Two Democrats call for scrutiny of possible conflicts of interest in Trump team’s OneWest Bank inquiries

Reporting from Washington — Two House Democrats want Congress to look into possible conflicts of interest in the Trump administration’s handling of investigations into Pasadena’s OneWest Bank — a bank formerly headed by now-Treasury Secretary Steven T. Mnuchin.

Reps. Maxine Waters (D-Los Angeles) and Al Green (D-Texas) said Friday that there was “room for considerable doubt as to the impartiality and the adequacy of this administration’s investigations into OneWest” and a subsidiary, Financial Freedom.

Mnuchin was the bank’s chairman from 2009 to 2015. President Trump has nominated Joseph Otting, the former chief executive of OneWest, to be comptroller of the currency, a key bank regulator who is part of the Treasury Department.

And Brian Brooks, who was OneWest’s vice chairman, reportedly will be tapped to be deputy Treasury secretary.

Waters and Green wrote to House Financial Services Committee Chairman Jeb Hensarling (R-Texas) on Friday asking that the panel “examine the high potential for conflicts of interest with regard to the Trump administration’s settlement with, and any pending investigations into, OneWest Bank while under Treasury Secretary Steven Mnuchin’s leadership.”

“The American people must be able to have confidence that investigations conducted by this administration are thorough, transparent and objective, and that those who are responsible for violating the law are held accountable,” wrote the lawmakers, who are senior members of the committee.

Sarah Rozier, a spokeswoman for Hensarling, said that Waters has called for Trump’s impeachment and that she “would find her requests for investigations taken more seriously if she wasn’t so obvious in wanting to use them solely for political purposes.”

“We should allow these investigations to move forward,” Rozier said.

The Justice Department announced in May that Financial Freedom agreed to pay $89 million to settle allegations it defrauded the Federal Housing Administration regarding reverse mortgage insurance payments. Last fall, two California advocacy groups asked the Department of Housing and Urban Development to investigate allegations that OneWest discriminated against or failed to serve minority communities.

And OneWest’s owner, CIT Group, said in its 2016 annual report that Financial Freedom was under investigation by HUD’s inspector general’s office.

Waters and Green said that they were concerned that Mnuchin serves in Trump’s Cabinet and that two other former OneWest executives “are poised to take prominent positions in the Treasury Department,” but that the Trump administration “has not announced what steps it will take to assure the public that no special treatment will be provided for one of their own.”

The lawmakers said they wanted the committee to make sure the OneWest investigations “operate without White House interference.”

Spokespeople for Mnuchin and Otting did not immediately respond to requests for comment.

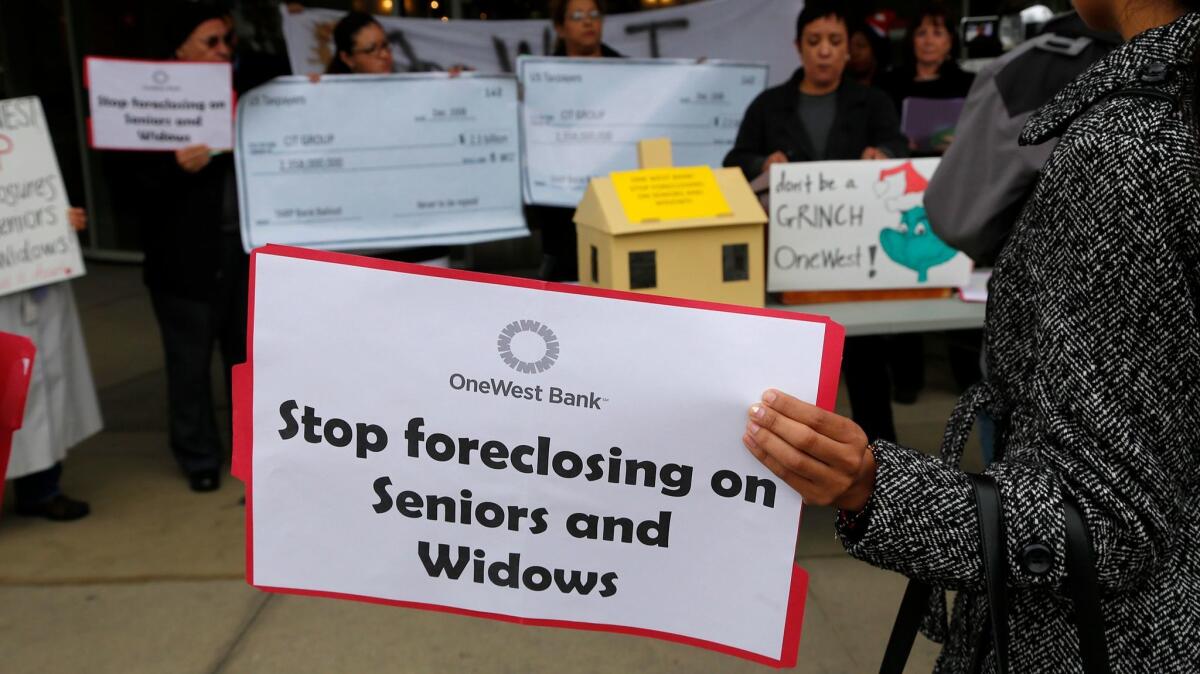

Democrats have criticized Mnuchin for OneWest’s foreclosure practices.

Mnuchin has said that OneWest tried to help homeowners avoid foreclosure, but had inherited “the worst mortgage portfolio in the history of time” from failed subprime giant IndyMac Bank.

Mnuchin and other investors put up nearly $1.6 billion to buy IndyMac in 2009 and renamed it OneWest. They sold the bank to CIT Group in 2015 for $3.4 billion.

Twitter: @JimPuzzanghera

UPDATES:

2:45 p.m.: This article was updated with comment from a spokeswoman for Hensarling and to indicate that a spokesman for Otting did not immediately respond to a request for comment.

This article was originally published at 1:50 p.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.