $80,000 when they applied.

One other new feature is that the program will cover up to $20,000 in delinquent property taxes for qualified applicants who pay their taxes directly to the county. Previously, the program covered delinquent taxes just for applicants who paid taxes through a lender’s escrow account. This change could make aid available to an estimated 50,000 households, if their financial troubles stemmed from COVID-19.

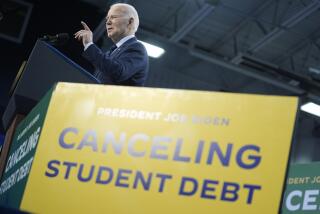

Federal taxpayers provided $1 billion in funding for the program as part of President Biden’s American Rescue Plan in 2021. Since the program launched in January, however, it has doled out only a fraction of that money — $69 million to about 2,000 households, or an average of $35,000 per successful applicant.

The state is launching its long-awaited mortgage relief program to help homeowners facing COVID-related money troubles. Here are the rules.

Are you eligible?

To qualify for relief, you must meet the following terms:

- You have not received any aid yet from the program.

- You own and occupy only one property, and it is your primary residence.

- Your residence is a single-family house, condominium or non-mobile manufactured home in California.

- You experienced a COVID-related financial hardship after Jan. 21, 2020. That hardship could be a loss of income or an increase in expenses.

- Your household earns no more than 150% of the median income in your county, which you can look up on the program’s website. You also have a limited amount of cash or non-retirement-account savings — less than $20,000 more than what you owe your lender.

- The first mortgage you took out on your home was a “conforming loan,” which meant it was small enough for Fannie Mae or Freddie Mac to purchase it from your lender. The limit rises annually; last year in Los Angeles County it was $822,375.

- You have at least two past-due mortgage payments as of June 30, 2022, are currently delinquent, and owe your lender no more than $80,000 at the time of your application, or

- You have a reverse mortgage but have fallen behind on your property tax and/or your insurance payments, or

- You have missed at least one property tax payment to your county’s treasurer by May 31, 2022.

If your lender has modified the loan, deferred payments or taken other actions to make your account current, you are not eligible for mortgage relief.

One catch: If your lender isn’t one of the many taking part in the program, you can’t obtain the state’s help. To see which lenders are participating, check the program’s website.

In a significant shift in the market, fewer homes are going into escrow, inventory is rising and sellers are increasingly cutting their asking prices.

How do you apply?

Applications are available only online at camortgagerelief.org. For help filling one out, you can call the program’s contact center at 1-888-840-2594, where assistance is available in English and Spanish.

If you don’t have access to the internet or a computer, you can ask a housing counselor to assist you. For help finding a counselor certified by the federal Department of Housing and Urban Development, call (800) 569-4287. You may also get help from the company servicing your mortgage.

The online application process starts with questions to determine your eligibility. If you meet the state’s criteria, you can then complete an application for funds. Here’s where you will need some paperwork to establish how much you earn and how much you owe.

According to the program’s website, among the documents you will need to provide are a mortgage statement, bank statements, utility bills and records that show the income earned by every adult in your household, such as pay stubs, tax returns or a statement of unemployment benefits. If you don’t have access to a scanner, you can take pictures of your documents with your phone and upload the images.

The site provides links to the application in English, Spanish, Chinese, Korean, Vietnamese and Tagalog.

When will the program end?

The state will continue to offer help to homeowners who became delinquent because of COVID-related issues until it has spent all $1 billion from the federal government, a process that’s expected to take three years. The state estimates that the money will be enough to help 20,000 to 40,000 borrowers.

The money will be awarded on a first-come, first-served basis, with one important exception: Forty percent of the aid must go to “socially disadvantaged homeowners.” Those are residents of the neighborhoods most at risk of foreclosure, based on the Owner Vulnerability Index developed by UCLA’s Center for Neighborhood Knowledge.

About The Times Utility Journalism Team

This article is from The Times’ Utility Journalism Team. Our mission is to be essential to the lives of Southern Californians by publishing information that solves problems, answers questions and helps with decision making. We serve audiences in and around Los Angeles — including current Times subscribers and diverse communities that haven’t historically had their needs met by our coverage.

How can we be useful to you and your community? Email utility (at) latimes.com or one of our journalists: Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.