Q&A: Muhammad Yunus, father of microfinance, talks about L.A. loan program

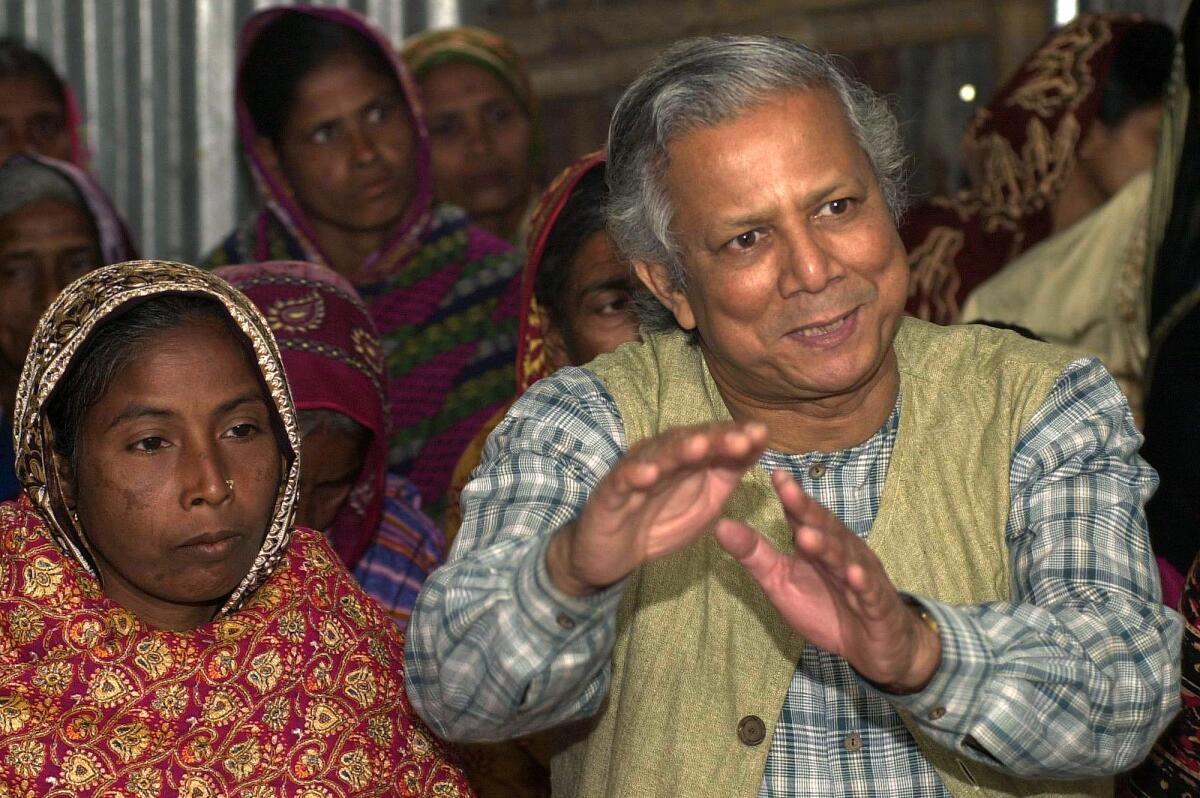

Muhammad Yunus, a 2006 Nobel Peace Prize laureate for pioneering the concept of small loans to impoverished entreprenuers, swung through Los Angeles over the weekend to mark the official launch of his Grameen America microfinance organization here.

The event at the Skirball Cultural Center drew several hundred people, many who came to see the man known as the Banker to the Poor. Yunus developed his ideas about using unsecured credit to fight poverty during a 1974 famine in Bangladesh, where he was an economics professor.

Yunus, 74, founded the Grameen Bank in 1983 and helped expand it to thousands of locations worldwide. In 2011, the Bangladesh government forced Yunus to resign his leadership of the bank, a controversial decision that officials said was due to Yunus’ advanced age.

He launched Grameen America in 2008. The eight branches in New York have a nearly perfect repayment rate from borrowers, Grameen says.

The organization, aided by $2.5 million from the California Community Foundation, hopes to eventually expand its two branches in Boyle Heights and Pico Union to 13 total and provide more than $650 million in microloans to 91,000 female-owned businesses.

Before heading to the Global Social Business Summit in Mexico City this week, Yunus spoke with The Times. Here is an edited version of that conversation.

What is it about Los Angeles that makes it a prime place for Grameen?

Entrepreneurial ability and potential is in everybody. So it’s not in L.A. or any particular community. We started to believe that is built into a human being no matter where he or she lives – no matter if they live in L.A., or the top of a mountain, or in a forest – same ability. But the facilities to explore those entrepreneurial abilities, to push those abilities to come out, don’t exist.

So we started in New York City, and many other cities were interested in doing the same. We were invited here, so that’s why we came. We don’t choose anything. If you ask us to go to some deserted area, we’ll be happy to do that, too. We go and try not to come to pre-judgment.

In Los Angeles, there are other microlenders such as Kiva Zip, OnDeck. Even regional banks such as CityNational saying they’re offering smaller loans. How do these other models compare to yours?

The more the better, as long as you reach the people. There’s plenty of room for many more to come. Everybody is welcome. Everybody is needed here. We’re doing something that worked in New York, and we just repeat what we have done, and that gives us confidence. We are not saying ours is the best, or ours is the worst.

Silicon Valley investor Peter Thiel has this idea that there are two kinds of progress – one where you build on what already exists, and another where you create something from nothing. How does that fit into your take on entrepreneurship?

The orientation that’s a given in our society and our educational institutions is that the purpose of your life is to get some job. I think that diminishes the human ability. Human beings have huge creative capacity. When you’re growing up, finishing school, you’re at the peak of that creative capacity. And now somebody says, go start a job. That’s very humiliating, to use this huge potential to go to the lowest point in a career, to do some repetitive job, squeezing your whole creative capacity into some kind of robotic capacity. It should be the other way, where you’re given the full opportunity to explore your own creative power.

Doesn’t that kind of thinking suggest you should never work under someone else, you should never follow someone else’s directive?

Yes, obviously. Why should you?

What about this idea of social business, where profit is not the top priority? What incentive does a bank have to follow a humanitarian route?

In social business, personal profit is zero. You can take back your investment money, but nothing beyond that. You’ve dedicated the business entirely, 100%, to solving problems, so you’re not mixed up with the personal and the collective. People give away money, and they don’t see anything wrong with that. I’m giving them another option, to invest it, to create a business, to become self-sustaining. That money can recirculate endlessly and do so much more powerfully than giving away money. Charity money has only a one-time use.

Why are the vast majority of Grameen loan recipients women?

Based on our experience in Bangladesh, money going to the families through women brings much more of a benefit than the same money going through a man. Women want to build it up for the future, they have a longer term vision. Women look at the family situation, improving the children’s situation, unlike the men, who try to concentrate on immediate gratification and enjoyment of life. We saw the same thing in other countries where the idea of microcredit has spread. It has to do with women culture, not country culture. Women and men both work in factories, but when they get their wages, men go to the pub and women buy groceries and go home. We don’t see women’s pubs anywhere in the world.

The 2014 Nobel Peace Prize is shared by a young woman named Malala Yousafzai, who argues for the rights and potential of children. How do children and their education play into your larger purpose?

In Bangladesh, we lend money to women, and they’re all illiterate. Their husbands are illiterate. We wanted to make sure their second generations are not illiterate. We made it happen – 100% literacy in Grameen families. We gave them education loans so they can go to universities, colleges, medical school. We have a whole new second generation with high education. It is built into our system. You’re more powerful with some knowledge. Your understanding of the world, your opportunities are wider when you have some education.

Twitter: @tiffhsulatimes

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.