Prop. 19, which gives new property tax breaks to older homeowners, holds lead

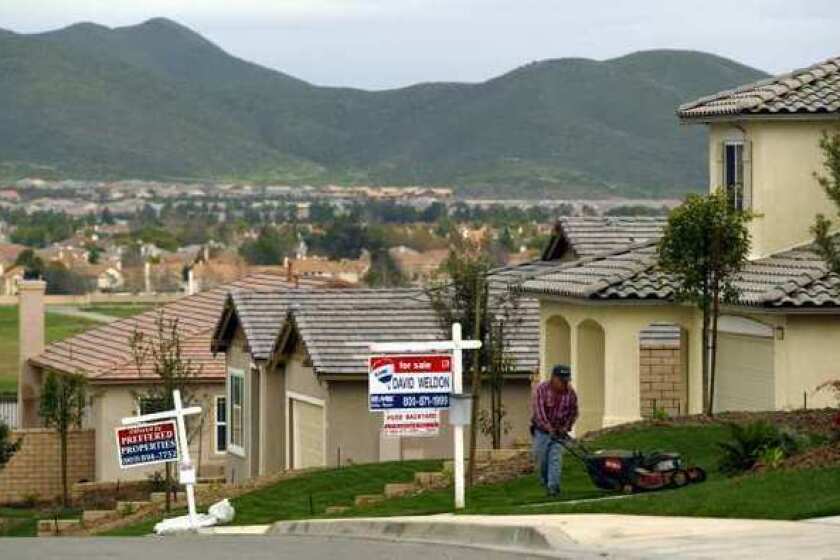

A new property tax break for older California homeowners, easing their tax burdens if they move, held onto its lead in updated results Wednesday morning.

Should Proposition 19 succeed it would mean that those 55 and older will be able to blend the taxable value of their old home with the value of a new, more expensive home they purchase, resulting in property tax savings that could reach thousands of dollars a year. The measure was ahead by nearly 350,000 votes with 99% of precincts reporting Wednesday.

As part of the measure, children who inherit their parents’ houses would no longer receive a property tax break if they intend to keep it as a second home or rent it out.

Currently, older homeowners have a one-time opportunity to retain their existing tax benefits if they move to a home of equal or lesser value within the same county. They can do the same when moving between Los Angeles and nine other counties. If they didn’t meet those requirements or moved to a more expensive home, they would have to pay the full amount in property taxes.

If Proposition 19 wins, older homeowners will receive a property tax benefit when they buy a more expensive home anywhere in the state — up to three times. Disabled homeowners will be able to do the same, and victims of wildfires and other natural disasters will be able to do so after their home is damaged.

Supporters of Proposition 19 argued the measure would help empty nesters and those wanting to move for health reasons to find new homes without facing a big tax hit.

Proposition 19 also restricts an inheritance property tax break that allowed the children of homeowners to keep their parents’ low property tax assessments. A 2018 Times investigation found a large number of inherited homes along the coast that are used as investment properties.

Older homeowners would get a larger incentive to move into new homes and the so-called Lebowski loophole would go away.

The California Assn. of Realtors was the driving force behind Proposition 19, with real estate interests raising more than $39 million for its passage. Realtors are expected to benefit from increased home sales, both by older homeowners deciding to take advantage of their new tax benefits to move and heirs preferring to sell their parents’ properties rather than paying higher property taxes.

Much of the Realtor-backed campaign for Proposition 19 focused on benefits to wildfire victims and increased funding for wildfire response. But disaster-affected homeowners constitute well under 1% of those eligible for tax relief under Proposition 19, according to an analysis by the California Budget and Policy Center, which found the benefits almost entirely accruing to older homeowners.

And while the measure does reserve new tax revenue for wildfire response, the state’s nonpartisan Legislative Analyst’s Office believes that the vast majority of the wildfire funding will not start flowing until 2025 at the earliest.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.