Column: Yes, Amazon is a near-monopoly. Dismantling it will be harder than you think

Few Amazon customers or sellers could be surprised by most of the allegations in the massive lawsuit filed against the company Tuesday by the Federal Trade Commission and 17 states.

The lawsuit accuses Amazon of a host of anti-competitive practices, all aimed at exploiting its enormous footprint in the online retail market.

These include price manipulation and punitive and coercive behavior against sellers with the temerity to use competing retail platforms or to set their own prices or engage in non-Amazon methods to serve their own customers.

The harms here...have basically created a really distorted and competitive landscape....That may require significant relief.

— FTC Chair Lina Khan, contemplating an Amazon breakup

Then there’s the degradation of the Amazon shopping experience by the infusion of “sponsored” — that is, favored — products that may be inferior or more expensive than those a buyer may be seeking.

The company’s public response to the lawsuit is that it would result in “fewer products to choose from, higher prices, slower deliveries for consumers, and reduced options for small businesses,” its general counsel, David Zapolsky, said in a prepared statement, adding that the agency is “wrong on the facts and the law.”

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

But most of the FTC’s allegations are familiar enough. Consumers know how hard it is to determine whether Amazon’s prices are the lowest available. They know that when they’re searching for an item on Amazon.com, the varieties pushed at them most assiduously are those from Amazon’s commercial partners or marketed by Amazon itself.

The antitrust lawsuit alleges that Amazon uses its position in the marketplace to inflate prices on other platforms, overcharge sellers and stifle competition.

They feel the pressure to sign up for Amazon’s Prime service, now $139 a year, necessary to receive one- or two-day, or even overnight, delivery, in addition to the company’s video and music streaming services.

Sellers who have marketed their merchandise on Amazon are certainly aware of the cost — a share of as much as 50% taken by the company.

They know the consequences of flouting its rules or trying to discount its products from Amazon’s price, which include banishment from the website’s one-click “buy box” or the burying of discounting sellers “so far down in Amazon’s search results that they become effectively invisible,” to quote the lawsuit.

The question is what to do about it.

Barnes & Noble was on the verge of disappearing, like Border’s and Waldenbooks. Under new management it’s turning around, and that’s good news for readers.

That’s the question implicit in every one of the FTC complaint’s 174 pages. It’s the same question raised anytime the government tries to rein in a big, powerful corporation, but it’s especially important in this case, because there are so very few corporations that dominate their markets so powerfully.

The FTC points to Amazon’s ability to leverage its various businesses, which include its “fulfillment” services — the warehousing, packing and shipping of sellers’ merchandise — and Prime eligibility, which gives sellers’ products preferential placement on the website and by eliminating shipping charges lowers the cost of their products for buyers.

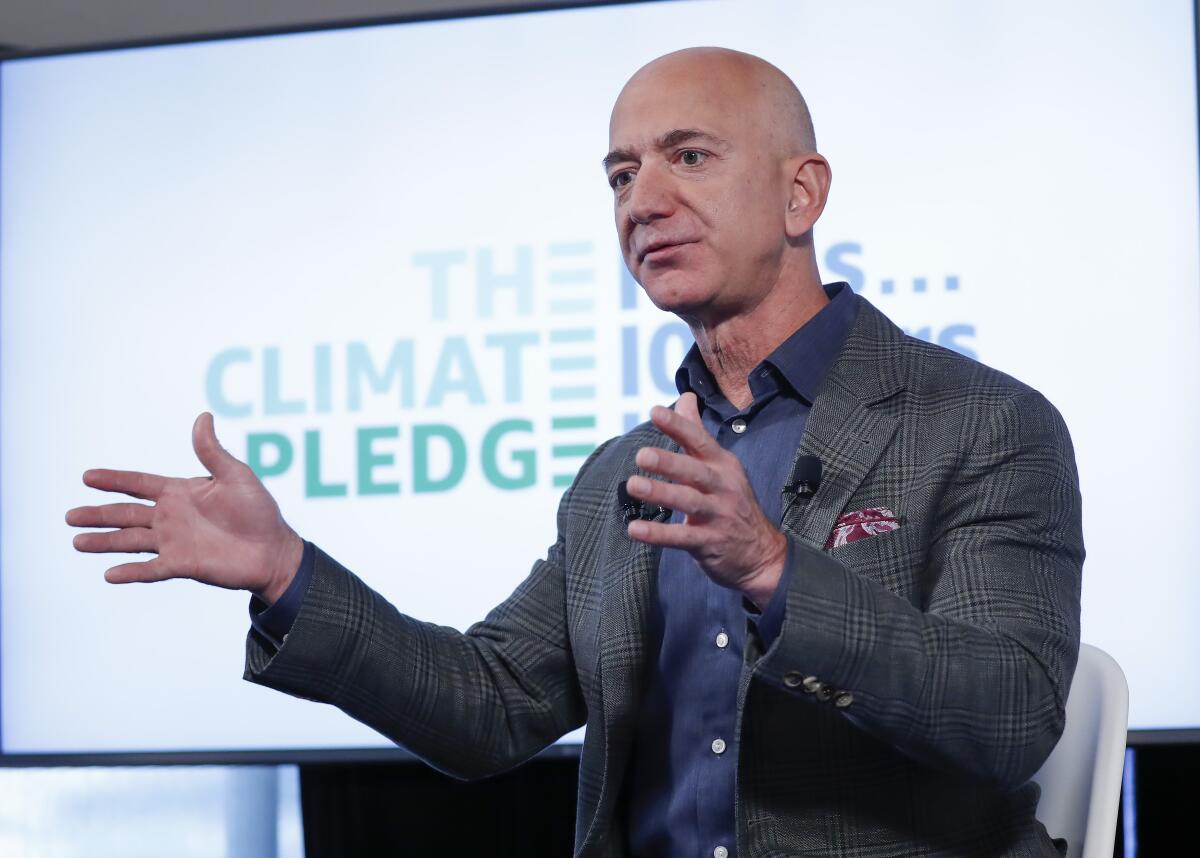

That suggests that one answer would be to break up Amazon, say by forcing it to divest its fulfillment operation. FTC Chair Lina Khan dodged that issue in her statements about the lawsuit, possibly because she knows that the remedy to Amazon’s misdeeds, assuming it’s found guilty, would be in the hands of a federal judge.

“At this stage, the focus is more on liability,” she told reporters in a briefing session Tuesday. On Wednesday, during an appearance at a Washington, D.C., conference sponsored by Politico, she noted that in the lawsuit, “we don’t specify any one type of remedy.”

She also observed, however, that “the harms here are really mutually reinforcing, and have basically created a really distorted and competitive landscape ... that may require significant relief.”

The lawsuit isn’t entirely silent on possible remedies, mentioning, among other options, “structural relief.” That could only mean a breakup.

Some disclosures are proper here. I, like many other customers, am a willing prisoner of the Amazon ecosystem, or perhaps more accurately, an addict. The books I read for pleasure are almost invariably ebooks, which means they’re Amazon ebooks; I blindly buy the latest version of the company’s Kindle e-reader (up to and including its new large-format Kindle Scribe).

If I’m interested in a book that doesn’t come in a Kindle version, I’ll wait until it does. I can’t remember the last time I bought an ebook not on Amazon. All but two of the books I’ve written come in Kindle versions, for which I’m thankful.

Publishers and authors rightly fear that they’ll lose out financially from the digitization of books; but it’s also quite possible that, properly managed, the technological revolution will make them more money.

Outside of food and gasoline, I probably do 70% to 80% of my shopping online, and the vast majority of purchases are on Amazon. I’ll make a purchase on Amazon even if the product is available at a store less than a mile away, and especially if it will be delivered the next day or even (increasingly) overnight.

That doesn’t mean that I’m an uncritical fan. I’ve had to train myself to look past the “sponsored” products Amazon thrusts at me when I’m searching for an item. I’ve avoided its Echo/Alexa devices, because I know they exist to push favored products my way, and who wants a device in the home with the capability of listening in to private conversations?

I’m not happy that I can’t own an ebook purchased on Amazon, but only purchase a license giving me the right to read it (but not give it away, like a physical book). Nor that this arrangement gives Amazon rights over my ebook library that I may not even know about, as when it stealthily deleted from customers’ Kindles versions of George Orwell’s “Animal Farm” and “1984” after copyright issues arose with those versions.

An Amazon ebook generally can be read only on an Amazon Kindle or an Amazon app — another pair of mutually reinforcing near-monopolies.

Quite obviously, Amazon could never get away with such restrictive rules if it had genuine competition in the ebook or e-reader markets.

Amazon and its mouthpieces in Congress have made much of the fact that Khan has had Amazon’s number for years. Exhibit A is her 2017 article in the Yale Law Review titled “Amazon’s Antitrust Paradox.” Amazon and Meta (then Facebook) tried to use it to force Khan to recuse herself from FTC proceedings against them. Wisely and properly, she turned them down.

The article delved deeply into Amazon’s anti-competitive strategies, which consisted chiefly of undercutting competitors’ prices and consequently taking losses; the company’s expectation that this would drive rivals out of its markets and leave the field clear for it to turn to extracting profits from consumers by exploiting its near-monopoly bore fruit in the long term.

Khan homed in on, among other tools, Amazon’s fulfillment services. But she noticed how Amazon leveraged its Prime membership by bundling “other deals and perks” into it, turning Prime into its “biggest driver of growth.”

Amazon’s bid for One Medical raises troubling questions about health data privacy and marketing practices.

The discussions in the FTC lawsuit of Prime and fulfillment as anti-competitive tools replicate Khan’s 2017 analysis with astonishing fidelity, showing that Khan understood Amazon’s business strategy very well indeed.

The remedies Khan offered in 2017 wouldn’t be adequate to rein in the Amazon of today. She recommended applying especially close scrutiny to merger deals reached by companies that already dominated their markets — but that might not work with a company such as Amazon, which has the ability to expand its market dominance without having to acquire other companies.

What most people overlook is that the 2017 article was a critique not so much of Amazon, but of the failure of antitrust regulators to recognize that the new online retail market was fundamentally different from bricks-and-mortar retailing, and that Amazon had been able to exploit that failure.

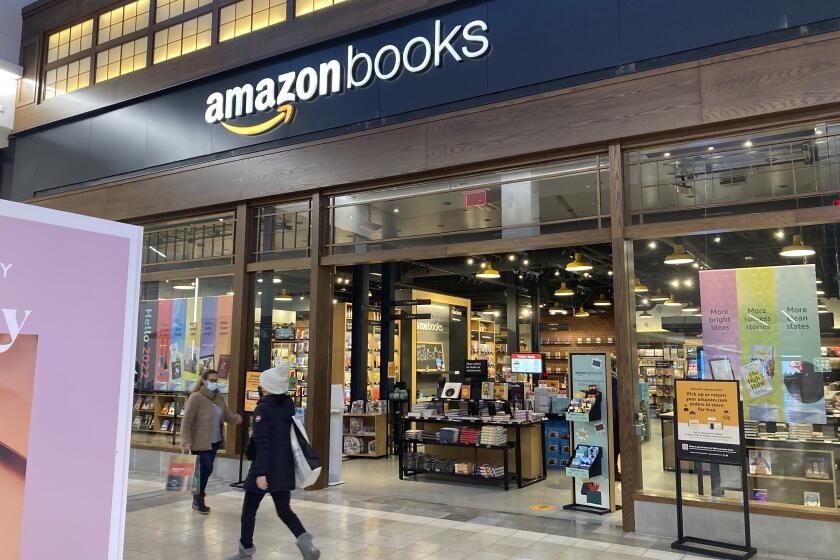

The best example, Khan pointed out, involved the efforts by major book publishers to counteract Amazon’s policy, rolled out in 2007, of pricing bestseller ebooks at $9.99, undercutting the publishers’ hardcover and ebook prices. Within two years, Amazon’s share of the ebook market was 90%.

The publishers struck a deal with Apple allowing them to set their own ebook prices for sale on Apple’s iBooks app. Amazingly, the Justice Department sued Apple and the publishers for colluding to fix prices. As Khan noted, the DOJ found “persuasive evidence lacking” that Amazon had engaged in predatory pricing.

Apple eventually settled the lawsuit for $450 million, the three largest publishers — Hachette Book Group, Simon & Schuster, and HarperCollins — settled for a combined $69 million, and the last two, Macmillan and Penguin, settled by agreeing not to set ebook prices. Apple never became a significant player in the ebook market.

As Khan perceived, old-school antitrust regulators failed to understand how the retail market had evolved and Amazon was poised to take advantage: “How steep discounting on a platform ... creates a higher risk that the firm will generate monopoly power” than discounting in physical stores, and how Amazon’s business had become so big and varied that it could undercut rivals’ prices, take a temporary loss, and recoup its red ink in multiple ways.

The lawsuit that her FTC filed against Amazon sends a clear signal: She doesn’t intend to make the same mistake.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.