Q&A: Can homeowner association board give tips and bonuses to vendors and employees?

Question: Last holiday season our board voted to hand out money to vendors, employees, management and anyone else they felt deserved a “tip” or “bonus.” Several owners in attendance at that board meeting objected, stating “association funds should not be given away in this manner.” The association’s accountant told the board that gifts and bonuses of association funds violate IRS Revenue Code 70-604. The board said they consulted with the association’s attorney, who assured the board that such tips and bonuses were fine because courts give deference to board decisions.

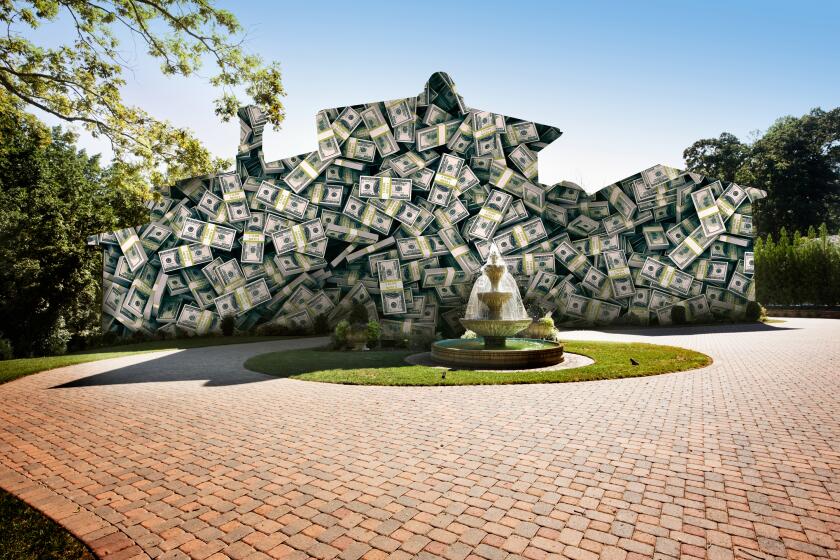

Many owners here have lost their jobs and others do not make enough money to pay their bills, let alone their monthly assessments. There have been bank foreclosures and the board has foreclosed on owners who couldn’t pay their association dues. Rather than give owners’ money away, shouldn’t it go back to titleholders who paid it? Is the association’s attorney right? Is it true that the board alone can make decisions to hand out bonuses of association funds to third parties?

Answer: While this question arises from a holiday season circumstance, it is an issue that has year-round implications for any bonus or tip giving. The association attorney is correct that courts tend to give deference to board decisions, but the same is not true of the IRS and adherence to the tax code. The simple irrefutable rule is: Follow the money. From where did the tips and bonus money originate? Paying monthly homeowner association payments is not a donative act; it is mandated by law, the failure of which results in foreclosure of one’s property. Titleholders pay that money to fund association operations.

The board’s so-called deference also is a “qualified” action predicated on using sound business judgment in matters directly related to the common interest development that it has been elected to oversee. Deference does not mean that a board’s actions are beyond reproach.

Unfortunately, some association attorneys rely on Finley vs. Superior Court, a 2000 case decided by the California Court of Appeal, and its progeny as blanket approval for all board decisions without titleholder vote. In Finley, the homeowner association used more than half a million dollars of homeowner-paid assessments to make contributions to a political action committee to support a local Orange County ballot measure. The association argued that the board was protected by the business judgment rule, California Corporations Code section 309. The titleholders unsuccessfully challenged those contributions as being beyond the legal authority of the board, illegal and in violation of their constitutional rights.

But there have been cases that have since limited how much deference can be given to board decisions.

In 2009, in Patrick vs. Alacer, the Court of Appeal sided with a shareholder who had made repeated demands for an investigation into allegations that directors had looted money, taken bloated salaries and participated in other misconduct. The board’s special litigation committee decided to invoke its “deference” in not pursuing an action, claiming its decision was protected by the business judgment rule. Justices didn’t agree and made it clear that directors must be “disinterested” and should have conducted an “adequate investigation.”

Then, in 2010, in Dover Village Assn. vs. Patrick Jennison, an association brought action against a unit owner, alleging that the owner was responsible for the costs of repairing a leaking sewer pipe underneath his unit. The association again cited “deference” to its decision to hold the unit owner responsible. But the Court of Appeal said there is “no provision in the [law] that makes the Association or its board the ultimate judge of legal issues affecting the development.” The “deference” test failed.

Generally, the “business judgment rule” can be rebutted by a factual showing of fraud, bad faith or gross overreaching. Given the dire consequences attached to the mandate for titleholders to pay assessments, homeowner association boards are not in a position to give any money away as tips and bonuses.

The Internal Revenue Service has addressed how to handle excess titleholder-generated assessments.

Revenue Ruling 70-604 and Private Letter Ruling 61.00-00 allows a board, after receiving approval by its titleholders through a vote, to defer income to the next year when its taxable income may be lower. The alternative to deferring income is to return excess income to the titleholders who paid it. But a board cannot give bonuses using mandated assessments for the purpose of absorbing what would have otherwise qualified as “excess” assessments.

The IRS and most tax professionals believe that the decision should be made by a vote of all titleholders, not just the board. If conditions during the next tax year are unfavorable, the association will end up having to pay taxes on income for both years.

Zachary Levine, a partner at Wolk & Levine, a business and intellectual property law firm, co-wrote this column. Vanitzian is an arbitrator and mediator. Send questions to Donie Vanitzian, JD, P.O. Box 10490, Marina del Rey, CA 90295 or [email protected]

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.