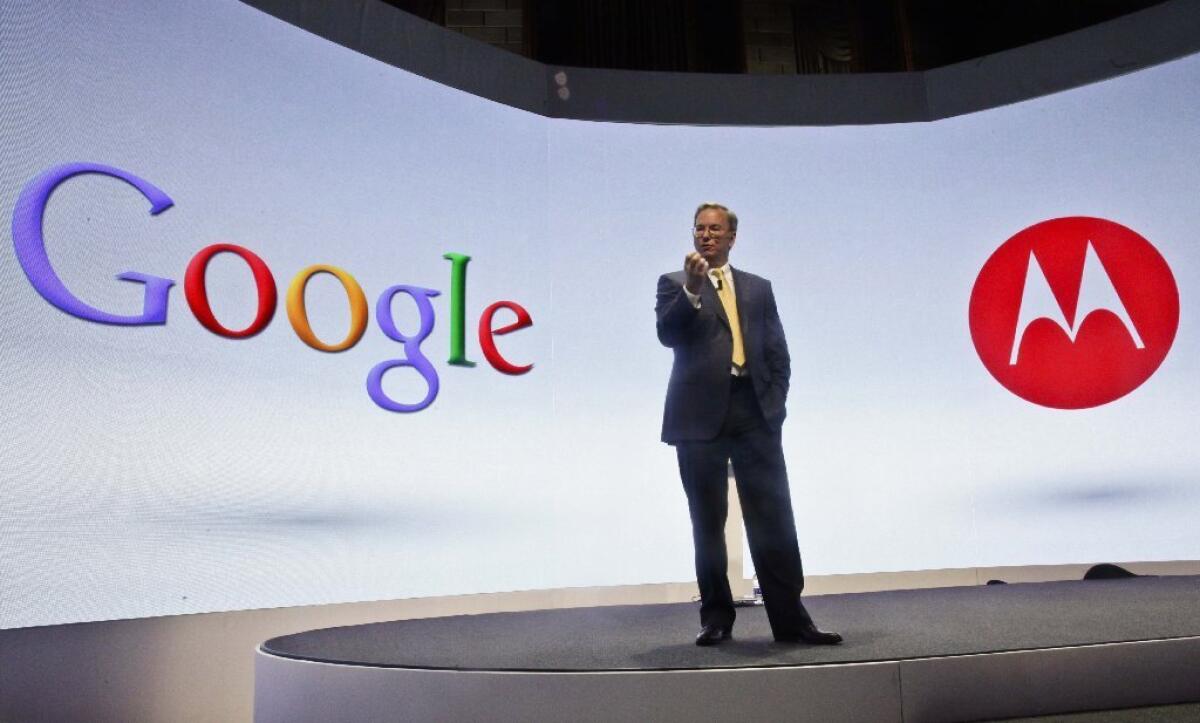

Google earnings: What to expect after surprise Motorola deal

SAN FRANCISCO -- Does Google have an encore?

The technology giant stunned the world with the surprise announcement Wednesday that it was selling its money-losing Motorola Mobility division to Lenovo.

Now Google is gearing up to unveil its fourth-quarter results.

Even before the Motorola announcement, expectations were high. Google is the big kahuna of online advertising. And in October 2013 it reported one of its best quarters. On Wednesday, just as Google was passing the Motorola hot potato, Facebook hit the equivalent of an earnings grand slam.

Now Google will have to top all of that.

What’s Wall Street expecting? For Google to earn $12.21 a share on revenue of about $16.76 billion.

Let’s pause for some words of caution from BGC Partners analyst Colin Gillis, delivered in a research note Thursday.

Gillis suggests that investors take a hard look at Google’s earnings performance over the last eight quarters.

“Data from Bloomberg show that Google has missed [earnings per share] consensus four times (50%) over the last eight results,” Gillis said. “More notable is that sales have missed consensus seven of the last eight quarterly results.”

The one quarter for which Google exceeded both earnings per share and revenue estimates: the third quarter.

Analysts will be taking a close look at how much advertisers are paying when users click on an ad.

In the third quarter, that “cost per click” fell again, this time 8% year over year, but the number of clicks increased 26%.

Also of interest to analysts: Google’s effort to get advertisers to bid both on clicks on mobile devices and desktops.

And last, but definitely not least, just how big a millstone did Google just jettison?

On Wednesday, Google said it would get $2.9 billion for Motorola, which has been hemorrhaging cash. The operating loss for Motorola was $248 million in the third quarter.

Analysts may also be taking a harder look at another hardware play: Google’s proposed $3.2-billion purchase of smart home device maker Nest Labs.

“We have tremendous respect for Google and the innovation that the company is driving, aggressively pushing into robotics, wearables and home automation while its competitors have yet to even launch a smartphone with a large screen,” Gillis said. “That said, we see the downside risks outweigh the upside in the December quarter.”

Among those risks?

“Expenses are likely to continue to rise as Google acquires companies with limited revenue, the company may not benefit from the favorable tax rate that drove September quarter earnings, and the acceleration of the core business may stall as increased clicks are offset by a continuation of lower click prices,” Gillis said. “Finally, we expect Motorola is a drag on results, one of the reasons for the sale that was just announced.”

ALSO:

Google to sell Motorola unit to China’s Lenovo

Boom! Facebook #winning on mobile lifts stock to record high

Google to keep Motorola team responsible for modular phone project