Douglas Emmett benefits from a narrow focus in real estate

Douglas Emmett Inc. has developed an extremely specific taste in properties: office and residential high-rises in Los Angeles and Honolulu.

At 15.1 million rentable square feet, its office space would cover 262 football fields. With nearly 2,900 apartment units, the real estate investment trust could house the roughly 3,700 year-round residents of the Santa Catalina Island burg of Avalon, assuming some doubling up.

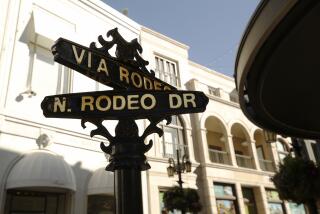

“We’ve always taken the position that real estate is a very local business,” Chief Executive Jordan L. Kaplan said. And the localities that Douglas Emmett is particularly interested in are the San Fernando Valley and L.A.’s Westside.

“Los Angeles is the No. 1 entertainment capital, the No. 1 manufacturing capital and the No. 1 international trade capital in the U.S. How can you beat that?” Kaplan said. “Going forward, the fundamentals of Los Angeles are going to be outstanding.”

Office space dominates his company’s focus, accounting for about 85% of its holdings. Its properties include 100 Wilshire in Santa Monica, the Warner Center Towers, Sherman Oaks Galleria and 1901 Avenue of the Stars.

Among its residential properties are the Shores oceanfront community in Santa Monica and 555 Barrington in Brentwood.

Throughout much of its history, the company has followed a strict philosophy, Kaplan said: Select prime properties in densely developed areas where there isn’t a lot of room for new construction or, in effect, new competition; pick areas in locations that offer a broad array of businesses and industries, so that a loss of jobs in any one sector won’t mean a huge loss of tenants.

Douglas Emmett tries to buy as many properties in those areas as possible in order to improve the company’s ability to control rent pricing. The company averages about a 25% share of the office space in the regions in which it operates, Kaplan said.

The company was co-founded in 1971 by Dan A. Emmett and Jon A. Douglas. Each put up $7,500 to start developing apartment houses on the Westside.

To build up cash, Douglas started a separate residential real estate brokerage called the Jon Douglas Co. By the time the partners sold it to Coldwell Banker in 1997, it had become known as one of Los Angeles’ preeminent luxury residential real estate firms.

Douglas Emmett went public in October 2006, selling 66 million shares at $21 apiece on a day when the new stock closed at $23.65.

Douglas died in 2010, but Emmett, now 73, remains with the company as board chairman.

The latest

In May, Douglas Emmett reported first-quarter sales of $148.9 million, up from $145.5 million a year earlier. Net income was $15.5 million, up from $14.6 million.

Two multifamily residential development projects are in the works on properties the company already owns. One, in Honolulu, will break ground on 452 units later this year. The Los Angeles project isn’t expected to break ground until 2015.

Accomplishments

The company’s shares have been on a roll, closing at a new 52-week high of $29.22 on Thursday.

After running in the red in 2009 and 2010 and barely making a profit in 2011, Douglas Emmett nearly doubled its 2012 profit in 2013, with net income of $45.3 million. Executives attributed the improvement to fewer vacancies and higher rental rates because of the stronger economy.

Challenges

Douglas Emmett has to figure out where it might go next, which could be north to the very competitive San Francisco Bay Area or south to San Diego.

“Our challenge is to continue to grow our portfolio and continue our initial strategy,” Kaplan said, “which is to buy the best and most high-quality assets. It’s competitive and it’s tough. Every time you make a purchase, your back teeth chatter.”

Analysts

Of the 15 analysts that cover the company, two strongly suggest buying the stock. Two others consider it a buy. Nine analysts suggest holding onto the stock. Two say it will underperform.

James Feldman, a research analyst at Bank of America, said in an investors note that it is maintaining a buy rating despite a small decline in office portfolio leases. Feldman said it was justified because of Douglas Emmett’s “depth of experience and operating strength in its core markets.”

Twitter: @RonDWhite

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.