PG&E to file for bankruptcy as wildfire costs hit $30 billion. Its stock plunges 52%

PG&E Corp. said Monday it plans to seek bankruptcy protection because it faces potential liabilities of $30 billion or more from the deadly California wildfires, a move that halved its already battered stock price and prompted its chief executive to quit.

The filing also might set the stage for PG&E’s sale, though it’s also possible that California lawmakers could eventually attempt to help the company.

It would be the second time in 18 years that the San Francisco company’s utility, Pacific Gas & Electric, landed in Bankruptcy Court. The utility, but not the parent, filed in 2001 in the aftermath of an energy crisis that gripped the state in 2000-01.

PG&E said it “does not expect any impact” to the electric and natural-gas services delivered to the utility’s 16 million customers in Northern and Central California as a result of the latest Chapter 11 filing, which is planned for on or about Jan. 29 for both the parent corporation and its utility subsidiary.

But Gov. Gavin Newsom said at a news conference in Sacramento that he was forming a task force to evaluate what steps the state might take to help Californians amid the bankruptcy.

“The issue is about three fundamental things,” Newsom said. “It is about safety. It’s about reliability and it’s about affordability. This is a top priority for this administration.”

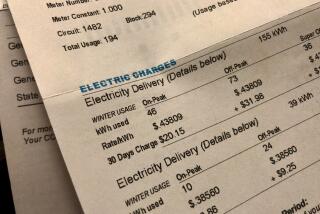

PG&E spokeswoman Lynsey Paulo said she was unsure whether the bankruptcy filing would prompt the utility to ask regulators to change customers’ electricity and gas rates. “This is a long process that we’re just announcing today, and I can’t speculate on what changes, if any, could result,” she said in an email.

In its prior bankruptcy case, PG&E spent three years reorganizing in the aftermath of the state’s energy crisis before it emerged from Chapter 11 in April 2004. With the help of $6.7 billion of newly issued debt, the utility distributed $10.2 billion to creditors, but the overhaul also saddled customers with added costs.

Under Chapter 11, a company’s debts are frozen — and it’s protected from creditors seizing assets — while the company works out a plan to compensate those creditors and otherwise overhaul its financial situation. Creditors often receive far less than 100 cents on the dollar.

In this case, those creditors would include people and businesses that were victims of the massive fires that have raged throughout California the last two years, including November’s Camp fire, the deadliest wildfire in state history, and the wine country fires in 2017.

PG&E said in the filing that it already faced about 50 lawsuits related to the Camp fire on behalf of at least 2,000 individual plaintiffs, and about 700 lawsuits on behalf of at least 3,600 plaintiffs in connection with the 2017 fires, five of which seek to be certified as class actions.

The company faces the liabilities because of allegations that its power lines and other equipment contributed to the fires, and that the utility allegedly failed to maintain and repair its distribution and transmission lines adequately to prevent or curb the disasters.

Even before Monday, PG&E’s stock had lost three-quarters of its value in the last 18 months as the severity of the company’s potential liabilities intensified. After PG&E’s bankruptcy announcement, its shares plunged an additional $9.21, or 52%, to $8.38 on Monday.

PG&E now has a total market value of only $4.2 billion. The company also had $1.5 billion in cash and equivalents as of Friday, a sum dwarfed by the potential liabilities it faces, according to a company filing with the Securities and Exchange Commission.

A Chapter 11 reorganization “is ultimately the only viable option to restore PG&E’s financial stability and make sure PG&E has sufficient liquidity to fund its ongoing operations and provide safe service to customers,” the company said in the filing.

PG&E, which has 23,000 employees, said it’s already in talks with potential lenders for $5.5 billion in so-called debtor-in-possession financing when it files for Chapter 11.

“We believe a court-supervised process under Chapter 11 will best enable PG&E to resolve its potential liabilities in an orderly, fair and expeditious fashion,” John R. Simon, PG&E Corp.’s interim chief executive, said in a statement.

Simon assumed the post over the weekend after former CEO Geisha Williams left the company as reports mounted that PG&E would again head to U.S. Bankruptcy Court.

PG&E and other California utilities already look to be in line for some state relief for fire-related expenses.

Senate Bill 901 empowers the California Public Utilities Commission to oversee new fire-related bond issues by the utilities, which would use the proceeds to cover any damages. The costs to pay off the bonds would be recouped from customers over decades.

The law noticeably omitted fires that began in 2018 from the new financing rules, focusing instead on deadly blazes in 2017 and any fires that happen in future years.

The law took effect Jan. 1, and the precise details of how those debt offerings will work remain unclear. At best, though, the law provides only partial relief to PG&E’s troubled finances, and now with the bankruptcy filing, any effort by state lawmakers to revisit the issue may be on hold.

“The landscape has shifted, quite frankly, from a legislative approach to one that’s in the courts,” said Assemblyman Chris Holden (D-Pasadena), who had intended to ask lawmakers to amend the new law so that 2018 fire costs could be securitized.

Holden, chairman of the Assembly Utilities and Energy Committee, said the Legislature must wait to see how the bankruptcy process plays out, though he may ask lawmakers to intervene and require any payment of debts owed during a court proceeding prioritize the claims of customers.

“Otherwise, the victims would be victimized once again,” he said.

PG&E’s reorganization will be too late for some major institutional investors that were hurt as a result of PG&E’s plummeting stock price. They include Vanguard Group, BlackRock Fund Advisors and T. Rowe Price Associates, which are among PG&E’s largest shareholders, according to FactSet.

“People often think utilities are safe investments, but this is such a crazy situation,” said Daniel Lowenthal, a partner at Patterson Belknap Webb & Tyler who heads the law firm’s business reorganization and creditors’ rights practice.

“Investors and claimants are going to potentially take a huge haircut on their investments due to a catastrophic situation no one foresaw,” he said.

PG&E’s looming bankruptcy has precedent, however, as other major companies also have sought bankruptcy relief from massive financial liabilities.

In 1982, for instance, building products maker Johns-Manville Corp. filed for bankruptcy because it was targeted for billions of dollars’ worth of claims for asbestos-related illnesses. Dow Corning Corp. filed in 1995 because it faced thousands of personal-injury lawsuits involving silicone-gel breast implants.

Todd Feinsmith, co-chair of the bankruptcy practice at the law firm Pepper Hamilton, said the fires’ victims probably would be unsecured creditors and thus in lower standing than secured creditors, such as banks, that have loans to PG&E that are secured, or backed by the utility’s collateral, and certain bondholders.

As a result, it’s possible that “a special fund would be set up with the goal of compensating the victims,” he said.

PG&E might well do that and otherwise reorganize on its own, but there’s also the possibility that an outside suitor will try to buy the utility. “It would not be surprising at all if the company is sold to a third party in the bankruptcy proceedings,” Feinsmith said.

One reason: Under bankruptcy law, a buyer often can buy the bankrupt company’s assets without having to assume its debts, he said.

If a sale happens, “there would be cash proceeds from the sale and those proceeds would become distributable to the creditors, including the fire victims,” Feinsmith said.

Times staff writers John Myers and Taryn Luna contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.