Why Disney is doubling down on theme parks with a $60-billion plan

Over the decades since Walt Disney opened his first theme park in 1955, the company’s tourism business has ballooned to an enterprise worth tens of billions in yearly sales, with sprawling locations in Anaheim, Orlando, Paris, Shanghai, Hong Kong and Tokyo.

Today, the Burbank entertainment giant is doubling down once again. Disney plans to invest $60 billion over 10 years into its so-called experiences division, which includes the theme parks, resorts and cruise line, as well as merchandise.

In Anaheim, the city council recently approved an expansion plan at Disneyland Resort, which could lead to at least $1.9 billion of development and involve new attractions alongside hotel, retail and restaurant space.

Why the massive investment? At a time when Disney faces revenue challenges due to cord cutting, streaming wars and a slower film box office, its theme parks are a bright — and reliable — spot for its business. Moreover, they play a major part in the company’s strategy — using well-loved movies to inspire rides and vice versa (think “Pirates of the Caribbean”), feeding an ongoing virtuous cycle.

“When you consider other elements of Disney’s business, those theme parks, they’ve shown themselves to be proven winners,” said Carissa Baker, assistant professor of theme park and attraction management at the University of Central Florida’s Rosen College of Hospitality Management. “There’s no doubt that they have stayed very competitive in the film space and the TV space, but they’ve always led the theme park sector.”

With the approval of DisneylandForward, new attractions and adventures will be coming to Disneyland. Here’s what’s been teased by Disney officials so far.

During the most recent fiscal year, the company’s experiences division — which is heavily anchored by the parks — brought in about 70% of Disney’s operating income, according to a filing with the U.S. Securities and Exchange Commission. By contrast, Disney’s sports sector, including ESPN, contributed 19% of operating income. The entertainment division, consisting of the company’s TV channels, streaming services and movie studios, brought up the rear at 11%.

Those numbers represent a stark contrast from even 10 years ago, when the company was heavily reliant on its TV networks, which brought in 56% of Disney’s operating income (that segment included ESPN at the time). The parks and resorts division drew just 20%.

The tide began to turn in 2019, as the global theme park industry saw record-breaking attendance, just in time for the pandemic to hit the next year.

With the parks closed, Disney reported an operating loss of $81 million in 2020. Disneyland and Disney’s California Adventure, in particular, were shut for 15 months, due to tight restrictions in the Golden State. Since then, pent-up demand from visitors has propelled theme park revenue in a way that hasn’t been replicated in movie theaters.

“The industry was really growing quickly before COVID-19, and that obviously put a crimp on everything,” said Martin Lewison, associate professor of business management at Farmingdale State College in New York. “But it appears as long as the economy remains healthy, the industry is back on track for that growth.”

Disney shareholders reject billionaire investor Nelson Peltz, who wanted changes, for a board seat. The hard-fought battle exposed Disney’s challenges.

Theme parks are typically one of the fastest parts of the travel and hospitality industry to recover after economic downturns, said Dennis Speigel, founder and chief executive of consulting firm International Theme Park Services. Part of that is because it’s hard to duplicate the theme park experience at home.

“Disney sets the bar for our entire global theme park industry,” Speigel said. “The guests, the visitors, they love the way Disney immerses you in their storytelling.”

The Disneyland Resort expansion plan, known as DisneylandForward, will help the 490-acre park stay fresh for visitors. The plan calls for changes to the park’s zoning, allowing the company more freedom to mix attractions, theme parks, shopping, dining and parking. While the plan doesn’t specify exactly which attractions will be added to the resort, company officials have floated ideas including immersive Frozen, Tron and Avatar experiences.

Over the years, Disneyland has cycled out many rides and exhibits to make way for new ones — for example, of the original 33 attractions that debuted with the park, only about a dozen still exist. (One that didn’t make it? The Monsanto Hall of Chemistry).

Though Disneyland and Disney’s California Adventure have recently seen additions such as Star Wars: Galaxy’s Edge, Avengers Campus and the renovated Pixar Place Hotel, giving guests new reasons to come back again and again are the key to increased growth. This summer, the Magic Kingdom will open Tiana’s Bayou Adventure, replacing the controversial “Song of the South”-inspired Splash Mountain attraction.

“In the theme parks business, you tend to make more money the more you invest,” said Lewison of Farmingdale State College. “People love riding Haunted Mansion 50 times, but the truth is that even that gets old. So new rides, new lands, new parks — these things draw in attendance, they create pricing power and they add capacity.”

And Disney’s rivals in the theme parks business show no signs of slowing down, meaning Disney can’t just rely on its existing hits. Universal Studios Hollywood recently added Super Nintendo World to its park, SeaWorld is touting new attractions and shows for its 60th anniversary this year, and even immersive art installation company Meow Wolf is expanding throughout the U.S.

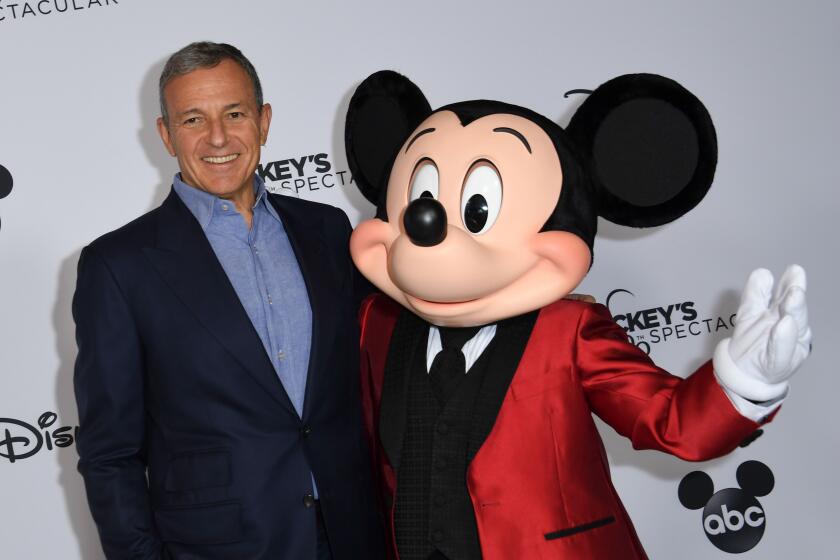

The competition is becoming so fierce that Disney Chief Executive Bob Iger faced a pointed question during last month’s shareholder meeting about Walt Disney World’s readiness to vie with a new Universal park set to open in Orlando in 2025. He pushed back on the query, saying the idea that Disney World didn’t prepare enough attractions to compete for guests that year “just couldn’t be further from the truth.”

“We’ve been aware of Universal’s plans for a new park for more than a decade,” he said. “We have a sophisticated approach to analyzing the needs of all of our businesses and strategically deploying capital.”

The importance of the parks to Disney’s bottom line is also showing up in the entertainment giant’s search for Iger’s successor. (Iger is expected to retire in 2026.) Josh D’Amaro, the chair of Disney Experiences, which includes the parks, is considered one of four front-runners for the job. Notably, it was Bob Chapek, formerly of the parks division, who initially succeeded Iger, though he was later ousted from the role.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.