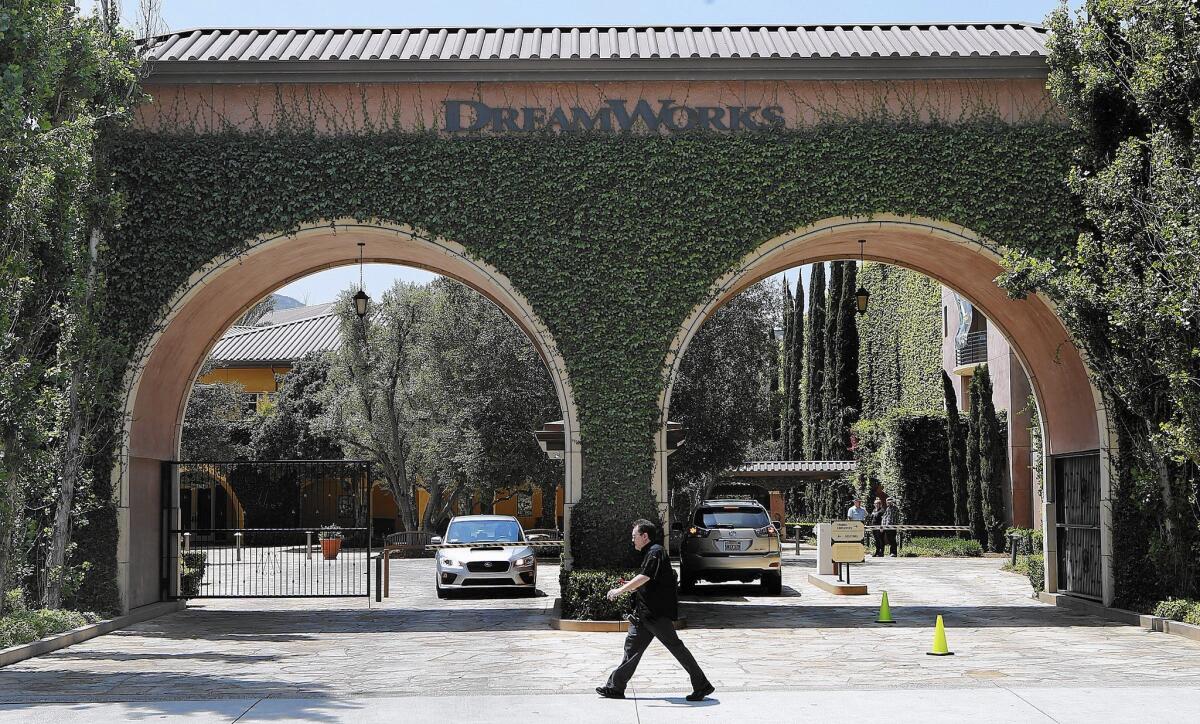

Comcast-DreamWorks deal shaping up to be a match made in Hollywood heaven

As a small studio with an erratic record at the box office, DreamWorks Animation has long sought a suitor that would allow it to keep making films under the protection of a larger corporate parent.

Comcast Corp., as an ambitious cable giant looking to become an entertainment colossus in film, television and theme parks, wants more firepower to compete with its bigger rival Walt Disney Co.

The result? A quickly developing deal that would see Comcast acquire DreamWorks for more than $3 billion, a union most analysts see as a match made in Hollywood heaven.

“Comcast is, no doubt, attracted as much by DreamWorks’ library and intellectual property as much as what they might do next,” Craig Moffett, a prominent cable TV analyst, said in a research report. “It is likely the content library and characters that appeal.”

Executives with Comcast and DreamWorks Animation declined to discuss the negotiations Wednesday, but people with knowledge of the matter said talks are serious and likely to result in an acquisition.

Comcast’s ambitions date back more than a decade when the Philadelphia company tried but failed to buy Disney in a hostile takeover. Ever since, Comcast has assembled pieces of the puzzle, buying NBCUniversal in 2011 and later bulking up its Universal Studios theme parks.

By buying Glendale-based DreamWorks Animation, run by Hollywood mogul Jeffrey Katzenberg for more than two decades, Comcast will get access to the maker of the “Shrek” and “Kung Fu Panda” movies.

In many ways, Comcast is taking a page from the playbook of Disney Chief Executive Robert Iger, who has steered Disney to new heights with savvy acquisitions, including those of Pixar Animation Studios and Marvel Entertainment.

“Comcast is definitely trying to emulate Disney,” said Scott Krisiloff, chief investment officer at Avondale Asset Management, which is not an investor in either company.

Replicating Disney’s strategy is hardly a surprise given its two architects: Comcast Chief Executive Brian Roberts and Steve Burke, chief executive of NBCUniversal. Roberts has spent decades building his family’s business with bold acquisitions, and his long-time business partner, Burke, spent his formative years at Disney. His late father Daniel Burke helped build ABC (now owned by Disney) into a juggernaut.

Comcast executives on Wednesday declined to discuss the proposed DreamWorks acquisition, which was confirmed by people with knowledge of the matter who were not authorized to discuss it publicly.

Analysts said the pairing makes sense as content ownership takes on increasing importance amid changing viewership trends.

For example, NBCUniversal could deploy the “Kung Fu Panda” bears, green “Shrek” monster and zany zebras and penguins from “Madagascar” throughout its Universal Studios theme parks. Those same characters could ramp up its consumer product sales and children’s TV programming, much like Disney has done over the years with such animated characters as Winnie the Pooh, Mickey Mouse and the princesses from “Frozen.”

Disney long has been a maestro of mining value from its intellectual property. Since becoming CEO of Disney in 2005, Iger has made a series of well-timed acquisitions that expanded Disney’s deep bench of characters. Those deals enabled the company to restock its film studio pipeline to better adapt to competition and changing technology.

The Burbank company acquired Pixar for $7.4 billion, Marvel for $4 billion and Lucasfilm for $4.06 billion, all of which have paid off handsomely.

“They may be looking at what Iger and Disney did so brilliantly: putting a premium on valuable IP,” said Los Angeles entertainment attorney Ken Kleinberg.

Over the years, Disney has fine-tuned the art of exploiting its properties over its vast footprint — directing its businesses to work together for maximum mileage.

A film like “Frozen,” which was released in November 2013, can generate revenue long after it exits movie multiplexes.

Comcast also has its “symphony” initiative, in which its various businesses work in concert to promote high-profile projects such as the upcoming movie “The Secret Life of Pets.”

Universal already has a successful animation franchise — Illumination’s “Despicable Me” and “Minions” movies have turned into a multibillion asset, ranking among the most profitable films ever for the century-old Universal Pictures. However, Illumination is a relative newcomer to the field and doesn’t have the deep library of DreamWorks. As Disney has demonstrated, two animation studios can thrive under the same corporate umbrella.

Comcast has one potent offering that Disney lacks: Comcast is the nation’s largest high-speed Internet service provider with more than 23 million homes, making the company a formidable distribution and marketing outlet.

Such diversification gives Comcast a huge cash arsenal and protects it from economic downturns that can crimp theme park attendance and TV advertising sales. Comcast also gleans early insights into consumer behavior because it has data on what content is being watched in the homes where it provides cable service.

“They are trying to mimic Disney, but they are trying to build their own platform, which is even more of a behemoth in some ways because … they own the pipes to get the content to the last mile,” Krisiloff said.

Comcast’s chief, Roberts, on a conference call with analysts Wednesday, emphasized the importance of both businesses.

“You need that content, you need innovative distribution technologies and that’s how we’re running our company,” he said.

Still, DreamWorks is not necessarily the caliber of company that Disney has acquired. When Disney purchased Pixar in 2006, it was buying an entertainment powerhouse that had reeled off a series of hit films that included “Toy Story,” and counted Steve Jobs as its visionary owner.

DreamWorks has struggled in recent years. Last year, the company laid off 500 workers and closed a facility in Northern California after a rough run at the box office.

“Comcast is trying to execute on a similar strategy, but they are not getting top content,” Krisiloff said. “Studios have always had animation studios, and for whatever reason nobody has ever really been able to copy Disney’s success.”

But Comcast has been particularly opportunistic about buying undervalued assets and restoring luster. Comcast bought NBCUniversal in 2011 from General Electric, which desperately wanted to flee the entertainment business and unloaded the firm for a bargain price. At the time, the NBC broadcast network was losing money; it now churns out hundreds of millions of dollars a year in profit.

Within months of closing the NBCUniversal deal, Comcast bought the 50% stake in the Orlando, Fla., park that it didn’t own and set out to revive park attractions. The parks unit has experienced explosive growth through the “Wizarding World of Harry Potter” attractions in Orlando and, now, in Los Angeles.

The huge success of the Harry Potter theme park attractions has underscored the increasing value of owning intellectual property, Kleinberg said.

In the first quarter, Universal theme park revenue was up 58% to $1 billion, helped by revenue now included from the Universal Studios Japan business. Theme park profit increased nearly 54% to $375 million.

Comcast is planning to build a 300-acre, $3-billion theme park in China, currently slated to open in 2019. Having the popular “Kung Fu Panda,” “How to Train Your Dragon” and “Shrek” characters would be key. For example, the pandas could become the face of the theme parks and entice more visitors from China, which is undergoing a boom in theme park construction.

DreamWorks’ deep ties to China represent another attractive feature for Comcast, which could capitalize on DreamWorks’ relationships in the world’s most populous country. DreamWorks operates a studio in Shanghai through a joint venture that produced “Kung Fu Panda 3,” a big hit in China. DreamWorks also is involved in a sprawling entertainment district in Shanghai.

“China represents a big, big opportunity for the company,” Burke told analysts on the call. “It already is a significant profit generator. But as that market grows, I think it’s very important that we be there.”

Then there is DreamWorks’ burgeoning children’s TV business. DreamWorks has a lucrative partnership to supply animated shows to Netflix, and it controls the rights to a trove of nostalgic properties, including “Casper the Friendly Ghost,” “Lassie” and “The Lone Ranger.”

DreamWorks Animation’s partnership with NBC dates back more than a dozen years. In 2004, NBC experimented with a costly prime-time cartoon called “Father of the Pride,” about a family of lions in the Siegfried and Roy show in Las Vegas. As part of that deal, NBC helped to finance an animation studio that Katzenberg opened in Asia.

Times staff writers Richard Verrier and Yvonne Villarreal contributed to this report.

ALSO

Judge rules Sumner Redstone trial will be open to the public

In his films, Prince melded music and image into something powerful

How Key and Peele got Keanu Reeves to voice a cat in the film ‘Keanu’

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.