Column: Vanguard, one of our top investment firms, shuns crypto ‘like the plague.’ That’s good for its customers

After Jan. 10, when the Securities and Exchange Commission approved the first bitcoin exchange-traded investment products, the biggest investment firms jumped into the pool with both feet, jostling one another to offer their clients, big or small, access to bitcoin funds.

All, that is, except the second-biggest private investment management fund on the planet, Vanguard Group.

The firm has made clear, most recently in a Jan. 24 message to its clients, that it has no plans to offer a bitcoin exchange-traded fund (ETF) or any other cryptocurrency-related products. Nor will it allow any such products from other firms to be offered via its brokerage arm.

While crypto has been classified as a commodity, it’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.

— Janel Jackson, Vanguard

Vanguard spelled out precisely why it is shunning crypto despite the “headlines and buzz” the asset class generates. Put simply, it doesn’t think crypto belongs in retail investors’ portfolios.

That’s a smart and responsible policy that places the interests of Vanguard’s clientele ahead of those of the greedy promoters and scamsters infecting the entire cryptocurrency field.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Bitcoin and other crypto investments have typically spelled financial disaster for ordinary investors. Stories of life savings lost in supposedly safe crypto investments are distressingly common.

Vanguard’s executives know they’re swimming against a tide of pro-crypto propaganda from entertainment and sports stars as well as prominent authors. That doesn’t faze them.

“In Vanguard’s view, crypto is more of a speculation than an investment,” Janel Jackson, the firm’s global head of ETF capital markets, stated in the recent message, which was headlined “No bitcoin ETFs at Vanguard? Here’s why.”

Contrasting crypto with traditional asset classes, she wrote: “With equities, you own a share of a company that produces goods or services, and many also pay dividends. With bonds, you get a stream of interest payments. Commodities are real assets that meet consumption needs, [and] have inflation-hedging properties.... While crypto has been classified as a commodity, it’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.”

2023 was a brutal year for the likes of Elon Musk, Sam Bankman-Fried, book banners, anti-union managements and more

These words are significant for several reasons. One is Vanguard’s size: With more than $7 trillion in assets under management as of 2023, the firm ranks as the second-largest American investment management firm, after BlackRock (more than $9 trillion). Also, more than many other such firms, Vanguard’s target market is retail investors pursuing a long-term buy-and-hold strategy.

Then there’s Vanguard’s history of viewing trendy flavor-of-the-month investment crazes skeptically and keeping them off its platform.

Before getting more deeply into Vanguard’s decision and history, a few words about the SEC’s decision to give bitcoin ETFs a green light.

Under its chairman, Gary Gensler, the agency has consistently resisted giving approval for crypto-based investing schemes. In a tweet as recently as Jan. 9, Gensler advised investors to “be cautious” about anything related to crypto assets. “There are serious risks involved,” he wrote.

The very next day, however, the SEC approved proposals from several investment firms for bitcoin ETFs after having rejected 20 applications dating back as far as 2018. What had changed, Gensler observed after the vote, was that the SEC’s hands were tied by a ruling from a federal appeals court in Washington, D.C. The court found that the commission hadn’t made the legal case for turning down the latest application.

Gensler emphasized that the SEC’s vote didn’t mean that its general distaste for crypto investments had changed. The ETF it approved was limited to holding a single cryptocurrency, bitcoin, he warned, and shouldn’t be taken as a signal that the commission would look kindly on other crypto-based investment products.

Commissioner Caroline A. Crenshaw, like Gensler a member of the SEC’s Democratic Party majority, was even more blunt in dissenting from the approval. Are the crypto markets safe? she asked rhetorically. “Substantial evidence indicates that the answer is no.”

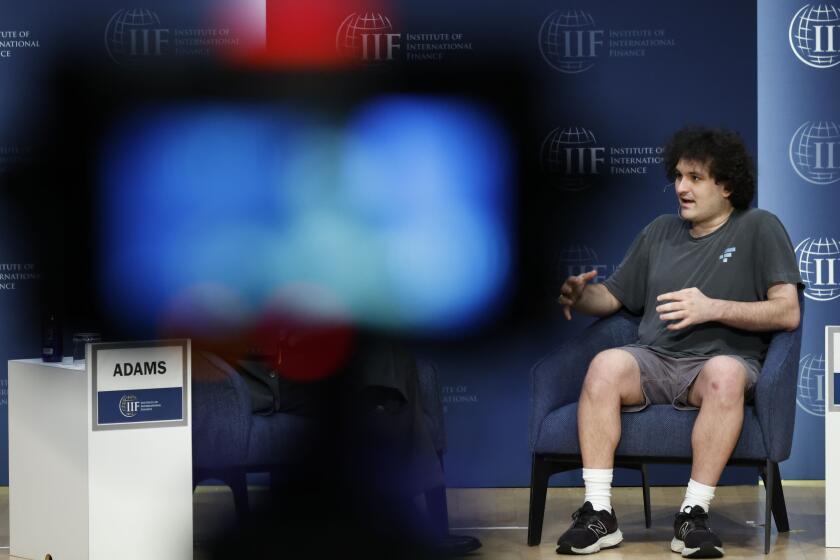

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

She added that the spot bitcoin trading underlying the new ETFs “is so susceptible to manipulation, so rife with fraud, so subject to volatility, and so limited in oversight that we cannot credibly say ... that there are adequate investor protections in place.”

The SEC’s approval, which covered applications for 11 bitcoin ETFs developed by firms such as BlackRock, Fidelity and Invesco, inspired a rush of hyperventilating from crypto enthusiasts, who described it as a “game-changer” for the asset class. But it didn’t quell concerns from other investment watchdogs such as Dennis Kelleher, the co-founder and chief executive of Better Markets, who called it “a grievous, historic mistake” that will suck unwary investors into “a worthless product.”

Of the nation’s top investment management firms, almost all are offering clients opportunities to invest in bitcoin and other cryptocurrencies. Some are marketing these assets more aggressively than others.

Fidelity, which ranks third in assets under management, behind BlackRock and Vanguard, started offering employers sponsoring 401(k) plans for their workers a bitcoin investment option in 2022, only a few months before Sam Bankman-Fried’s crypto scam, FTX, cratered due to fraud. (A federal jury, it may be recalled, found Bankman-Fried guilty on seven fraud counts in November.)

Fidelity’s venture raised the hackles of Democratic Sens. Richard Durbin of Illinois and Elizabeth Warren of Massachusetts, who urged the firm to back away from its 401(k) option. Fidelity plainly didn’t do so, since it still promotes bitcoin for 401(k) plans on its website.

That brings us back to Vanguard. (I’m an investor in some of its funds; since it’s a mutual — owned by its fund shareholders — technically I’m an owner of the firm, albeit a minuscule one.)

To be fair, Vanguard doesn’t promise that it will never offer bitcoin investments: “We continuously evaluate our brokerage offer and evaluate new product entries to the market,” Vanguard spokeswoman Karyn Baldwin told me by email.

Investment promoters are pushing people to add cryptocurrencies to their retirement plans. Here’s why that’s a lousy idea.

But she made it plain that bitcoin ETFs will have a mountain to climb to show they belong with “asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.”

All investment firms make a big deal about placing their clients’ interests front and center, but few were based on that principle to the extent of Vanguard.

The firm was founded in 1975 by the venerated John C. “Jack” Bogle. He built the firm around the concept of passive investing through index funds. Replicating the holdings of the major stock indexes, these funds trade relatively seldom because the components of the indexes rarely change.

That reduces commissions and other transaction costs such as taxes, which cut into clients’ returns. More important, such passive investments consistently do better than “active” fund managers, who trade frequently and pick their investment targets, hoping to capture a run-up in particular stocks or market categories.

Bogle was hostile to speculation, as opposed to investing, to the end of his life in 2019. In a 2012 book titled “The Clash of the Cultures,” he contrasted “the culture of long-term investing — the rock of the intellectual, the philosopher, and the historian — with the culture of short-term investing — the tool of the mathematician, the technician, and the alchemist.”

He lamented “the gradual but relentless rise” of the latter, “characterized by frenzied activity in our financial markets, complex and exotic financial instruments,” which came to dominate a financial system “peppered as it is with self-interest and greed.”

If you think that would make him extremely leery of bitcoin, no kidding. At an investment conference in 2017, answering a question about bitcoin, he responded: “Avoid it like the plague. Do I make myself clear?”

He explained, “Bitcoin has no underlying rate of return.... There is nothing to support bitcoin except the hope that you will sell it to someone for more than you paid for it” — in other words, the “greater fool” theory.

Column: Shame, suicide attempts, ‘financial death’ — the devastating toll of a crypto firm’s failure

Customers of the bankrupt Celsius reveal how the cryptocurrency firm’s collapse upended their lives.

It’s worth noting that such skepticism doesn’t always translate into a business decision to avoid the accursed investment. After all, Jamie Dimon, the chairman and CEO of JPMorgan Chase & Co., expressed similar doubts about bitcoin around the same time, calling it a “fraud ... worse than tulip bulbs.”

Unlike Vanguard, however, JPMorgan hasn’t followed the instincts of its leader: The firm has been giving clients access to crypto funds at least since 2021.

The roster of trendy investments that Vanguard has denied to its customers, almost invariably to their benefit, is a long one. A list compiled recently by Morningstar’s John Rekenthaler includes government-plus funds in the 1980s, internet funds in the late 1990s (“What artificial intelligence investing is today, internet funds were 25 years ago,” Rekenthaler wrote — fair warning) and “130/30 funds” of 2009 vintage, which held hedge fund-like portfolios mixing long and short positions, supposedly to goose returns without adding risk.

As Rekenthaler noted, all these ideas eventually “crashed and burned.” None was embraced by Vanguard, largely because every one ran counter to the interests of long-term investors.

Vanguard’s policy evidently has stuck in the craw of the crypto faithful. One claimed in a tweet that a Vanguard representative he reached “apologized profusely for management’s lack of vision, admitted they owned Bitcoin personally, and said that they’ve received literally thousands of calls from customers looking to move accounts.”

All we can say to that is: “Oh, sure.” Here’s a prediction, though: Vanguard, which has been around for nearly a half-century, will still be around long after crypto has been consigned to the investment craze graveyard, where it belongs.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.