Walmart says thrifty shoppers boosted holiday sales. Retail giant to buy TV maker Vizio

Walmart reported another quarter of stellar results, ending the year on a high note as its low prices attract shoppers looking for deals in an economically challenging environment beset by a recent bout of inflation.

Yet inflation is fading fast, and on Tuesday, the company released a modest earnings forecast.

Walmart also confirmed that it would buy smart TV maker Vizio for $2.3 billion to boost its advertising business. The deal gives Walmart access to Vizio’s SmartCast operating system, which would allow the retailer to offer its suppliers the ability to display ads on streaming devices.

Walmart already sells its own private label televisions under its Onn brand. Walmart said Vizio’s SmartCast system has 18 million active accounts. The Wall Street Journal was the first to report last week that a deal was in the works.

In addition, Walmart announced its biggest dividend hike in more than 10 years. Its shares rose 3% to close at $175.86 while Vizio’s shares jumped 16% to $11.08.

Walmart is boosting compensation to retain staff. The amount of stock grants will vary by store format.

The American consumer has remained resilient, propped up by a strong labor market and steady wages. But shoppers pulled back on spending in January after the holiday season splurge.

Walmart, based in Bentonville, Ark., is among the first major U.S. retailers to report quarterly results, which could throw more light on how consumers are feeling, particularly after the government reported a significant decline in consumer spending last month.

Home Depot reported Tuesday that sales continued to fade during the fourth quarter as the country’s largest home improvement retailer feels the effects of high mortgage rates and inflation on its customers.

Economists attributed part of the pullback to snowy weather but also believe that Americans may finally be buckling under higher interest rates and other financial burdens, which would have consequences beyond Walmart. Consumers account for roughly two-thirds of U.S. economic activity.

Walmart has used its clout to work with suppliers to manage inflation. Chief Executive Doug McMillon told industry analysts Tuesday that general merchandise prices are lower than a year ago and even two years ago in some categories. The picture is mixed in the grocery area, with eggs, apples and deli snacks cheaper than last year, and prices for asparagus and blackberries rising.

Dry groceries and consumables such as paper goods and cleaning supplies are up in the mid-single digits, percentage-wise, compared with the high teens two years ago, McMillon said.

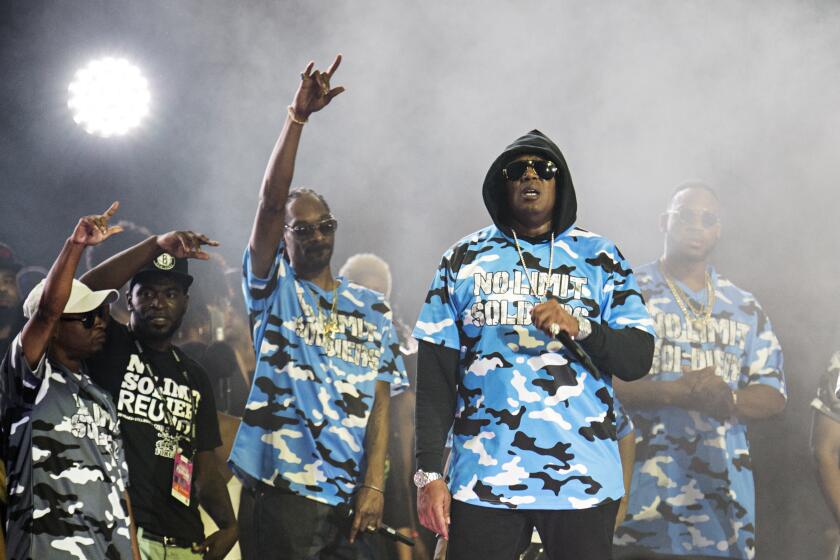

Snoop Dogg and Master P sue Post Consumer Brands and Walmart, claiming they quashed sales of Broadus Foods’ Snoop Cereal breakfast products.

Walmart continues to cater to customers seeking necessities, but it’s also drawing households that make more than $100,000 a year. Two-thirds of Walmart’s market share gain in general merchandise comes from that latter group.

Walmart earned $5.49 billion, or $2.03 per share, in the quarter that ended Jan. 31. That compares with $6.27 billion, or $2.32 per share, in the year-ago quarter. Adjusted earnings were $1.80 per share.

Sales rose 5.7% to $173.39 billion.

Analysts were expecting earnings of $1.64 per share on sales of $170.85 billion, according to FactSet.

Comparable-store sales — those from established stores and online operations over the last 12 months — rose 4%, slower than the 4.9% for the Walmart U.S. division in the previous quarter. Global e-commerce sales were up 23%, compared with 15% in the previous quarter.

But the average receipt — how much shoppers spent per trip — slipped 0.3% in the latest quarter from a year earlier as the number of transactions rose 4.3%.

The company’s global advertising business increased roughly 28% to reach $3.4 billion.

Walmart recently announced plans to build or convert more than 150 stores in the next five years, while remodeling existing stores.

That is a notable shift. In 2016, Walmart said it was slowing new store openings as it shifts some of its focus to online sales and technology to counter Amazon. Walmart hasn’t opened a new store since late 2021.

But it’s clear that Walmart is highly focused on stores, and last month it sweetened perks for its U.S. store managers.

Walmart said that starting with the company’s current fiscal year, U.S. store managers would receive up to $20,000 in Walmart stock grants every year.

Walmart expects earnings per share to be in the range of $1.48 to $1.56 for the first quarter. Analysts were expecting $1.60 per share. It anticipates net sales to increase 4% to 5%.

Walmart expects earnings for the current fiscal year to be between $6.70 and $7.12 per share. Analysts were expecting $7.06, according to FactSet. The company expects sales to be up 3% to 4% for the year, slower than in the previous year.

“There are economic outcomes that could cause us to move to the high end of the range or the low end of the range, but given where we are right now, going into the first part of this year, we feel really good about the plan,” Chief Financial Officer John David Rainey said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.