Column: Boeing’s board shouldn’t escape blame in 737 Max scandal

This may have been overlooked, but the Boeing board of directors did Wells Fargo a big favor in 2019; it provided Wells’ directors with real competition in the race for the worst failure of leadership among major American corporate boards.

The failure came, of course, from an epic disaster: two crashes of Boeing’s 737 Max airliners, costing the lives of 346 passengers and crew members. The crashes have been attributed to slipshod engineering, irresponsible cost-cutting and sweetheart arrangements with government regulators — all aspects of management that fall within the board’s jurisdiction.

The most striking indication of the board’s dereliction of duty isn’t that the crashes and their underlying factors occurred in the first place, but that the directors didn’t leap into action after the first crash, in October 2018, or immediately after the second, in March. That suggests that the Boeing board didn’t view its responsibilities as extending beyond the company’s bottom line to its other stakeholders — including the airlines as its direct clients and the flying public as its ultimate customers.

This is the quintessential 1990s board. It’s CEOs and luminaries, but nobody with the kind of expertise you really need.

— Corporate governance expert Nell Minow

“The board took no action after the first crash,” observes the veteran corporate governance expert Nell Minow. “That’s unforgivable.”

In the same sense, the Wells Fargo board appeared to view the eruption of underhanded business practices in its retail banking divisions as disciplinary problems to be solved by management, rather than an offense against its own customers’ interests.

Even though in the American corporate paradigm the buck stops with the board of directors, it’s Chief Executive Dennis Muilenburg who has so far shouldered the blame. The board ousted Muilenburg on Dec. 23. He won’t go away empty-handed. In an American corporate tradition, the wages of his failure could come to more than $50 million in severance, deferred compensation, pension payouts and performance bonuses.

That’s about the size of the fund Boeing is planning to establish for families of the 346 victims in the two crashes. The company says it will spend another $50 million on “community programs and economic development in impacted communities.”

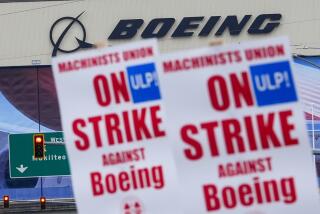

But the crisis is still unfolding. All 737 Max planes are grounded, pending an airworthiness green light from the Federal Aviation Administration that appears to be anything but imminent. Boeing is suspending the 737 Max assembly line in Renton, Wash., and hasn’t given its airline customers clear signals on when the aircraft will be able to fly again.

A few years ago, Washington state awarded the Boeing Co. the largest corporate tax break any state had given any corporation — a massive $8.7-billion handout aimed at encouraging the aerospace industry generally, and Boeing specifically, “to maintain and grow its workforce within the state.”

Relations with the FAA — the coziness of which may have contributed to the poor engineering decisions that produced a flawed aircraft — have become seriously frayed.

The company has estimated that the fiasco could cost it nearly $10 billion, not including sales lost to its lone major competitor, Airbus. It’s not likely to destroy the company, but Boeing will be hobbled by the 737 Max affair for years to come. Yet the board that oversaw this calamity is not being held to task.

Muilenburg will be replaced as CEO by board member David Calhoun, an executive at the private equity firm Blackstone Group who first joined the board in 2009. Calhoun became Boeing’s non-executive chairman in October when the board separated the chairman and CEO jobs; he’ll be succeeded as chairman by Lawrence Kellner, former chairman and CEO of Continental Airlines, who has been a board member since 2011.

The shortcomings of Boeing’s board may have set a standard in 2019, but they’re not unique. Business setbacks generally bring the flaws in a corporation’s governance into the open the way a receding tide exposes underwater wrecks to the open air, and the last year offered numerous examples.

Tesla’s legal issues with the Securities and Exchange Commission over the behavior of Chairman and CEO Elon Musk resulted partially from the inability of the board — which includes Musk cronies and his brother — to rein him in. The hotly anticipated initial public offering of office-rental firm We (formerly WeWork) was canceled after it became clear that its board, in thrall to its founder Adam Neumann, had countenanced conflicts of interest by Neumann on an absurd scale.

Nothing about WeWork looks normal, and Wall Street may finally be waking up

Despite repeated cases of corporate directors’ delinquency in overseeing their companies, boards are almost never swept clean when problems emerge. Wells Fargo CEO John Stumpf retired in 2016 as evidence of the bank’s allegedly fraudulent treatment of depositors and borrowers proliferated, but five directors whose tenures date back to the period when the allegations of fraud were in full cry remain on the 12-member board.

One reason that boards often get a pass when problems emerge may be that it’s hard to pin down their role and duties. The answer varies from company to company. But one responsibility surely is to set goals and incentives that serve a company’s long-term interests.

That points to what may have been the Boeing board’s principal failure. It dates back to 2011, when the company decided to tweak the design of its existing 737 narrow-body airliner to compete with Airbus rather than design a new aircraft from the ground up.

Former CEO James McNerney, who made that decision, was under explicit pressure from the board to reduce economic risk and bolster profit. The course he chose limited the cost of the new plane and sped up its development. But it introduced operational issues that the designers addressed chiefly through software, including an automated stability program now largely blamed for the crashes.

In other words, the Boeing board set policies and created incentives for top management that led to disaster. Of the Boeing board’s 13 current members, at least seven were in place when those decisions were made in 2011.

The Boeing board bristles with corporate CEOs, financial executives and celebrities (Caroline Kennedy and former United Nations Ambassador and South Carolina Gov. Nikki Haley), with some former government officials and a business school professor thrown in.

Like directors of other major American corporations, they’re exceptionally well paid. The average compensation of the 12 outside board members named in the company’s latest proxy statement was $345,480 in 2018. The list doesn’t include former Adm. John M. Richardson or Haley, who joined in 2019.

“This is the quintessential 1990s board,” says corporate governance expert Nell Minow. The board’s surfeit of directors from the finance side of business, she says, arguably leaves it without enough members who could “evaluate more than balance-sheet metrics.”

Wells Fargo Chairman and Chief Executive John Stumpf fulfilled the prediction of a growing volume of tea leaves Wednesday by announcing his immediate resignation from the bank company.

Eight of the 13 Boeing board members hold multiple directorships; two serve on four boards each. That raises the question of how much attention they can devote to any of their companies, especially when crises erupt.

It may also foster a groupthink that interferes with objective evaluation of top executives by directors. Three current or former Boeing directors have served together on the board of Caterpillar — Calhoun, former U.S. Trade Representative Susan Schwab and Muilenburg. As it happens, Caterpillar is listed by the board’s compensation committee as one of Boeing’s “peer companies,” against which its executive compensation is judged. (Calhoun also has served on the Boeing board’s compensation committee.)

A similar situation existed in 2011, when McNerney and two members of the board’s compensation committee — Calhoun and Mike Zafirovski — all were former General Electric executives. GE was then a peer group for judging compensation.

Boeing’s “corporate governance principles” state that no director should hold more than four board seats, but that’s an indulgent standard. One would think that corporate directors serving on four boards would barely have free time for quiet contemplation, much less the energy to deal with emergencies.

“If things are going badly at a company — and it’s fair to say that things are going badly at Boeing — being a director is a more than full-time job,” Minow says.

In an emailed statement, Boeing says its directors “gain valuable insight and experience through outside boards, which enhance their ability to contribute strong oversight and diverse perspective in the Boeing boardroom.” But it’s proper to ask whether these ostensibly valuable insights are worth the dilution of attention.

Consider the demands on the bandwidth of Boeing director Edward Liddy, a former chairman and chief executive at Allstate who also serves on the boards of 3M and the pharmaceutical firms Abbott Laboratories and AbbVie. Liddy receives a total of nearly $1.3 million from those posts, or an average of more than $320,000 each, according to the latest corporate disclosures.

Every now and then, decision-makers in government or business have to confront a dilemma with two contradictory qualities: It’s imperative, and impossible.

One gets the impression that Liddy’s appointment to the Boeing board in 2010 had a somewhat pro-forma quality. The company says he’s on the board because his career experience “enables him to provide the Board with valuable insights on corporate strategy, risk management, corporate governance, and many other issues facing large, global enterprises.”

That would be more impressive if virtually the exact same language explaining his unique contributions didn’t appear in the proxy statements of 3M, Abbott and AbbVie. Did the prose come from Liddy himself, or out of the boilerplate manual for board bios? (We were unable to reach Liddy for comment.)

We don’t mean to pick on Liddy, since he’s not alone in appearing stretched thin. Boeing director Schwab also serves on the boards of Caterpillar, FedEx and Marriott International and holds down posts as an advisor to the law firm Mayer Brown and a professor at the University of Maryland. (Schwab didn’t respond to messages sent via the law firm and the university.)

787 Dreamliner teaches Boeing costly lesson on outsourcing

Among the other Boeing board members are Kennedy, identified in company disclosures as the former U.S. ambassador to Japan and not as the daughter of President Kennedy, and Haley, who as governor of South Carolina presumably endeared herself to the company by helping it fight a unionization drive at its South Carolina plant in 2015.

Boeing might argue that Haley brings some expertise in government relations and Kennedy’s contacts in Japan are valuable, considering that Japan is home to major customers and suppliers. But the board’s near-catatonic response to the crashes suggests that what the company needed was not directors who could lobby governments here and abroad, but members who would push for an aggressive response to a corporate crisis.

That doesn’t mean it’s easy to point to any individuals who should be on the Boeing board in place of today’s directors, or even pinpoint the skill sets that would stand the company in good stead in a rapidly evolving technological environment or in an elemental crisis. The Boeing board isn’t devoid of appropriate skills — some of its members have experience in complex engineering and product safety.

But “given the relatively technical nature of the Max’s problems, the absence of directors with more technical aerospace engineering experience could be a concern, particularly now that Muilenburg is gone,” observed Ric Marshall, a governance expert at MSCI, a firm that provides research tools for investors. (Muilenburg was an aeronautics engineer.)

“Investors like to see boards in crisis be more proactive and decisive, and that’s not what we’ve seen from this board so far,” Marshall said.

The first crash, of an Indonesian Lion Air jet in October 2018, should have alerted the board to the necessity of proactive oversight of potential issues with the 737 Max aircraft. But there are no indications that the board took such an aggressive approach. A month after the crash, the company called the 737 Max “as safe as any airplane that has ever flown the skies.”

In April, weeks after the Ethiopian crash, then-Chairman and CEO Muilenburg created a board committee to examine aircraft production issues. But the board didn’t create an aerospace safety committee to oversee “the safe design, development, manufacture, production, operations, maintenance, and delivery of ... aerospace products and services” until Aug. 26. That’s tantamount to deploying an aircraft’s landing gear after it already has belly-flopped onto a runway.

The board now has arranged to include “safety-related experience as one of the criteria it will consider in choosing future directors,” the company has said. As with other recent initiatives aimed at placing safety front and center in its design and production — or at least giving the impression that it does so — this also prompts the question: Why only now?

As my colleague Samantha Masunaga has reported, records and correspondence only now reaching the public, some thanks to the efforts of whistleblowers, indicate that concerns about 737 Max engineering had been percolating through the company’s technical staff for years before the Lion Air crash. Whether any of these concerns bubbled up to the board is unknown, but what’s certain is that even if they did, the board took no action.

It’s a safe bet that most of the Boeing directors currently in place will still be holding on to their seats with what George Orwell called “prehensile bottoms” for years to come — the company says no directors have announced imminent retirements, although shareholders do have the option of voting against them at the next annual meeting.

But if Boeing is serious about upgrading the safety consciousness on its board, showing the world that it will have a different focus in the future, shouldn’t almost all of the holdovers voluntarily get out of the way?

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.