SeaWorld hopes to reverse sagging fortunes by building own San Diego hotel

For years after Walt Disney opened his Anaheim park, he was dogged by a single regret: Short on cash, he wasn’t able to buy land to fend off a flood of budget motels that siphoned revenues and cheapened his beloved Disneyland.

It was a painful lesson. A decade later, his company wisely purchased more than 20,000 acres of Florida land for its Disney World theme park, now home to 26,000 hotel rooms, catapulting it to one of the world’s 40 largest hotel companies.

As SeaWorld Entertainment Inc. embarks on a venture unveiled last week to develop a branded hotel in San Diego, it will be following a path blazed by theme park industry behemoths Disney and Universal Studios.

SeaWorld may not have the real estate hoard of its rivals, but it has identified enough land within at least four of its 11 parks to cash in on what industry experts say is a time-tested — and lucrative — pursuit: Build a hotel at your amusement park and tourists will spend piles of cash on high-priced rooms, multiple visits to the park, meals and souvenirs.

And the perks for guests are equally enticing: early entry into the parks before the masses arrive, front-of-the-line passes and delivery of park purchases to your hotel room.

“Hotels attached to theme parks generally do very well and you’ll find there’s a premium guests will pay for the perks,” said Martin Lewison, a theme park consultant and assistant business professor at Farmingdale State College in New York.

SeaWorld has been saddled with sagging revenues and attendance since the 2013 release of the documentary “Blackfish,” which was critical of the parks’ treatment of killer whales. Protests by animal rights activists and negative publicity have dogged the company, which decried the film as inaccurate and unfair.

Company executives acknowledge that they will have to do a lot more than simply banish killer whale theatrics from SeaWorld’s Shamu show to win back disenchanted visitors.

Transforming SeaWorld Entertainment into a resort business with its own hotels is pretty much a no-brainer for Chief Executive Joel Manby, who called it a “very proven model.” Room rates can be as much as double that of a comparable property outside the theme park, he said during a presentation last week.

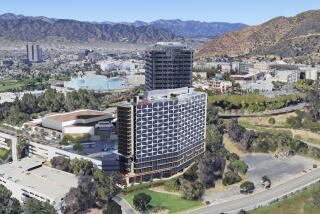

In San Diego, SeaWorld will partner with longtime hotel owner and operator Evans Hotels, which already has two Mission Bay resorts near the marine park. A hotel of up to 300 rooms has been included in SeaWorld San Diego’s master plan since the 1980s, but talk of a definitive partnership with Evans didn’t intensify until Manby joined the company in March, Evans President Robert Gleason said.

A hotel, which probably would be no taller than three stories and could cost $60 million to $80 million, is still years away from construction, assuming that it can pass muster with the city of San Diego and the California Coastal Commission.

Although there is no specific design yet, Gleason envisions engaging public spaces and grounds that tie into a SeaWorld aquatic theme. There might even be room for an interactive animal attraction, he said.

Evans’ participation doesn’t come without risks, despite a strongly rebounding lodging market that is fueling hotel development across the country.

But Gleason isn’t worried, conceding only a “calculated risk” for a firm whose ties with SeaWorld date to the park’s 1964 opening. The companies collaborate on marketing, and Evans’ Bahia hotel has SeaWorld-themed suites decorated with large murals featuring dolphins and mantas.

“We wouldn’t be moving forward if we weren’t long-term believers in the SeaWorld brand,” Gleason said. “We come down on the side of believing in their leadership team to successfully deliver what their current and future guests want.”

Leisure industry analyst Bob Boyd isn’t so sanguine. Just as SeaWorld draws protests, so too could a branded hotel, he said.

“With the growth of the Internet, which has made minority voices louder than they normally would be, there is a good percentage of the population that doesn’t like SeaWorld having orcas in captivity,” said Boyd of Newport Beach-based Pacific Asset Management. “And if they see SeaWorld on the hotel name, they won’t go there.”

Still, the financial reward of being linked to a theme park that continues to see millions of visitors pass through its turnstiles makes the alliance a smart move, said Scott Smith, a former hotel operator who teaches at the University of South Carolina’s School of Hotel, Restaurant and Tourism Management.

“They’re still losing customers but there is still a large percentage of people who will continue to patronize SeaWorld, and if you can become the preferred hotel of SeaWorld, man, you can’t pay for enough advertisement to get the kind of referrals SeaWorld will be able to send you,” Smith said.

Although it’s difficult to quantify the profits spun off by Disney’s and Universal’s theme park hotels, the companies’ continued building binge speaks for itself. During a recent earnings conference call, NBCUniversal Chief Executive Steve Burke, discussing the company’s theme park business, said that “ideally, you want to have as many hotels as you can while still being profitable in the hotel business.”

Toward that end, Universal Orlando will open its fifth hotel next year, bringing to 5,200 the number of on-site rooms at the Florida resort.

In its latest earnings report, Walt Disney Co. said occupancy at its hotels was a healthy 84%, with guests spending on average 7% more than the year before.

If SeaWorld and Evans Hotels are to be successful in their new venture, the park will still need to beef up its attractions and the hotel will have to come up with appealing nighttime entertainment, said Robert Niles, founder of ThemeParkInsider.com.

By the time the hotel opens, though, there’s little doubt it will thrive, he added.

“Then instead of having someone who’s a one-day visitor spending $90, now you have a two-day visitor spending a couple hundred bucks,” Niles said. “They tend to spend more time and more money in the park, regardless of what they’re spending at the hotel. There’s a reason why everyone else is doing it.”

Twitter: @loriweisberg

Weisberg writes for the San Diego Union-Tribune.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.