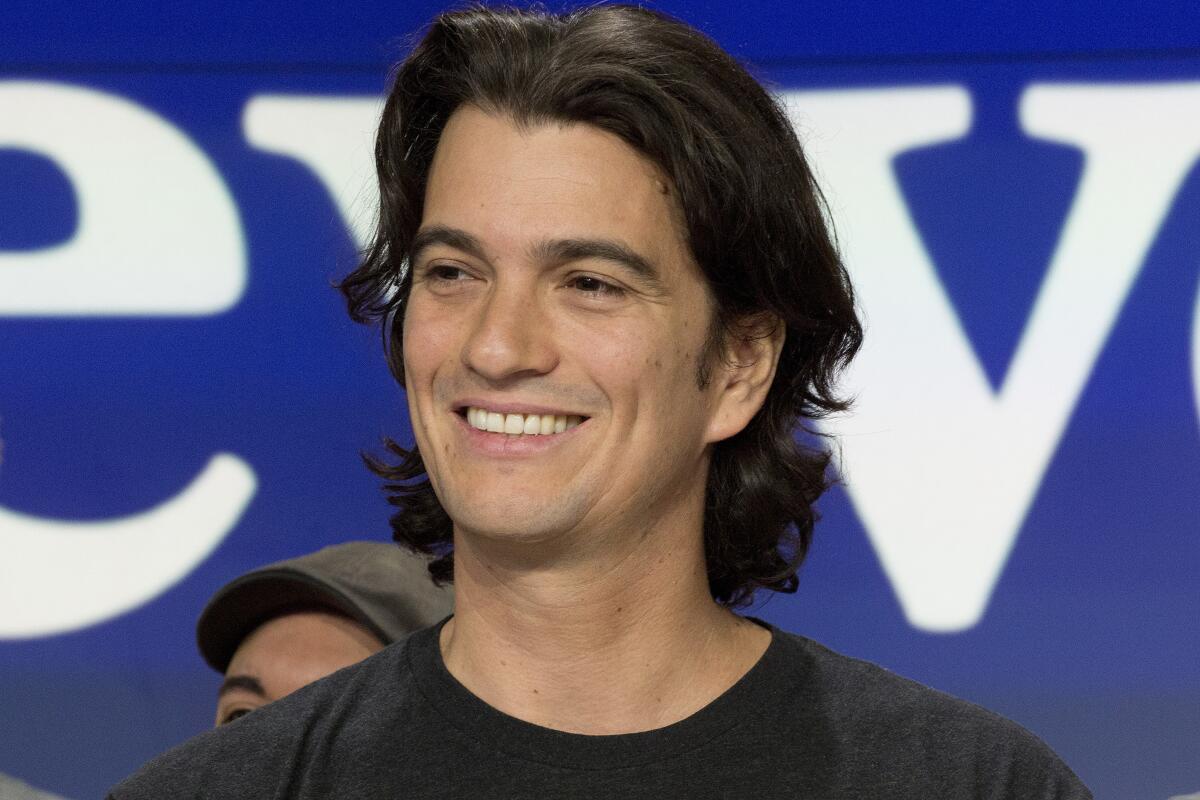

WeWork’s Adam Neumann resigns as CEO, hoping to salvage IPO

Adam Neumann, the charismatic entrepreneur who led WeWork to become one of the world’s most valuable start-ups, is stepping down as chief executive after a plan to take the office-sharing company public hit a wall.

Members of WeWork’s board had been pressuring Neumann in recent days to resign and take a new role as non-executive chairman. The move is designed to salvage an initial public offering that had been met with immediate scorn from public investors. A litany of apparent conflicts of interest and Neumann’s propensity to burn through capital were chief concerns.

“While our business has never been stronger, in recent weeks the scrutiny directed toward me has become a significant distraction,” Neumann said in a statement Tuesday. “I have decided that it is in the best interest of the company to step down as chief executive.”

Two senior WeWork executives, Sebastian Gunningham and Artie Minson, were appointed as co-CEOs. WeWork — whose official name is We Co. — intends to push ahead with the IPO, but some people briefed on the deliberations said it’s unlikely to take place next month as planned. The new CEOs said in a statement that they will be “evaluating the optimal timing for an IPO.”

WeWork is under a tight deadline to go public. It must do so by the end of the year in order to secure a $6-billion debt financing contingent on a successful stock offering. The company, which is deeply unprofitable, will need to find an alternative source of capital next year if the IPO falls through.

Gunningham and Minson “anticipate difficult decisions ahead” to protect the company’s “long-term interests and health,” they said in an email to staff reviewed by Bloomberg. WeWork’s high-yield bonds initially fell to their lowest level in more than four months, trading at 92.75 cents on the dollar, after Neumann’s decision to step aside.

As part of Neumann’s departure, he has agreed to further reduce his sway in board decisions, and his wife, Rebekah, will relinquish her role in the business, said the people, who asked not to be identified because the details were private. After an IPO, Neumann’s stock would carry three votes per share, down from 20 in the initial plan. Rebekah Neumann, who was listed on the IPO prospectus as a founder and CEO of the WeGrow education arm, will leave.

“When Miguel, Rebekah and I founded WeWork in 2010, we set out to create a world where people work to make a life and not just a living,” Adam Neumann said in an email to employees. “As we take this next step in our company’s journey, I am equally ready to listen, grow and continue working relentlessly on my commitment to all of you.”

Masayoshi Son — founder and CEO of Japanese conglomerate SoftBank Group Corp., which is WeWork’s biggest investor — was among those pushing for Neumann to resign, a person familiar with the matter has said.

The news comes after a whirlwind week of uncertainty for WeWork. Banks that provided a $500-million credit line to Neumann were looking to revise the terms as the company’s struggle to go public cast doubt on the value of his collateral, people briefed on the discussions said last week. It’s not clear what changes the banks could seek or what right they have to make demands.

On Friday, Wendy Silverstein, a big name in New York commercial real estate who joined WeWork last year as head of its property investment arm, left the company. She is spending time caring for her elderly parents.

The president of the Federal Reserve Bank of Boston also added to the angst. In a speech Friday in New York, Eric Rosengren warned that the proliferation of co-working spaces might pose new risks to financial stability.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.