Column: Is Elon Musk already looking to bail out of his Twitter deal?

Is Elon Musk’s spectacular $44-billion acquisition of Twitter about to fall victim to one of the greatest outbreaks of buyer’s remorse of all time?

That’s what some Musk observers are asking, based on the recent action in shares of Twitter and Tesla, the electric-car maker on which Musk’s fortune is based, along with Musk’s behavior in the immediate wake of his deal for the social media platform.

The economic argument against Musk’s following through on his acquisition was laid out by Reuters in an article headlined “Elon Musk probably won’t buy Twitter.” The commentary piece concluded that Musk has financial reasons to let the deal fall apart.

Elon....It’s not your rules which will apply here.

— EU Commissioner Thierry Breton

Then there’s the behavioral argument, which hinges on Musk’s actions since the deal became public. He appears to have begun violating the terms of the formal purchase agreement within hours of its public release Tuesday.

The agreement allows Musk to issue tweets about the deal “so long as such Tweets do not disparage the Company or any of its Representatives.” In at least three tweets since then, however, Musk has arguably disparaged the company and two of its executives, though the tweets did not directly reference the deal.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

The agreement doesn’t say what Twitter can do if Musk violates that provision. But it’s not inconceivable that he’s giving the Twitter board an excuse to send him packing.

Closing the deal, which is fashioned as a merger between Twitter and a new company owned entirely by Musk, would take several months. If the deal blows up, either Twitter or Musk would be on the hook for $1 billion in damages (depending on which side takes the blame). So it’s worthwhile to examine the cost-benefit calculation for Musk if he chooses to walk away.

Let’s begin by observing that Musk hasn’t bought Twitter quite yet. He has lined up financial backing to buy the Twitter shares he doesn’t already own — about 91% of them, at $54.20 each. About half of the required $44 billion would come from Musk himself, including $21.5 billion in the form of margin loans against his Tesla shares.

Musk is commonly described as the world’s richest man, with a net worth of some $240 billion, but that doesn’t mean he has all that money lying around for him to do with as he wishes. Most of it is tied up in his 21% ownership of Tesla, but some of those shares have already been borrowed against and the company has imposed limits on how much more borrowing he can do against them.

Twitter can be a funnel of valuable information, or a pipeline for a Niagara of verbal sewage. An absolutist approach to free speech means, well, more sewage.

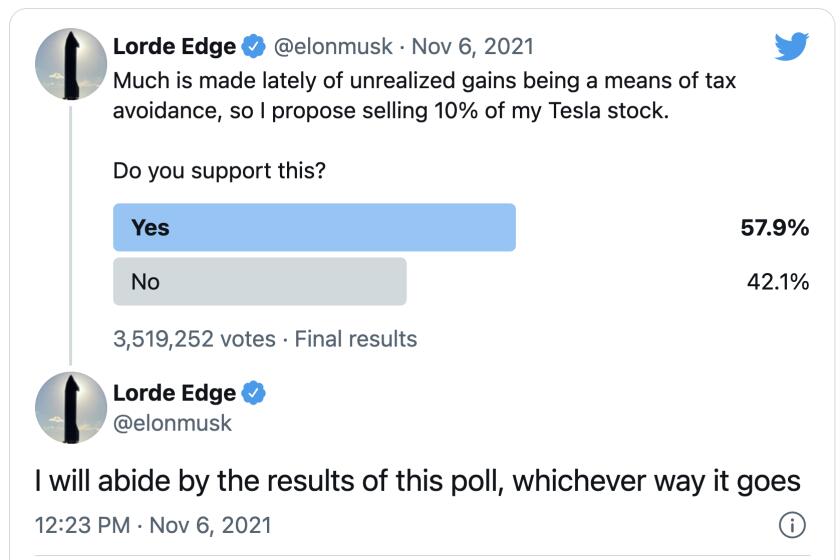

He is also known to float proposals with little intention of carrying them out. His famous 2018 tweet proclaiming a plan to take Tesla private and claiming that funding was assured is a good example — funding wasn’t assured, and the proposal appeared to be mere vapor. (Musk and Tesla settled a government lawsuit over the tweet for $20 million each.)

In this case, the funding does appear to be assured and Musk’s intentions far more advanced. But that doesn’t mean that he can’t back away from the deal at any point before its closing.

If Musk can’t obtain the necessary loans, he might have to sell some of his Tesla stock — which has fallen in value by some 24% since he initially disclosed a 9.2% stake in Twitter on April 4.

On Tuesday, the day after the sale agreement was reached, Tesla shares fell by nearly 13% to $873.28. They later recovered somewhat; TSLA ended down $4, or 0.45%, at $877.51; TWTR closed up 47 cents, or about 1%, at $49.11. Tesla peaked last November at about $1,230.

The recent action appears to represent real misgivings by Tesla shareholders about Musk’s Twitter adventure. They could be unamused for several reasons. One is the extent to which he is financing the deal by borrowing against his Tesla holdings.

That makes Musk vulnerable to margin calls from his bank lenders, forcing him to sell shares if the stock continues to fall; Musk as a seller is not a good look for Tesla, since much of its value derives from his identification with the company.

The price at which Musk might have to start selling to shore up the collateral for the banks is unclear. Bloomberg places it at about $740. Another day like Tuesday, when Tesla fell by $121.60, would put Musk perilously close to that point.

Another issue for shareholders is that new distraction for Musk is the last thing they need, given their chief executive’s notably short attention span.

Elon Musk has used Twitter to violate securities law and smear his critics. Placing him on the Twitter board is a terrible idea.

That’s especially true now, when Tesla is facing intensified competition in the electric-vehicle market from rivals at all price levels, from Ford and General Motors to BMW and other luxury brands. Tesla no longer can claim the EV market, particularly the luxury EV market, for itself.

Then there’s the conflict that Twitter might generate for Musk — that is, Tesla — with the government of China.

To some extent, Beijing holds the future of Tesla in its hands, and it doesn’t much care for Twitter. The platform is already banned in China, and anything that happens on Twitter outside Beijing’s control — but within what it thinks is Musk’s control, might end up in retaliatory steps against the carmaker.

Shareholders might also be concerned that Tesla stock’s day of reckoning is upon them. The company’s market value of about $900 billion (at the current stock price) is roughly equivalent to those of the next 10 most valuable car companies combined, even though its vehicle output — 930,000 in 2021 and 305,400 in the first quarter of this year — amounts to only a bit more than 1% of global market share.

In other words, Tesla has been grossly overvalued for years by any traditional stock market metric. Companies can remain in that condition indefinitely, but more often than not, gravity has proved to be a harsh mistress to highfliers, and the trigger for a drastic revaluation can come from anywhere.

Just as Tesla shareholders have been displaying disquiet about the deal, Twitter shareholders have been displaying skepticism. Twitter stock has not converged decisively toward the $54.20 sale price since the announcement, nestled below $50 for much of the week.

That’s a sizable gap from the offer price for a deal that doesn’t face any significant pushback from antitrust regulators, or indeed any noticeable obstacles other than Musk’s predilections and the solidity of the financing.

Musk has been explicit about some of what he would do with Twitter once he takes over. He says he would strengthen Twitter’s role as platform for “free speech,” calling himself a “free speech absolutist.” But he may not have a very clear understanding about how that principle is defined.

Elon Musk thinks tax policy is a game. He should be made to pay.

“By ‘free speech’, I simply mean that which matches the law,” he tweeted Tuesday, for instance. “I am against censorship that goes far beyond the law. If people want less free speech, they will ask government to pass laws to that effect. Therefore, going beyond the law is contrary to the will of the people.”

Except things are nowhere near that simple. Much of the discourse that has made Twitter resemble a toxic cesspool of hate speech, violence-mongering and disinformation isn’t illegal in the United States, but noxious enough to undermine the platform’s utility to millions of potential users. Twitter has suspended or permanently banned users who violate its established standards of civility — even though their speech isn’t illegal. Restoring those accounts might drive many users away.

Musk needs to learn that not everybody lives on his street. The European Union has taken a more aggressive stand against public hate speech than the U.S. EU officials already have warned Musk that their rules will have to govern Twitter in Europe.

“We are open but on our conditions,” Thierry Breton, the EU’s commissioner for the internal market, warned this week. “At least we know what to tell him: ‘Elon, there are rules. You are welcome but these are our rules. It’s not your rules which will apply here.’”

Musk himself has been a purveyor of damaging misinformation and disinformation on Twitter — promoting the useless anti-COVID nostrum hydroxychloroquine as well as economically dubious cryptocurrencies, for example. Once he becomes Twitter’s sole proprietor, its flaws will be his flaws; if he continues to use it to promote factitious narratives, he will be responsible for its debasement as a “public square.”

The apparent success of his takeover bid has not seemed to get that message across to Musk. Start with his denigrating tweets about Twitter and its representatives.

On Tuesday, Musk replied to a tweet by conservative journalist Saagar Enjeti attacking Twitter executive Vijaya Gadde.

Gadde, the Twitter lawyer in charge of content moderation, was associated with Twitter’s blocking of tweets about Hunter Biden’s laptop computer and references to a New York Post article about the laptop. Musk called that blocking “obviously incredibly inappropriate.” The exchange reportedly prompted a surge of tweeted attacks on Gadde.

Soon after that, Musk replied approvingly to an attack by right-wing conspiracy-monger Mike Cernovich on Twitter lawyer Jim Baker, whom he accused of having “facilitated fraud.” Musk tweeted in reply, “Sounds pretty bad...”

On Tuesday, Musk tweeted out a report that Truth Social, the Twitter-like service launched by former President Trump to offer a social media platform to conservatives like himself, was beating Twitter in Apple Store downloads. Musk added: “Truth Social ... exists because Twitter censored free speech.” Your mileage may vary, but that sounds like disparagement to me.

Nor has Musk kept his Twitter logorrhea in check in other respects. On Wednesday, he joked, “Next I’m buying Coca-Cola to put the cocaine back in.” All in fun, obviously (the last vestiges of cocaine came out of the soft drink in 1929), but Musk may have to decide whether he wants to play with Twitter as though it’s just another device for him to get his infantile jollies, or set down real-world rules that would make it a more useful tool for public discourse, as he says he intends.

Which way will he go? At $44 billion, Twitter is an extremely expensive plaything. The service does not turn a profit, but it will have to do so to cover the debt that it will be saddled with by Musk — an estimated $1 billion a year in debt service.

According to Twitter co-founder and former CEO Jack Dorsey, Musk’s goal is to turn Twitter into a service that is “maximally trusted and broadly inclusive.” It’s not at all clear that those goals can be reconciled, or that Musk really wants to devote much of his free time or spend the money to reach that nirvana.

It’s possible that a $1-billion breakup is his preferred out. But we may not know for months.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.