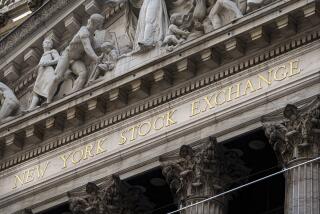

Stocks rise broadly on Wall Street, travel companies rebound

Stocks rose broadly on Wall Street on Monday, nearly reversing the Standard & Poor’s 500’s losses from last week, when jitters over a new coronavirus variant roiled markets.

The benchmark index rose 1.2%. More than 85% of stocks in the index gained ground, with technology companies and banks accounting for a large slice of the gains. The rally also included airlines, cruise lines and other travel-related companies that stand to benefit from the economy staying clear of more pandemic-related restrictions.

The Dow Jones industrial average rose 1.9%, and the Nasdaq composite gained 0.9%. Small-company stocks outpaced the broader market, sending the Russell 2000 index 2% higher. Long-term bond yields rose, also making up a big portion of what they lost last week.

Wall Street was encouraged by comments from Dr. Anthony Fauci, the White House’s chief medical advisor, who said early indications suggested that the Omicron variant of the coronavirus may be less dangerous than the Delta variant. It will still take a few weeks to learn whether Omicron is more contagious, causes more severe illness or evades immunity.

Joe Sanberg and other anti-poverty activists say California’s current path to a $15 hourly minimum wage isn’t enough given rising living costs.

“The COVID concerns from last week maybe aren’t as pronounced, and some of the geopolitical tensions maybe are not quite as pronounced,” said Willie Delwiche, investment strategist at All Star Charts. “At least for a day, people feel better about it.”

The S&P 500 rose 53.24 points to 4,591.67. The Dow gained 646.95 points to 35,227.03. The Nasdaq rose 139.68 to 15,225.15. The Russell 2000 picked up 44.17 points, closing at 2,203.48.

Bond yields rose, which benefits banks. The yield on the 10-year Treasury rose to 1.44% from 1.33% late Friday. JPMorgan Chase rose 1.2%.

Delwiche said that the rise in the 10-year bond yield says more about investors’ confidence in the economy than the pickup in stocks.

“Seeing yields in the 10-year get back above 1.40% is the most encouraging development,” he said. “It’s hard to make an optimistic case of the U.S. economy if yields are moving lower.”

U.S. crude oil prices rose 4.9% and helped send energy stocks higher. Exxon Mobil rose 1.1%.

Airlines, cruise operators and a wide range of travel-related companies made solid gains. Norwegian Cruise Line vaulted 9.5% for the biggest gain in the S&P 500. Rivals Carnival and Royal Caribbean jumped 8.1% and 8.2%, respectively.

American Airlines climbed 7.9%, and United Airlines gained 8.3%. Expedia Group rose 6.7%. The travel industry has been under pressure over concerns about the latest coronavirus variant and the potential for it to crimp economic activity in the midst of the busy holiday season.

Shares in COVID-19 vaccine makers fell. Moderna slid 13.5% for the biggest decline among S&P 500 stocks. Pfizer dropped 5.1% and BioNTech slumped 18.7%.

The stock market is coming off a choppy week as investors gauged the threat from COVID-19 along with a mixed batch of job market data and lingering inflation concerns. The S&P 500 posted two straight weekly losses heading into this week. The benchmark index is up 22.3% for the year.

Investors are still reacting to the Federal Reserve’s plan to hasten the withdrawal of its support for the market and economy, said Michael Arone, chief investment strategist at State Street Global Advisors.

The central bank plans to speed up the pace at which it trims bond purchases, which have helped keep interest rates low. That has raised concerns that the Fed will raise its benchmark interest rates next year sooner than expected.

“What you’re seeing now is that is being priced into markets and that underlying shift in expectations is starting to play out in market leadership,” Arone said.

Banks and other sectors that benefit from higher interest rates are starting to lead the market higher, and industries that typically suffer from higher rates, such as technology stocks, are lagging, he said.

Investors will get more economic data this week that could help give them a clearer picture of the economy.

The Labor Department will release its job openings and labor turnover survey for October on Wednesday, along with its weekly unemployment benefits report Thursday. Wall Street will get another update on inflation when the Labor Department releases the consumer price index for November on Friday.

A mix of corporate news helped send several stocks higher. Del Taco Restaurants surged 66.1% on news it is being bought by Jack in the Box.

Department store operator Kohl’s rose 5.4% after activist investor Engine Capital pushed for a sale or spinoff.

BuzzFeed fell 11% in its market debut after the digital media company went public through a merger with a special purpose acquisition company.

BuzzFeed News employees walk out on Thursday to push for higher wages as they continue to negotiate a contract.

The price of bitcoin, which fell sharply Friday, steadied by late afternoon Monday, edging up 0.1% to $48,947, according to Coindesk.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.