Intel will build Ohio computer chip factories amid global shortage

Intel will invest $20 billion in a new computer chip facility in Ohio amid a global shortage of microprocessors used in a wide variety of products, including phones, cars and video games.

After years of heavy reliance on Asia for the production of computer chips, vulnerability to shortages of the crucial components was exposed in the U.S. and Europe as they began to emerge economically from the pandemic.

The U.S. share of the worldwide chip manufacturing market has declined from 37% in 1990 to 12% today, according to the Semiconductor Industry Assn.

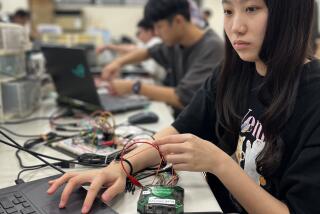

Two chip factories on the 1,000-acre site in Licking County, just east of Columbus, are expected to create 3,000 company jobs and 7,000 construction jobs, and to support tens of thousands of additional jobs for suppliers and partners, the company and local and state officials announced Friday.

Construction is expected to begin this year, with production coming online at the end of 2025.

Shortages of chips have crimped the ability of U.S. automakers to produce vehicles. Last year, General Motors was unseated by Toyota as the nation’s top-selling automaker for the first time.

A unique set of circumstances brought on by the pandemic has roiled the used car market, leading to an inventory shortage that has sent prices soaring.

The U.S. and Europe are pushing to aggressively build chip manufacturing capacity and reduce reliance on producers that are now mostly based in Asia.

Most big semiconductor companies are dependent on chips produced in Asia, particularly in Taiwan. Taiwan leads the world in chip production, accounting for 22% of global manufacturing capacity, followed by South Korea with 21% and Japan and mainland China each with 15%, according to the semiconductor association.

Several chipmakers last year signaled an interest in expanding their American operations if the U.S. government is able to make it easier to build chip plants.

Chipmakers are diversifying their manufacturing sites in response to the shortages. Samsung said in November that it planned to build a $17-billion factory outside Austin, Texas.

Micron Technology, based in Boise, Idaho, said it would invest $150 billion globally over the next decade in developing its line of memory chips, with a potential U.S. manufacturing expansion if tax credits can help make up for the higher costs of American manufacturing.

Demand for computer chips continues to grow.

Lawmakers have been urging House and Senate leaders to fully fund a law meant to address the semiconductor shortage. They want Congress to fully fund the $52-billion CHIPS for America Act, allowing for stateside investment in semiconductor factories. Not only has the chip shortage disrupted the U.S. economy, it is creating a vulnerability in the country’s defense system because 8 of every 10 chips are produced in Asia, lawmakers say.

Separate federal legislation also under consideration would create a new tax credit for investment in semiconductor manufacturing facilities.

Shortages during the pandemic highlighted the need for more manufacturing capacity in the U.S and for becoming less reliant on Asia, said Glenn O’Donnell, an analyst at Forrester Research.

“Your two biggest producers are Taiwan and South Korea and both are vulnerable spots on the world stage,” he said.

U.S. Commerce Secretary Gina Raimondo applauded the announcement.

“Intel’s work is essential to our efforts to rebuild America’s chip building capacity and create the kinds of good-paying jobs that support a vibrant American economy,” she said.

The Intel project is the largest single private-sector investment in Ohio’s history, on par with an agreement in 1977 that brought Honda to central Ohio, where it now employs more than 14,000 people. The Intel jobs are expected to pay an average of $135,000 a year plus benefits, with the project slated to add $2.8 billion to the state’s annual gross product, Ohio Gov. Mike DeWine said in a statement.

“Intel’s new facilities will be transformative for our state, creating thousands of good-paying jobs in Ohio manufacturing strategically vital semiconductors,” DeWine said.

Intel, based in Santa Clara, announced plans last year to spend $20 billion for two new factories in Arizona. It’s also pitching for European subsidies to build a big plant somewhere within the European Union and last month said it would invest $7.1 billion to expand its decades-old manufacturing operation in Malaysia, home to roughly 10% of the company’s global workforce. Along with the U.S. and Malaysia, Intel also has plants in Ireland, Israel, Vietnam and China.

Intel is the No. 2 semiconductor manufacturer globally, with $73.1 billion in revenue last year, behind South Korea-based Samsung Electronics with $76 billon, according to market analysis from Gartner Inc.

Central Ohio, long known for a largely white-collar workforce in banking and insurance, has added high-tech jobs in recent years, with Amazon, Facebook and Google all building data centers in the region.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.