How to spot Social Security scams and protect your identity

When the Social Security Administration calls, you pick up. But between October 2022 and June 2023, more than 55,000 people who answered calls from what they thought was the government agency said they were scammed.

Allegations of Social Security scams increased nearly 62% in the quarter ended June 23 compared with the year-earlier quarter, according to the Social Security Administration Office of the Inspector General.

The most common tactic is simple: Scammers say they’re with the Social Security Administration and ask for personal information or money.

Imposter scams gain victims’ trust by appropriating federal agencies’ authority, said Stacey Wood, the Molly Mason Jones Chair in Psychology at Scripps College. Some impersonate officials with fake IDs or use caller IDs that resemble government phone numbers.

So how do you know if a scammer’s calling? If they tell you any of these four stories, it’s time to hang up.

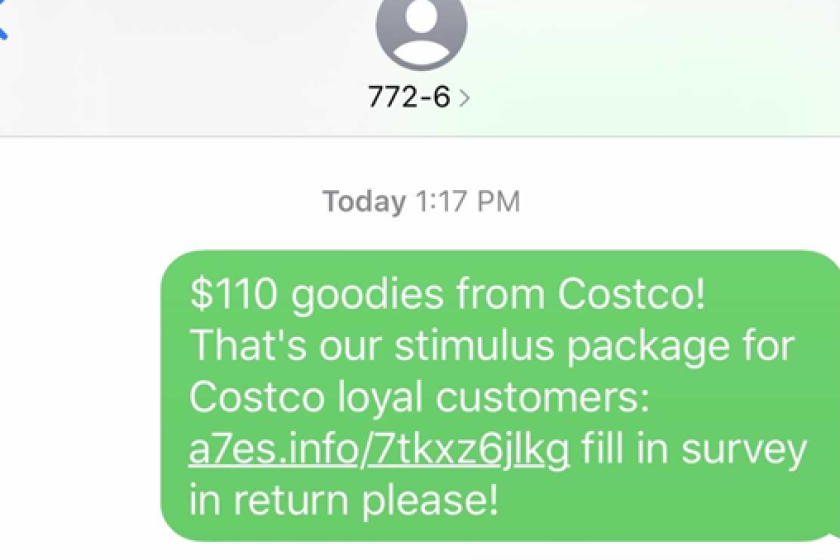

The FCC adopted a rule Thursday requiring mobile phone companies to block “highly likely to be illegal” texts, including those from non-working numbers.

1. Your Social Security number is suspended

THE TACTIC: A scammer tells you that your Social Security number is suspended and they need your personal information to reactivate it.

WHY YOU SHOULD HANG UP: The government doesn’t suspend Social Security numbers. Fraudsters are after personal information to steal your identity.

2. Your benefits are suspended

THE TACTIC: Perpetrators say your Social Security benefits are suspended. They’ll ask for your Social Security number to verify your identity or say you need to pay a fee to have your benefits reinstated.

WHY YOU SHOULD HANG UP: Both scenarios are bogus. The Social Security Administration doesn’t call and ask for your Social Security number or charge you to correct your benefits.

3. You can pay to increase your benefits

THE TACTIC: The caller says they can increase your benefits for a fee.

WHY YOU SHOULD HANG UP: This scam is commonly associated with the SSA’s annual cost-of-living adjustment. Imposters offer to apply the COLA if you pay for the service. The truth? The SSA automatically applies COLA increases to benefits.

Social media is full of scammers promising guaranteed returns on investment, and consumers lost $3.8 billion to them last year just in the U.S., the FTC said.

4. You owe money that has to be paid now

THE TACTIC: A scammer says you owe money for a penalty or as a correction for an overpayment. They may threaten to suspend your benefits or have you arrested if you don’t pay immediately using an unusual method of payment.

WHY YOU SHOULD HANG UP: Scammers often request payment through wire transfers, cryptocurrency, prepaid debit cards, gift cards or by mailing cash — none of which the Social Security Administration accepts. Scammers like these payment methods because they are practically impossible to trace.

Seniors are the biggest target

The Administration for Community Living, a division of the U.S. Department of Health and Human Services, announced in October that reports of scams targeting older adults were multiplying.

Because Social Security is a significant income stream for older adults, they are often more likely to answer calls or respond to letters out of fear of missing something important, Wood said.

Seniors also tend to be more lucrative targets. “They have more assets, so it’s just a better use of scammers’ time to exploit older people,” Wood said.

While you’re shopping for gifts and considering Giving Tuesday donations, bear in mind that scammers and fraudsters want to take advantage.

Red flags that you’re being scammed

You’re likely being scammed if someone:

— Calls unexpectedly from the Social Security Administration. The agency generally contacts beneficiaries through the mail, so be suspicious of any other contact method.

— Says there’s a problem with your benefits. If there is an issue with your benefits, the Social Security Administration will send you a letter explaining how to correct it and whom to contact.

— Pressures you to respond immediately. The Social Security Administration gives you time to pay legitimate penalties and won’t threaten to arrest or sue you if you wait to pay a debt.

— Requires you to pay to correct something. The Social Security Administration corrects issues with your benefits and applies increases for free.

Did someone send you money ‘by accident’ on Venmo, Zelle or Cashapp? Don’t rush to send it back. Here’s what to do.

Tips to protect yourself

— Never give out personal information. The Social Security Administration will never reach out to ask for sensitive information already on file.

— Know what’s available online. Scammers can find your personal information online. If someone has this information, it doesn’t mean they’re from the Social Security Administration, said Krissten Petersmarck, a certified national Social Security advisor in Detroit.

— Investigate unexpected changes in your benefits. If your Social Security benefits decrease unexpectedly, ask why. “If things are changing and you’re not aware of why, the first thing you need to do is contact the Social Security Administration,” Petersmarck said.

— Check your credit history. Check your credit reports with the credit bureaus (Experian, Equifax and TransUnion) for signs of identity theft, Petersmarck said. You can request a free credit report every year at AnnualCreditReport.com.

Vandiver writes for personal finance site NerdWallet. This article was distributed by the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.