Why Biden is getting little credit for the economy, especially in California

WASHINGTON — As President Biden struggles to sell Bidenomics to skeptical voters, he’s facing the all-too-real consequences of stubbornly higher inflation, but he’s also battling human psychology.

And both of those factors may be especially strong in California.

Most economists agree that the American economy during Biden’s presidency has made a remarkable recovery from the pandemic. And it continues to outperform expectations, even if California isn’t doing quite as well. But polls have consistently shown that the public by and large holds a negative view of the economy and, by extension, Biden’s handling of it.

Nationally, the U.S. had another strong month of job growth in February, but California has trailed the nation and its unemployment rate is substantially higher.

While partisan politics, pandemic hangover and other factors have colored people’s attitudes, experts say inflation appears to be the single biggest economic albatross for Biden.

He entered office with an approval rating of 57%, but in Gallup’s latest poll in March that number was 40%, with his handling of the economy perceived as one of his biggest weaknesses.

This even though the rate of inflation has come down significantly from earlier highs and the incomes of Americans, on average, have risen to equal or often exceed the higher costs for most goods and services.

On Wednesday the government reported that inflation, as measured by U.S. consumer prices, edged up in March to 3.5% from a year ago. It was a little higher than expected, driven partly by bigger price increases for transportation, electricity and medical services. Food inflation was subdued, but shelter and energy prices are still running a bit too hot.

Although the rate of inflation has declined since hitting a 40-year high of 9.1% in June 2022, it’s still well above the Federal Reserve’s 2% target, which could delay a much hoped-for cut in interest rates.

What’s more, experts say the slowdown in inflation isn’t what most people notice. Nor do they seem as relieved by the seemingly encouraging decline in inflation from 2022 as professional economists are. After all, it’s not that prices have fallen dramatically; they’re just not rising as fast as before.

That’s where basic elements of human nature come in, some economists and other analysts say: Consumers instinctively pay more attention to the dollars they have to shell out than they do to the increases in their paychecks.

That’s especially true when the purchases are for everyday items such as gasoline, for which prices in California are higher than elsewhere in the United States.

Today, U.S. consumers are paying 20% more for milk, about 30% more for bread and more than 50% more for eggs than they were in February 2020, according to the U.S. Bureau of Labor Statistics report Wednesday.

Rents are up more than 20% from pre-pandemic levels and electricity costs about 30% more.

For Californians, even with wage gains matching or exceeding consumer price increases, higher inflation may have an even stronger real and psychological impact because the state is so much more expensive to begin with.

“They worry whether inflation is coming back,” said Mark Baldassare, the statewide survey director at the Public Policy Institute of California. “It creates a new set of circumstances and anxiety in California, where housing and the cost of living is a major concern, especially for lower-income but also middle-income and younger Californians.”

In a statewide survey he conducted last fall, Baldassare found that a growing percentage of Californians were “not too happy” (26% compared with 20% in 2011 and 13% in 1998). And among the groups who are the least happy: 18- to 34-year-olds; renters; and those with household incomes of $40,000 or less.

Nationwide, prices for all goods and services have jumped about 20% over the last four years. And it’s been an especially startling jolt to many consumers because the vast majority of them had never experienced anything like it in their adult lives.

The last time inflation was at or near double-digits was in the early 1980s, and for most of the last 30 years it’s been close to the Federal Reserve’s 2% target.

“Part of the story is not just that we’ve had high inflation, but we’ve had high inflation with a generation that’s ill-equipped to deal with it,” said Justin Wolfers, professor of public policy and economics at the University of Michigan. “Young people today might think prices have risen by 20% and no one’s ever going to make me whole.”

But, in fact, Wolfers noted, gains in wages and salaries, on average, have actually outpaced inflation since the pandemic, with lower-income workers seeing the highest percentage gains.

Older people who went through substantial inflation before may have learned that it usually turns out to be a temporary problem: For at least the last half-century, when the cost of living has risen sharply, so have workers’ incomes, though not immediately.

Older generations understand the dynamic: “Inflation takes away with higher prices and then it gives back with higher wages,” Wolfers said.

In California, workers on average earned $1,595 a week in the third quarter of 2023, the latest available data from BLS. That’s 23% higher than the same quarter in 2019.

And it’s about 5 percentage points higher than the increase in prices over a similar period in California, based on data from the state’s Department of Finance.

But even though average paychecks have now matched or exceeded price increases — meaning most consumers’ purchasing power has not been eroded, Wolfers and other economists say — that’s not the way people process things.

When prices go up sharply, people get upset, thinking it unfair and unjust, and looking at the government or someone else to blame. But if their wages go up by just as much, people tend to “externalize” the increase, feeling they earned it, although in reality the bigger paycheck is largely the result of higher prices — and the resulting ability of employers to pay their employees more.

That psychology presents a big challenge for Biden, since it takes time for consumers to get over what they’ve internalized about high inflation. And although California will probably not be in play in November’s presidential balloting, the downcast mood of many residents due to inflation may only be magnified because the state’s economy has been lagging behind the nation.

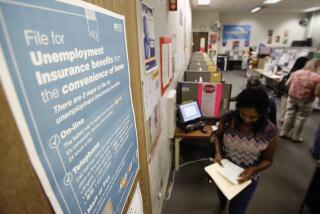

Between February 2020 and February 2024, California’s payroll jobs have increased by 1.7%, half of the national job growth rate. The unemployment rate in California in February was 5.3%, compared with 3.9% for the U.S. as a whole, although the state Finance Department’s chief economist, Somjita Mitra, said California’s share of long-term unemployed is comparatively much smaller.

The latest survey of consumer confidence by the Conference Board shows California significantly trailing other big states such as Florida, Texas and New York.

And there are fresh signs that more California consumers are struggling financially. The share of credit card delinquencies, for example, rose in December to the highest level since late 2009 around the time of the Great Recession, according to the California Policy Lab at UC Berkeley.

“In California, the credit trends are deteriorating; they’re not headed in a good direction,” said its executive director, Evan White.

Household surveys by the Census Bureau, most recently in February and March, found that Californians are struggling more with housing finances and paying more for usual living expenses than the national average. And a significantly larger share of Californians than most other states reported to the census that they had changed their driving behavior due to the cost of gas.

Gasoline prices in both the U.S. and California are up about 29% from February 2020, according to the U.S. Energy Information Administration. But the average price for a gallon of gas in California was $4.83 last month, compared with the national average of $3.45.

Gas prices have been rising again in recent weeks, and if that continues it could be another big impediment for Biden, said Mark Zandi, chief economist at Moody’s Analytics.

The other key economic factor that Zandi thinks could sway some voters is whether interest rates come down.

For homeowners, higher inflation has meant higher home prices too. But renters, particularly those in their prime home-buying years, in their 30s and 40s, have felt locked out of the market due to high inflation and mortgage rates — particularly in pricey California.

“That really undermines their thinking about the economy and their own financial health,” Zandi said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.