Adelson’s Las Vegas Sands exploring $6-billion sale of Vegas casinos

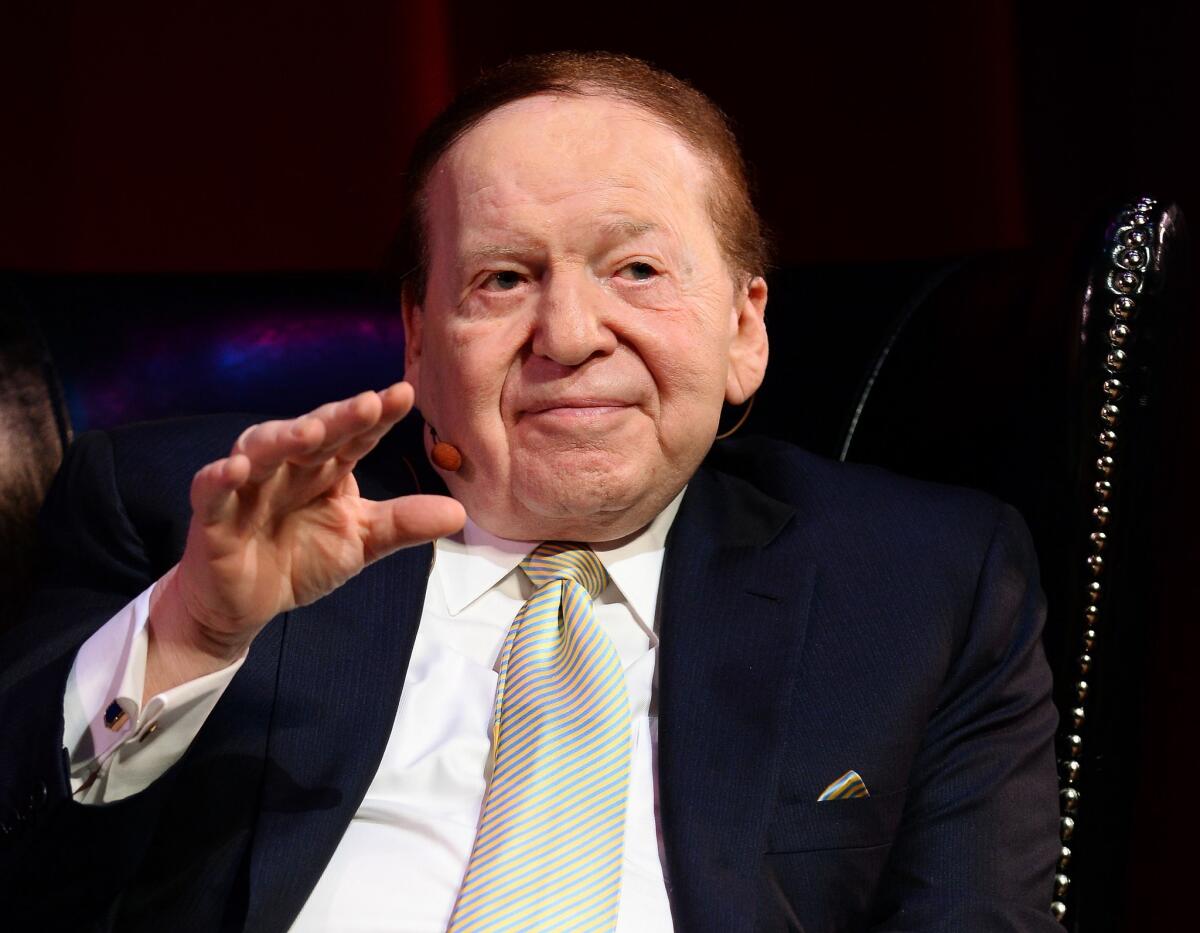

Sheldon Adelson’s Las Vegas Sands Corp. is exploring the sale of its casinos in Las Vegas, according to people with knowledge of the matter, a move that would mark the mogul’s exit, for now, from the U.S. gambling industry.

The world’s largest casino company, Sands is working with an advisor to solicit interest for the Venetian Resort Las Vegas, the Palazzo and the Sands Expo Convention Center, which together may fetch $6 billion or more, said the people, who asked to not be identified because the talks are private. The properties are all connected along the city’s famous strip.

A representative for Las Vegas Sands confirmed it was in very early discussions about a sale and that nothing has been finalized.

A sale would concentrate Sands’ casino portfolio entirely in Macao and Singapore, two larger casino markets for Adelson, who ranks as one of the world’s richest people, with a fortune estimated at $29.7 billion. The U.S. was already a small and shrinking part of his business, accounting for less than 15% of revenue last year.

The money could allow the company to fund other development opportunities. Sands dropped out of the competition to build a casino in Japan this year because of terms executives described as unfavorable. Adelson, 87, has expressed interest in building in New York City, an opportunity that could arise next year.

Sands shares rose as high as 12% in after-hours trading Monday after Bloomberg reported the news of the deal. The shares had closed down $1.55, or 3.1%, to $49.13.

With the global pandemic creating uncertainty in the Las Vegas convention business and an implied price for the properties of 12 times earnings before interest, taxes, depreciation and amortization, a deal could make sense, Ben Chaiken, a Credit Suisse analyst, wrote in a research note late Monday. He added the caveat that it’s not clear who would buy the casinos.

Adelson is chairman, chief executive and majority shareholder of Las Vegas Sands, which has a market value of $37.5 billion.

Casinos in Macao, the world’s biggest gambling market, generated 63% of the company’s $13.7 billion in revenue last year, before the pandemic struck. Covid-19 has devastated the casino industry, as it has other businesses where people gather in large numbers, such as movie theaters, concerts and restaurants. Singapore was second at 22%.

Sands is expanding in both regions, with Macau alone earmarked for $2.2 billion in spending.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.