Music catalogs are fetching huge deals. Are they overvalued?

In the 2006 book “Northern Songs: The True Story of the Beatles Song Publishing Empire,” journalist Brian Southall captured a music industry mantra: “For songwriters and publishers alike, the most important five words are always the same — ‘never give up a copyright.’”

For generations of popular musicians who stuck to that philosophy, the strategy is paying off handsomely. Song catalogs from the Baby Boomer era and after are fetching enormous sums from publishers, private equity firms and others looking to capitalize on the music business’ recovery.

Bruce Springsteen in December reached a deal with Sony Music Entertainment to sell his master recordings and songs for $500 million. Warner Chappell Music early this month bought David Bowie’s songwriting catalog for $250 million. A variety of rights and assets from artists including ZZ Top, Tina Turner and Paul Simon all sold last year.

Trade publication Music Business Worldwide estimated that more than $5 billion changed hands through music rights acquisitions last year, including publishing assets and recordings, with more to come in 2022. Buyers are said to be circling Phil Collins.

Music assets are selling for unusually high valuations. During the last 25 years, songwriting catalogs generally sold for about eight to 12 times the “net publisher’s share,” or the amount of revenue the songs generated minus the royalties paid out to the performers and songwriters. Today, valuations are hitting 25 to 30 times the publisher’s share, according to industry experts and executives.

That has led some insiders to suggest that investors are overpaying.

“The average earnings are not going up by multiples over a five-year period of time,” said music publishing veteran Matt Pincus. “So if the price is rational, they’re great investments, because they’re pretty stable. But there’s an upper limit on price.”

The sector is attracting some of the biggest players in finance. Sherrese Clarke Soares, an entertainment investing veteran, in October launched Newark, N.J.-based HarbourView Equity Partners to buy music rights with $1 billion in backing from Apollo Global Management. This month, “All of Me” singer John Legend sold his songs to private equity giant KKR and music firm BMG for an undisclosed sum.

“It has been fast and furious, with a lot of money chasing after a limited supply of legacy catalogs,” said Los Angeles-based music attorney Bill Hochberg, who represents the estate of Curtis Mayfield. “And now with John Legend, it’s not just legacy but also more recent stuff. There’s a lot of money out there, and it’s an asset class that’s pretty hot with the Wall Street crowd and private equity money.”

The idea of music catalogs as top-dollar investments is not new. Michael Jackson paid $47.5 million in 1985 for ATV Music, home to Beatles classics including “Help” and “Yesterday,” and later merged it with Sony Music Publishing. Sony Corp. in 2016 paid $750 million for the Jackson estate’s share of Sony/ATV.

Songwriting catalogs are stable assets that generate consistent revenues from radio play, disc sales, streaming and placement in movies, TV shows and commercials. They’re safe bets for institutional investors like pension funds to put their money, especially when interest rates are low and bonds don’t yield worthwhile returns.

But why are investors willing to spend so much on music rights? The surging growth of the recorded music business, thanks to streaming services like Spotify and Apple Music, has made music catalogs hot properties once again. Total U.S. album consumption increased 11% last year, according to an annual industry report by MRC and Billboard.

Plus, older music is becoming a bigger part of Americans’ streaming diet. Catalog music accounted for 70% of album consumption in 2021, up from 65% in 2020. Consumption of current tunes declined 4% in 2021, while catalog listening jumped 19%. The report credited an uptick in nostalgia for old favorites during the COVID-19 pandemic, amplified by the proliferation of music on TikTok and on home fitness platforms like Peloton.

Growth in the market for NFTs and music’s potential use in the metaverse also have fueled investor excitement, said Bill Werde, director of the Bandier music business program at Syracuse University’s Newhouse School of Public Communications.

“You can look at the numbers and very quickly see two key data points,” said Werde, who was previously editorial director for Billboard. “One is streaming data is going up, up up. And two is, as streaming data is going up and up and up, catalogs are becoming a bigger and bigger percentage of that listening. ... It doesn’t take a genius to say, ‘Well, we should probably own the catalog.’”

Timing is also a factor. Some of the artists who are now selling their catalogs were part of the songwriter-musician generation that started to prize their own song copyrights. That pop and rock revolution came after the ages of Manhattan’s Tin Pan Alley and the Brill Building songwriting machine, when performers were less likely to write and own their material. Now creeping into their 70s and 80s, those songwriter-artists are looking for new custodians for their work. In a high-profile example, Bob Dylan, 80, reached a deal in December 2020 to sell his 600-song catalog to Universal Music Publishing Group for an estimated $300 million.

The burgeoning price tags reflect a trend happening across the entertainment industry, including in Hollywood, where production firms launched by Reese Witherspoon, LeBron James, Will Smith and the Russo brothers are fetching astronomical deals. Media companies have been signing nine-figure producing arrangements for creatives such as Shonda Rhimes, Ryan Murphy and J.J. Abrams to fuel their streaming video ambitions.

While the prices of some deals have shocked analysts, those may be more rational than the ones happening in music, according to Pincus, who sold his Songs Music Publishing to Kobalt Capital in 2017. At least the TV showrunners can increase in value when they create new hits.

“On a catalog of already released songs, you know what the hits are already,” Pincus said, who now runs an investment vehicle called Music. “The only thing that moves the revenues is broader industry economics. It may be more rational to invest in people that make hits than it is to buy hits that already exist for very large multiples of their historical earnings.”

Copyright owners can boost the value of music assets by creating derivative works, such as Broadway musicals, coffee-table books, biopics and documentaries, which have proved popular on streaming video services like Netflix. Universal Music, Warner Music and BMG, for example, have been active in making music-related films.

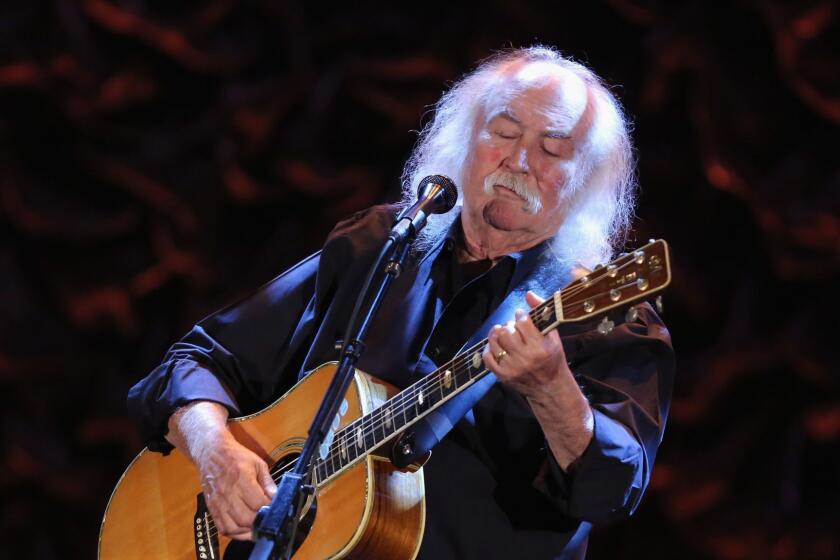

David Crosby was in talks with BMG for his next studio album about a year ago, when his manager told the record label they were working on an unusual project: an intimate documentary about the folk rock hero.

Stephane Hubert, who leads mergers and acquisitions for BMG in Los Angeles, argues there are opportunities to introduce such vintage artists to younger listeners and people outside of the U.S. and Britain. Country music and American rock artists have plenty of room to cross over internationally, he said.

BMG and KKR last month acquired ZZ Top’s music interests, following recent deals for BMG to buy a bundle of rights held by Tina Turner and recordings by Mötley Crüe. Asset manager Pimco has teamed with Bertelsmann-owned BMG to join the catalog frenzy, according to people familiar with the deal.

“When we acquire ZZ Top, we’re not just acquiring a treasure chest that’s going to deliver us a yield every year,” Hubert said. “We’re looking at a catalog that we can continue to work on together with the management of ZZ Top to bring it into the future, to introduce it to new demographics and new formats.”

But there are limits on how much copyright owners can increase revenues from older music, Pincus said. Mechanical royalties, one of the most important revenue streams for publishers, are set by the U.S. government through a compulsory license. ASCAP and BMI, the largest U.S. performing rights organizations (which collect publishing royalties from radio and other sources), are governed by consent decrees.

“The problem is that in music publishing, songwriting copyrights are basically 66% regulated almost everywhere around the world, meaning the economics are essentially fixed,” Pincus said. “So your ability to affect the economics of the earnings from the assets you’re buying is constrained.”

Rates for placement in films, TV shows and commercials can be negotiated. A viral social media video — think of the man who filmed himself skateboarding and drinking cranberry juice to Fleetwood Mac’s “Dreams” on TikTok — can lead to a boom in listenership.

But few artists have a repertoire that can support a hit stage musical, and rights often are shared by multiple parties, making it difficult to get everyone in agreement and limiting the potential benefit for investors.

Nonetheless, Hubert said such deals have become more interesting as legacy acts and current artists build themselves into brands.

“If you’d asked me five years ago, I would have said buying music assets that are passive income streams is not very interesting from an investment perspective,” Hubert said. “As a buyer, if you can work with the artist, you can always generate upside.”

Whether the mega-deals pay off hinges on how fast the music industry expands.

Goldman Sachs last year predicted that the number of streaming music subscribers worldwide would hit 1.28 billion by 2030, up from 443 million in 2020. That will depend on growth of streaming in Africa, the Middle East and other emerging markets as the U.S. matures.

But while the music industry is riding high right now, Werde said it’s not a bubble.

“If I can count on one thing, as I look at the history of the music business, it’s that you can always count on folks saying people are paying too much for publishing assets,” Werde said. “And generally, they’re not.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.