Want to watch free TV? This station owner is here to help

As inflation puts pressure on household budgets, consumers are taking a closer look at how much they spend on subscription streaming services.

One way to bring that cost down is adopting the original TV technology — over-the-air antennas that capture broadcast signals without a connection to a cable box, satellite dish or internet. The monthly price for watching is the same as it was when RCA Chairman David Sarnoff flipped the switch on the first commercial TV station at the 1939 New York World’s Fair: free.

But many Americans who grew up with cable TV and streaming don’t realize that free over-the-air broadcasting exists or understand how it works.

E.W. Scripps, the Cincinnati-based media company that owns 61 TV stations nationwide, is out to change that.

The company is spending $20 million this year on an unusual education and marketing campaign to help consumers understand the use and benefits of over-the-air antennas at a time when managing their TV sources is more complex than ever.

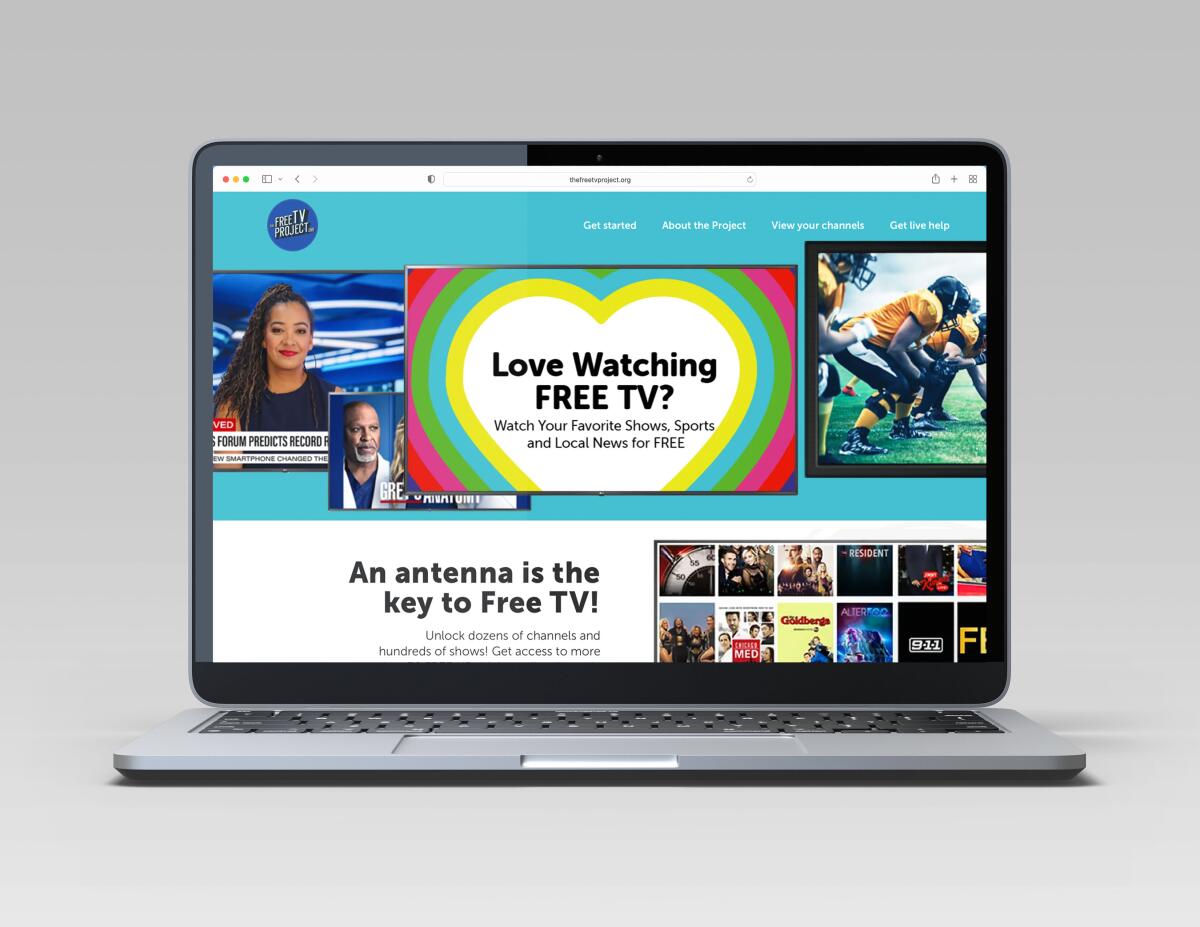

This month, Scripps launched a website — TheFreeTVProject.org — where users can type in their ZIP Codes to learn what stations they can get for free in their area with an antenna. In Los Angeles, the nation’s second largest TV market, antenna users can receive more than 160 free broadcast channels.

The site also explains how broadcast TV works and offers information on what type of antenna works best, based on the user’s geographical location. Not every antenna works in every area, and the one-time cost can range from $20 for an indoor antenna to $149 for outdoor models that require installation on a rooftop.

Scripps began airing cheeky 30-second TV spots that will run in cities where the company owns stations. It also will place ads on social media sites, outdoor billboards and connected TV streaming platforms, hoping to reach the cord-cutters or cord-nevers who don’t use an antenna.

Adam Symson, chief executive of Scripps, believes the combination of economic uncertainty and a scrambled TV landscape where streaming service prices are creeping up creates an opportunity to get more consumers to add over-the-air broadcasting to their viewing diet.

When cable TV was growing in the 1980s and ‘90s, many of its programs were past hits from the lineups of ABC, CBS and NBC.

“We’re sitting at a moment in time where there is more pressure on the consumer’s pocketbook than ever,” Symson said in a recent interview. “We’re reading every day about ‘plus fatigue.’ Consumers are frustrated by the fact they have five video streaming subscriptions and they are not sure what value they are getting out of them.”

The buzziest and critic-lauded scripted shows are now on streaming services, but broadcast is still the home of the bulk of the NFL football games — the most watched content on any platform — and other major sporting events, including Major League Baseball’s World Series, the NBA Finals, Triple Crown horse racing and the NHL’s Stanley Cup. All air on the major broadcast networks, which reach nearly every home in the U.S. with their signals.

“The only place cord-cutters and cord-nevers can watch live sports for free is going to be on over-the-air television,” Symson noted. “Free is an incredibly compelling consumer proposition.”

While major broadcast networks are neglected by critics and Emmy voters, they still offer first-run episodes of some of the most popular series on television, including “NCIS” and “Ghosts” on CBS, ABC’s “Grey’s Anatomy” and the inexhaustible “Law and Order” franchises on NBC.

A study conducted earlier this year by research firm Screen Engine/ASI found that 68% of all consumers consider the major networks a “must-have.” The number rises to 79% among antenna users.

TV antenna usage is already on the upswing. The Consumer Technology Assn. says 32% of U.S. households own a TV antenna, up from 26% in 2019. The CTA expects the number of antenna-using homes to reach 50 million by 2025 as more consumers cut the pay-TV cord.

Many of the new antenna customers are using them to pull in broadcast stations not offered in their markets by virtual multichannel video program distributors such as YouTubeTV, Hulu Live, Frndly TV or Sling. Some consumers own antennas as a contingency in the event their cable or satellite company gets into a carriage fee dispute with a TV station and takes it off its system.

Amanda Brown, vice president of consumer strategy and insights for Scripps, describes those consumers as “self-bundlers” who use an average of four platforms in combination with an antenna to serve their viewing needs.

Promoting antenna use clearly benefits the TV stations Scripps owns, but there is a public service element to the campaign as well. TV stations need to preserve their role as news sources in their communities, especially at a time when many local newspapers have folded or scaled back operations. What’s more, when internet or cellular service goes out during a severe weather event or other catastrophes, broadcast TV stays on the air.

“People turn to us,” Symson said. “If you don’t have a way to get us, that’s going to be a problem. We feel a responsibility to reach consumers on every platform but particularly on broadcast television.”

More Southern California internet providers are on board with the federal subsidy. But signups still lag. Here’s how to get free broadband service.

Creating your own TV bundle may seem like more trouble than it’s worth, but the cost savings suggest otherwise. Screen Engine/ASI found consumers who have over-the-air antennas as part of their TV mix spend an average of $72.60 a month on pay TV services and video-on-demand platforms such as Netflix. The average monthly cost for cable and satellite subscribers without antennas is $148.70.

A majority of antenna users are older, having grown up watching TV that pulled in signals with rabbit ears sitting atop a set or an aerial antenna on a roof. For younger consumers — many of whom have cut the cord, never signed up for cable or don’t even own a TV set — over-the-air broadcasting can be a mystery.

“We’ve done a lot of research on this and there is even a certain portion of the American audience that believes mistakenly that plugging in a digital antenna is piracy,” Symson said.

Screen Engine/ASI found viewers underestimate the number of channels they can receive with an antenna, with many still recalling the analog TV era when far fewer stations were available.

“They just don’t know that this option is out there so they don’t even understand the benefits around it,” said Brown. “Even the terminology around over-the-air needs some explanation to some consumers that are just completely new to this concept.”

The switch from analog to digital signals in 2009 allowed for the creation of more over-the-air channels (called sub channels). But a 2021 study by Horowitz Research found that only 20% of non-antenna users believed they could receive more than 20 channels.

Karlo Maalouf, owner of Mr. Antenna, a Las Vegas company that specializes in installing over-the-air antennas, welcomes the education effort.

“It’s a confusing environment right now,” said Maalouf, who noted that he rarely gets customers under the age of 40.

Outside of Scripps, media conglomerates that own TV stations have demonstrated little interest in informing consumers on how to get their programming for free, as they are still hooked on the retransmission fees they receive from cable and satellite providers.

Station ownership groups with network affiliates carrying NFL football have tremendous leverage in negotiations for those fees, and there has been little incentive to rock the boat.

“Many companies are concerned about talking about broadcast too much for fear of it negatively impacting the pay-TV ecosystem,” Symson said. “But I believe the consumer is in control at this point and what we have to do is insure the relevance of our product and our reach on into the future.”

Some companies are even discouraging antenna use. Last year, Maalouf filed a complaint with the FCC against a Meredith Corp. station because it refused to sell commercial time to his company, saying it would promote cord-cutting.

Scripps also receives carriage fees for its TV stations, and Symson said his company’s initiative isn’t aimed at hurting the pay TV business.

But the company does have a strong business incentive to see broadcast TV grow. It is investing heavily in so-called diginets — national TV networks that transmit over digital sub channels. While some are carried on cable and satellite systems and free TV streaming services such as Tubi and Pluto TV, all can be received with an antenna.

Last year, Scripps relaunched its 24-hour cable news channel, Newsy, as a diginet. The company also revived Court TV — one of the early stalwarts of cable television — as an over-the-air service. The channel, airing on channel 5.3 in Los Angeles, recently scored its largest audiences ever with its gavel-to-gavel coverage of the Johnny Depp-Amber Heard trial.

Every major TV station owner has diginets, most of which air vintage movies and TV series. The audience for diginets increased 69% from 2016 to 2021, according to Nielsen data, making them a rare segment of the TV business that is growing.

There is also greater potential for over-the-air broadcasting when a new digital TV technical standard — known as ATSC 3.0 or NextGen TV — reaches critical mass. Stations have begun switching to the standard this year, with KTTV, the Los Angeles outlet owned by Fox Television Stations, broadcasting in the format starting Aug. 24.

The system upgrades the quality of video and audio and will give broadcasters the opportunity to provide interactive services and deliver their signals to mobile devices. Stations also will be able to offer their programming on demand, putting them on equal footing with streaming services, at no cost to the consumer.

Maalouf believes the new standard will be a boon to the antenna business.

“It’s kind of like a glorified DVR,” Maalouf said. “I think that’s going to be key to the success of ATSC 3.0.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.