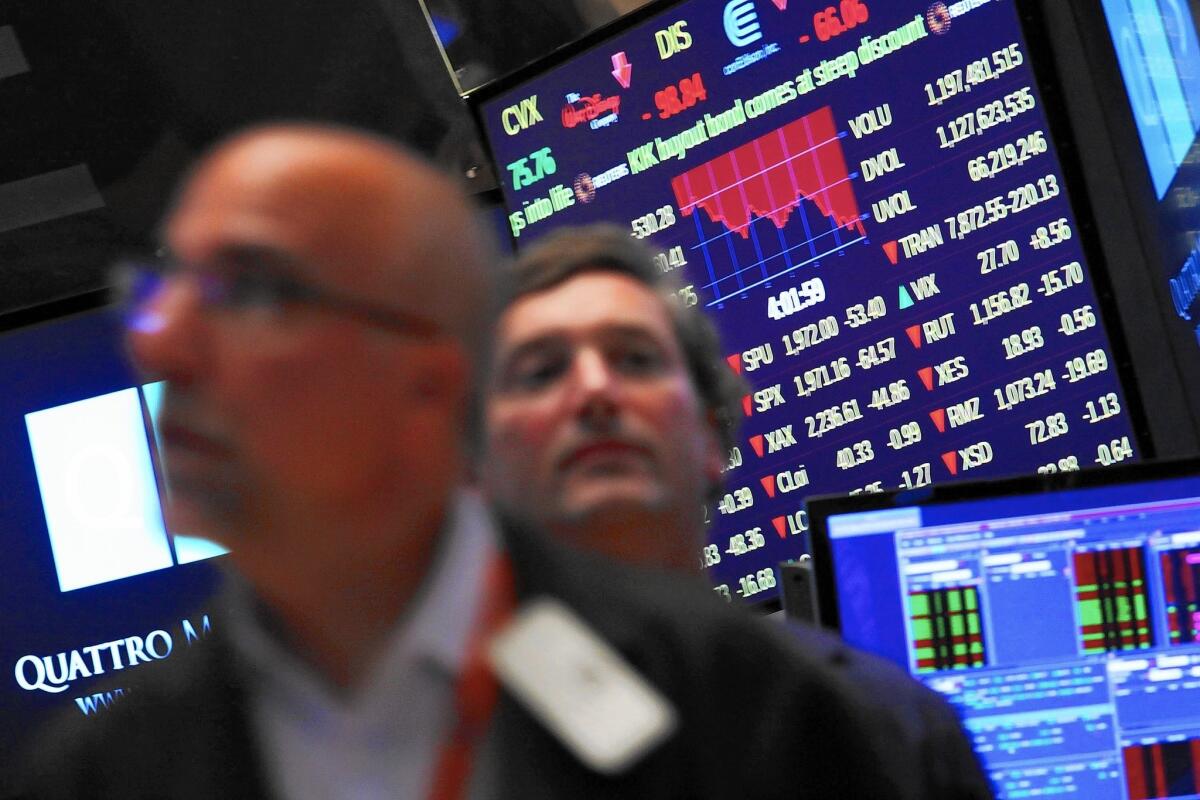

Retirement savers stayed calm while stock markets plunged

Americans saving for retirement weren’t panicking last quarter even as markets crashed and their 401(k) nest eggs shrank.

Only 5.6% of people enrolled in a 401(k) plan changed their portfolio allocations in the first three months of 2020, according to a Morningstar Inc. analysis of more than 635,000 participants.

Retirement savers’ lack of activity will be good news to experts who worry about individual investors selling at the worst possible time — by locking in losses after markets have already dropped.

“Assuming you’re in a risk-appropriate, well-diversified portfolio the best approach is probably to hang tight,” David Blanchett, head of retirement research at Morningstar Investment Management, wrote in the report. “There is a significant amount of research noting that 401(k) participants, and investors in general, are not very good at building their own portfolios or timing the stock market.”

Retirees have seen the value of their retirement funds badly eroded and are looking for ways to generate cash for living expenses.

At one point last month, the S&P 500 had plunged 31% year to date. Stocks have rebounded strongly since then, surging 24% from that March 23 low.

The median 401(k) lost 11.2% of its value during the first quarter, Morningstar data show. Many participants minimized losses by continuing to make retirement plan contributions during the period.

The savers most likely to tweak their 401(k) allocations were self-directed investors, with 10.8% making changes. By contrast, just 2.4% of investors in target-date funds touched their portfolios.

Other data have also shown that retail investors were not major sellers of stocks as the markets dropped in late February and March.

Research by Vanguard Group last month found that more than 9 in 10 investors didn’t trade in response to the market declines. For those Vanguard clients who did trade, 7 in 10 bought stocks.

Many 401(k) participants may simply have been trying to ignore the volatility for as long as possible. A study last month by Empower Retirement, which administers plans covering more than 9.4 million participants, found only 16% even logged in to check their balances over the 30 days starting Feb. 24.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.