State Farm’s California freeze: Looming insurance apocalypse or political ploy?

When State Farm announced in May that the company would stop writing new homeowners insurance policies in California, it issued a two-paragraph statement by way of explanation.

It listed “historic increases in construction costs,” “rapidly growing catastrophe exposure, and a challenging reinsurance market” as the culprits, adding that it needed to take this action to “improve the company’s financial strength.”

Those two paragraphs sent shock waves through the state. Coming in tandem with a similar pullback by Allstate, the implication was clear: California’s wildfires were getting out of control. Rising construction costs are one thing, but growing catastrophic exposure and the reinsurance market both point to a financial doomsday scenario. Given that State Farm has been the top home insurer in the state for decades, this could be the beginning of a market collapse that would leave millions stranded without affordable insurance as their homes burned to the ground.

But there’s a billion-dollar hole in that story, raising the possibility that the company’s move may reflect other considerations, from applying political pressure to staying on the right side of financial regulations.

For the last five years, many insurance companies in California have dealt with growing fire risk by dropping customers in high fire risk zones, declining to renew their policies. As a result, the number of people on the FAIR plan, the expensive backstop insurance pool that California requires insurance companies to participate in based on their statewide market share, has more than doubled since 2018.

Allstate tells regulators it has stopped selling new home insurance policies in California. State Farm said it’s no longer accepting new applications.

State Farm, however, has been swimming against this current. As other insurers moved out, State Farm moved in. Its market share in the Golden State grew from roughly 17.8% to 21.2% since 2018, which added more than $1 billion dollars in premiums to its books in the process.

Rex Frazier, president of the industry group the Personal Insurance Federation of California, experienced this State Farm expansion himself.

“We live in Sonoma County, in the redwoods,” Frazier said: prime fire country. No big insurer would cover his house in recent years, so he was forced to go with a plan from an expensive insurance startup — until just last year, Frazier said, when “State Farm, for whatever reason, opened up in our area, and I snatched it up.”

If California regulation meant that rates were failing to reflect wildfire risk, State Farm could de-risk its books by slowly backing away from customers like Frazier in the fire zones, like most of its peers.

But even today, State Farm is sticking with the high-risk properties it signed since 2018, and explicitly committed to renewing its existing policies when it announced its decision to stop writing new ones in May.

That suggests a more complicated calculus than that two-paragraph statement offered.

State Farm declined multiple requests for interviews, referring The Times to Frazier and other spokespeople at industry associations instead.

Those reps painted a picture of an insurance market threatened not just by wildfire but also by California’s regulatory apparatus, headed by Insurance Commissioner Ricardo Lara, keeping insurance premiums too low.

Since 1988, when California voters approved Proposition 103, insurance companies have had to submit all requests for premium increases to the state insurance commissioner’s office, along with evidence justifying their need to raise rates. That process can be slow, and even slower if companies want to boost rates by 7% or more, at which point the approval process can turn into a full-on trial.

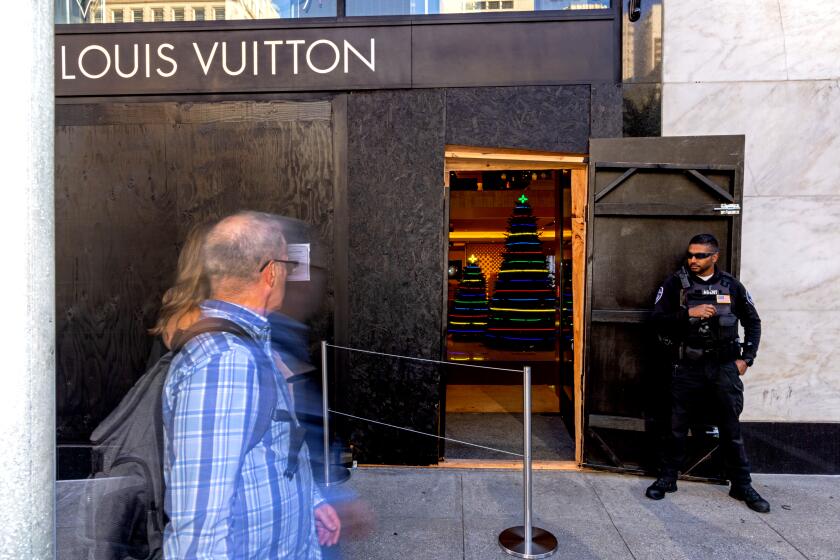

Industry groups and politicians are sounding alarms over the thefts. But in some cases, the statistics they cite are inflated or flat-out wrong.

Companies aren’t allowed to pass along the costs of their own reinsurance premiums — the policies they rely on to cover their own losses in the case of catastrophe. The reinsurance market is global and unregulated, and firms have been raising rates, especially for fire coverage, in recent years.

The last major sticking point that industry reps point to is the use of fire models. Insurance companies are allowed to use only historical losses to justify their increases to the insurance commissioner, rather than using forward-looking fire models. This rule, the companies say, makes for mismatches between price and risk in an evolving climate.

The industry argument is that California’s rate regulation is forcing companies to underprice policies relative to their risk for potential payout. If companies were allowed to pass along reinsurance costs, get rate increases through more easily, or use their own wildfire risk models in setting those prices, then State Farm wouldn’t need to make these kinds of decisions.

Proposition 103 and the regulations created by the Department of Insurance are undeniably, and intentionally, barriers to raising prices. California premiums are 14% lower than the national average and rank in the bottom half of U.S. states’ rates, in part because of the regulatory regime.

Those lower prices haven’t exactly dealt a fatal blow to insurers’ bottom lines, however. Most companies in the U.S. lose money on the core business of homeowners insurance over time, paying out more in losses than they bring in in premiums, but they make profits by investing their capital in bonds, stocks and other financial instruments. Data from the National Assn. of Insurance Commissioners show that California homeowners insurance, once investment income is taken into account, has been more profitable than homeowners insurance nationwide over a 30-year span.

It’s almost certainly the case that California’s wildfires are getting worse. The double-whammy of the 2017 and 2018 fire seasons, which saw the incineration of tens of thousands of homes, was a financial disaster for insurance companies, though they have been able to raise rates and turn a profit in the years since.

And the collapse of the insurance market would indeed be a disaster for the state. Brian Sullivan, owner and editor of insurance industry publication Risk Information, calls that scenario the “Floridification” of California. In the Sunshine State, hurricanes, rate price controls and litigation prompted the big insurers to pull back, and more lightly capitalized small companies moved in to fill the void. That has led to high prices and a string of insurance company bankruptcies.

It’s also led Florida into a financial sinkhole. More than 1 million Floridians have joined the state-backed Citizens plan, which is backed up by taxpayers and homeowners, unlike California’s industry-backed FAIR plan. “That’s the death spiral,” Sullivan said. “If California becomes Florida, it will be the dumbest possible outcome.”

But again, even in the face of these head winds, State Farm spent the last five years diving deeper into California’s market. So what gives?

This isn’t the first time that State Farm and other major insurance companies have hit pause on writing new policies in the state, and the reasons for past stops and starts include major disasters, global financial markets, claims of over-regulation, and mysterious years of bad luck.

Many companies stopped writing new policies after the 1994 Northridge earthquake, which prompted the creation of a distinct California Earthquake Authority to insure against seismic damage. But big insurers also have a history of more mundane business pauses. Allstate, which stopped writing new home policies in California in November 2022, did the same thing in 2007, only to reenter the market in 2016. State Farm also stopped writing new policies in 2003, only to reenter the market the next year.

Sullivan said that this time feels different. “Individual companies have made individual decisions before,” he said, but he thinks that both Allstate and State Farm hitting pause simultaneously points to a deeper problem.

Consumer advocates suspect that the political effect of the State Farm announcement is as significant as the business logic behind it.

“The idea that their decision is because they’re not getting the rate increases they want, that’s really not true,” said Amy Bach, executive director of consumer advocacy group United Policyholders.

“It’s a convenient excuse to blame the commissioner and blame Prop. 103 and blame the rate-making process,” Bach said. “But it’s really more complicated than that,” and could have as much to do with a bad year on the stock market hurting the company’s investment income as California’s tinderbox hillsides.

Even Frazier, the industry representative who thinks that California’s insurance regulation needs major reforms, admits that State Farm’s move cannot be entirely explained by mispriced wildfire risks. The mention of rising construction costs, to his eye, implies a different possible explanation for the pause.

The price of building materials and labor surged in the last three years, which has prompted California homeowners to raise their level of insurance coverage — where a homeowner might have been comfortable with a $250,000 policy to cover rebuilding costs in case of a fire, now they might want to up that to $350,000 or more, and willingly pay a higher premium for that more expansive protection.

As a whole, the homeowners insurance market in California has risen from $8.2 billion in premiums in 2018 to more than $12 billion today, with State Farm’s share rising from a little under $1.5 billion to more than $2.5 billion, largely on the back of these rising construction costs.

Frazier said that this jump might put State Farm in a financial bind. Insurance companies, like banks, are required to keep a certain amount of cash on hand to make good on claims in case of disaster.

The latest filings available, from the end of 2021, show that State Farm General, the California subsidiary of the national company, can’t dip below $458 million in reserves as a baseline, and would trigger higher scrutiny from regulators if its surplus fell below three times that, or $1.37 billion. Its latest reported surplus of $1.98 billion is well above that but marks a sharp drop from $2.3 billion in 2021. A growing book of business, a year of large losses, and rising reinsurance costs or other financial factors in today’s volatile financial markets could all, theoretically, mean that the company is edging toward those capital limits.

In this scenario, State Farm has gotten ahead of itself, growing its business beyond its capacity to fund it. Being allowed to charge higher premiums, whether through reinsurance pass-throughs or fire modeling, would bring in more capital to balance out its growing book of business. But the company could also straighten out its books by going to the reinsurance market, or applying for rate increases and transparently pleading its case to the Insurance Department.

Lara, the insurance commissioner, has mostly kept quiet in the wake of State Farm’s announcement, declining interview requests and pointing The Times to a statement underlining that more than 100 insurance companies are still writing new policies in the state, that State Farm will renew existing policies and that it’s working on wildfire risk mitigation plans.

But the complexity — and opacity — of the situation hasn’t stopped the insurance industry from using State Farm’s decision to argue for regulatory change.

California lawmakers held hearings Wednesday in Sacramento investigating the question of whether insurers should be allowed to use forward-looking wildfire models to price policies. The Insurance Department will be hosting a workshop in July to examine the same.

Consumer advocates remain skeptical.

“This has nothing to do with climate change, it has to do with the industry’s greed and its 35-year campaign — so far unsuccessful — to escape the requirements of Prop. 103,” said Harvey Rosenfield, the founder of Consumer Watchdog, which spearheaded the campaign to pass Proposition 103.

And with State Farm unwilling to talk with the media and open its books, it’s difficult to separate industry spin from financial — and fire — reality.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.