Gap CEO was done in by fashion missteps and fading brands

No longer the khaki king of the 1990s, Gap Inc. has needed an overhaul for a very long time — and Art Peck won’t be the one to deliver it after all.

Gap fired its chief executive late Thursday after his turnaround efforts failed to reignite sales growth. The apparel company, which includes the namesake Gap brand, Athleta, Banana Republic and Old Navy, brought back a member of the founding family to lead while it figures out a longer-term plan.

The stock fell 7.6% on Friday. Through Thursday’s close, before Gap announced Peck’s ouster and disappointing third-quarter performance, it had dropped about 30% for the year so far.

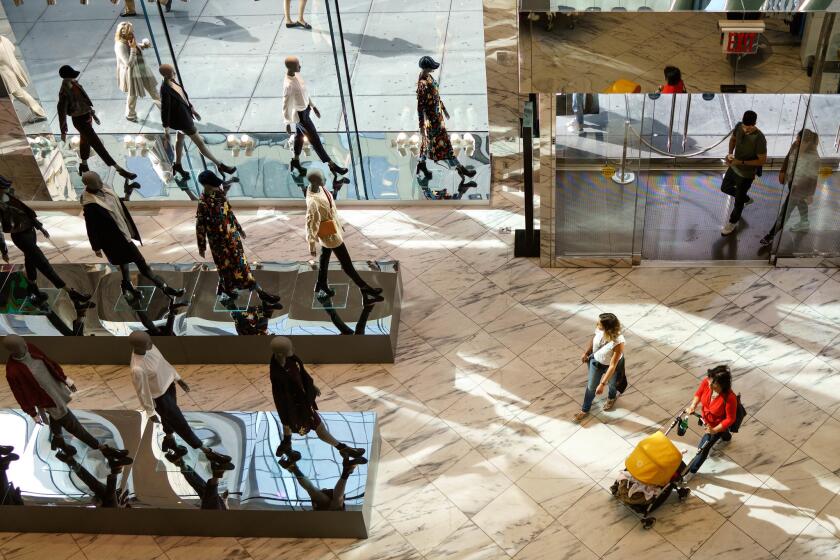

Peck’s termination comes after years of struggles at the company. Although the retailer made several public missteps in recent years — such as making blazers with armholes too small for an average woman and jumping on the regrettable “normcore” bandwagon — many of its problem areas aren’t even unique in today’s difficult retail environment: relying on routine 50% discounts and maintaining a major presence in declining American malls.

“It was probably the most overdue management change that we’ve seen in a while,” said Stacey Widlitz, president of SW Retail Advisors. “There comes a point ... when you can’t sit and do the same thing over and over again.”

The clothing industry is responsible for about 10% of global greenhouse gas emissions and consumes more energy than aviation and shipping combined, the U.N. says.

After a brief transition, Peck will exit the president and CEO role and vacate his post on the retailer’s board. Robert Fisher, the company’s current nonexecutive chairman and son of Gap co-founders Don and Doris, will step in as president and CEO on an interim basis.

Sales slump

Peck will be eligible for severance pay based on his termination without cause, the company said in a filing. He’ll get $2.33 million in severance and a payout of stock awards worth several million dollars, filings show. He’ll also be entitled to health benefits and financial counseling for 18 months.

Years of struggles

Gap, founded in 1969 in San Francisco, rose to prominence as a denim emporium selling jeans from Levi Strauss & Co., another Bay Area institution. It helped pioneer the vertical integration of retail and started producing its own branded goods. By the 1990s, it had transformed into a fashion juggernaut as it jumped on the khaki-pants trend and built up robust secondary brands in Banana Republic and Old Navy.

But struggles started brewing in the middle of the next decade, from declining mall traffic to operational issues. One of the most famous missteps came in 2010, when the company unveiled a new Gap logo. Some shoppers complained, so it ditched the new logo just a week later.

To try to turn things around, it turned to new CEO Glenn Murphy in 2007, who came from a drugstore chain. He closed a slew of U.S. stores, expanded overseas and invested in the supply chain. But the recession hit shortly after and thwarted momentum by turning a generation of shoppers onto discounters. Low-priced fast-fashion chains such as Zara and Forever 21 captured the attention of millennials, pushing Gap further out of favor. After a decade at the company in various roles, Peck replaced Murphy in early 2015 as part of a succession plan.

Peck, a former consultant, tried shaking up leadership and experimenting. But sales kept falling and the business declined to the point that the company decided to spin off Old Navy, its best-performing division and the motor for the company’s sales in recent years. The company didn’t even attach an official name to its new venture when it announced the separation in February, instead referring to it as NewCo.

Old Navy, which had anchored its parent company for years, was given to Sonia Syngal to shepherd. Peck was left saddled with Banana Republic, mired in a sales slump, and the aging namesake Gap brand. He tried to position the Athleta chain — a Lululemon competitor — as the bright spot within the portfolio he would run, but that hasn’t been enough to turn things around.

The company needs to find a way to sell more goods at full price and figure out a way to capture a new, younger consumer base, Dana Telsey, CEO of Telsey Advisory Group, said on Bloomberg Television.

“If you don’t have the right product, you aren’t able to sell goods at full price,” Telsey said. “There’s work to be done on the core product.”

Old Navy spinoff

Gap said Friday that it’s moving forward with the planned spinoff of Old Navy after Peck’s firing caused investors to take a critical look at the proposed deal.

“The board continues to believe in the strategic rationale for the planned separation,” Gap said in an emailed statement. It said any “additional perspective” would be provided in its Nov. 21 earnings call.

The company, and Peck in particular, had pitched the move as a way to unlock value for investors. But now that Old Navy, which was once the undisputed shining star of the clothing giant, is declining along with the rest of the firm, analysts are wondering whether it’s still worthwhile.

“You gotta think this is going to be a hard sell” to investors, said David Swartz, an analyst for Morningstar Investment Service. “Maybe Old Navy has peaked? If it was clearly doing better than Gap and Banana [Republic], that makes a lot more sense.”

Old Navy sees potential in China. Years ago, management envisioned pushing the brand overseas, but those efforts flopped.

Holiday season

“Gap is a company that clearly needed a change. Peck wasn’t moving the needle, except moving it backwards,” said Craig Johnson, president of retail researcher firm Customer Growth Partners. “It’s still a company that has great brand equity, but its residual brand equity that needs to be updated.”

Still, although sales have been poor, the market didn’t see his departure coming — at least not this close to the crucial holiday shopping season. Peck was well established as the face of Gap. In September, he and Old Navy chief Syngal hosted an event for analysts about the planned spinoff and their vision for the companies’ future. Peck spoke at length about how Gap had to broaden its appeal, including with larger sizes and more diversity.

Despite the holidays being a make-or-break time in retail, Peck’s departure might actually be a good turning point for the company, SW Retail Advisors’ Widlitz said, adding that merchandise and products have already been decided for this season.

“It leaves the door open for ‘no matter how bad December is, let’s think about the future,’” she said.

Townsend and Holman write for Bloomberg.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.