Brian Roberts has been the force behind Comcast’s growth. Now he’s in the hunt for Fox

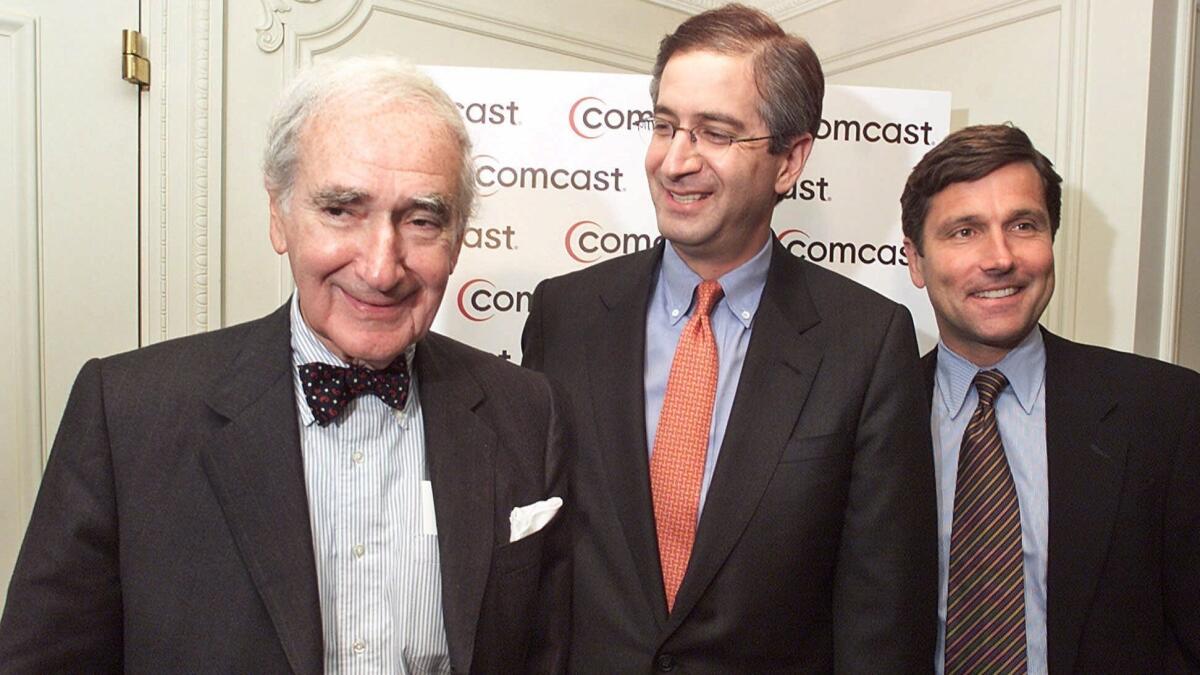

Brian Roberts was about 13 when he started working at Comcast in the early 1970s, earning 25 cents an hour assembling payment coupon books to send to the Philadelphia company’s cable TV customers. As a high school student, he would shadow his father — the company’s co-founder — at meetings with bankers and lawyers.

So when Roberts graduated in 1981 from the Wharton School, he figured he would work with his dad at Comcast. But Ralph Roberts suggested that he first spend a couple of years at another firm — advice that did not sit well with his son.

He was “persistent, day after day, until finally, he looked me in the eye and said: ‘Why are you rejecting me?” the late Ralph Roberts would recall in a 2003 book, “Wired to Win: Entrepreneurs of the American Cable Industry.”

Brian Roberts’ tenacity paid off: His father relented and sent him to a Comcast operation in Trenton, N.J. Brian Roberts climbed poles, strung cable wire and learned about marketing. He joined the corporate office in 1984, was named president in 1990, at the age of 31, and 12 years later became chief executive of Comcast.

In the last two decades, the 58-year-old mogul has been the force behind the company’s seemingly insatiable growth. He has orchestrated several highly successful media mergers, as well as bids that backfired.

Now he is expected to decide in the coming days whether to make another audacious move, this time attempting to sabotage Walt Disney Co.’s $52.4-billion deal to buy much of Rupert Murdoch’s 21st Century Fox. Rather than see the spoils go to Disney, Roberts wants to fortify Comcast with the Fox assets to better compete with Netflix and other tech giants that are invading the television space.

On Tuesday, a federal judge in Washington is expected to rule on another mega-merger — AT&T’s $85-billion bid for Time Warner Inc. If a judge clears the way for the deal, suggesting a favorable environment for big mergers, Roberts probably will join the Fox hunt.

Some Comcast investors already are worried about the cost of a bidding war — the company’s stock is down 20% this year. Murdoch turned down Roberts’ proposal in December of nearly $60 billion, even though it was 16% higher than an offer from Disney CEO Bob Iger.

Such high-profile rejection would discourage many CEOs, but not the indefatigable Roberts.

“Brian never gives up,” said NBCUniversal CEO Steve Burke, who has worked with Roberts for 20 years. “We have worked on a lot of deals together and he just out-hustles everyone. He’s a very persistent guy.”

The cable television industry was a patchwork of mom-and-pop operations in the 1960s. Big investors doubted the potential of what they viewed as folly: Who would pay good money for a monthly TV subscription when the signals were available over the air for free?

But the amiable, bow-tie-wearing Ralph Roberts took a chance. The former ad man was looking for a new career after unloading his belts, suspenders and accessories business (He worried that cuff links were going out of style.) So, in 1963, with two partners, Roberts bought a strapped cable TV system in Tupelo, Miss., with 1,200 customers.

Brian Roberts was 4 years old. The fourth of five children raised in a Philadelphia suburb, he long idolized his father. “I always wanted to work for my dad,” Roberts once told The Times. Ralph Roberts (who died in 2015) would tell underlings that he was amazed that his then-teenage son wanted to hang out with him. Their bond was legendary in cable circles.

This is very personal for Brian. Comcast is the only company he has ever worked for and the only company he will ever work for.

— Steve Burke, CEO of NBCUniversal

Even as a young man, Brian Roberts displayed a competitive streak.

When he entered the University of Pennsylvania, the lanky freshman joined the squash team. He stood 6 feet 2 inches and weighed about 125 pounds. His coach jokingly nicknamed him “Muscles.”

But he lifted weights and put in long hours of practice. By his senior year, he was Penn’s top player and an All-American. He took to heart his coach’s message: “No pain, no gain.”

After graduation, Roberts was a member of a U.S. squash team that won the silver medal at the Maccabiah Games in Israel in 1981 and 1985 (that year he also married Aileen Kennedy). Back then, the Penn graduate with owlish wire-framed glasses was mostly known as Ralph Roberts’ sidekick.

“He was like the backup guy, the one who carries the books,” former Turner Broadcasting Vice President Terry McGuirk said. He recalled an investor conference in the mid-1980s when Brian Roberts was about 25. Comcast was scheduled to make a presentation that day but a delayed flight prevented Comcast’s financial executives from attending. So Brian Roberts said he would wing it.

“For the next 45 minutes he talked off the cuff and the analysts in the room were blown away by the depth of his analysis,” said McGuirk, now chairman of the Atlanta Braves baseball team. “And I thought: ‘This is a guy who is going to have an impact on the industry.’”

Comcast helped accelerate the consolidation of the cable business with its huge appetite for acquisitions. The company gobbled Westinghouse cable systems, EW Scripps and Jones Intercable, among others. The game changer was its $47.5-billion takeover of AT&T Broadband in 2002, which transformed Comcast into the nation’s largest cable TV provider with 22 million customers in 38 states.

“His dad was a builder and a creator and they were always trying to build a bridge too far — buying companies that were bigger than they were,” McGuirk said. “But they always made it work.”

Today, Comcast is the nation’s largest internet service provider, with more than 25 million subscribers. It also offers phone service, including mobile phone subscriptions, and home security. Roberts has pushed to incorporate the latest technologies into the company’s offerings for customers. He and his team are known in the television industry for driving hard bargains.

“There are a lot of sons who succeed their fathers in the business who are not very good,” said Leo Hindery, a prominent former cable executive. “But Brian is the exception to the rule. He’s got his father’s values, his vision — and his courage.”

Roberts declined to comment for this article.

His merger attempts haven’t always gone smoothly. Comcast three years ago abandoned its takeover of Time Warner Cable when federal regulators said they would sue to block it. A decade before, in 2004, Roberts mounted an ill-fated hostile takeover of Disney — an effort that was poorly received in Disney’s boardroom and on Wall Street. Comcast’s stock tanked.

Nonetheless, Roberts was determined to bulk up his company with TV networks and other entertainment properties and, in December 2009, Comcast struck a deal to buy NBCUniversal from General Electric Co. About a year later Comcast assumed control of NBC, USA, Bravo, CNBC, MSNBC, Universal Pictures and Universal Studios theme parks.

“It’s been clear since Comcast tried to buy Disney that Brian has had ambitions to be a major player in the global media business,” telecommunications analyst Craig Moffett said.

Roberts’ mission for decades has been to mold Comcast into an entertainment and distribution powerhouse, said Burke, who was a rising star at Disney before he joined Comcast in 1998 with a mandate to help grow the business. After the 2004 Disney debacle, Burke brought in a former Fox executive, Jeff Shell, to build Comcast’s programming channels.

“We’ve had a clear strategy that has never wavered,” said Shell, now chairman of Universal Filmed Entertainment Group. “We’ve always known that we needed to get bigger and we need to become a more global company. Brian is clear-eyed about the future and he has unbridled ambition — the sky is the limit.”

The media industry is becoming like the great white shark: Companies have got to keep swimming or else they will sink.

— Leo Hindery, prominent cable industry veteran

Even after Murdoch rejected Comcast’s bid in December, Roberts’ retreat was short-lived. He launched a surprise attack Feb. 27 by announcing a $31-billion offer to buy Sky, the London-based satellite TV service that Rupert Murdoch helped launch in the late 1980s.

The move was startling because Fox has long owned 39% of Sky, and has been struggling since late 2016 to buy the remaining 61%. Disney also would like Sky, which has valuable sports rights. Iger has called it a “crown jewel.”

Last week, British regulators gave Comcast a green light to pursue its Sky bid. That means Disney must battle Comcast on two fronts — in the U.S. over Fox and in Europe over Sky.

Roberts’ entry isn’t a ploy to frustrate Iger or drive up the price of the assets, according to people close to him. Instead, Roberts wants Fox’s cable channels — National Geographic, FX and regional sports networks — along with Fox’s expanding operations in India and Latin America.

Also up for grabs is the controlling stake in streaming service Hulu as well as Fox’s prolific movie and television studios, which come with a deep trove of titles such as “Family Guy,” “The Simpsons” and “Planet of the Apes.”

“The necessary scale to be a relevant player in media is much larger than any of us imagined,” Moffett said. “You need to be global and you need production capabilities to feed the beast.”

Nabbing the Fox properties would boost Comcast at a crucial time. Amid the rise of streaming, consumers have been bypassing cable TV packages, which have long been Comcast’s bread-and-butter.

“Brian is trying to read the cards,” said Hindery, the former cable executive. “The media industry is becoming like the great white shark: Companies have got to keep swimming or else they will sink.”

Murdoch, for example, decided to sell much of his company after concluding that Fox might be too small to survive. Such fears have stoked the frenzy of consolidation in the media world. AT&T is trying to buy Time Warner; the controlling shareholder of Viacom and CBS wants to merge those two companies and Discovery just completed its deal with Scripps Networks, adding HGTV and Food Channel to its portfolio.

But Roberts faces significant hurdles in his bid for Fox, including persuading Murdoch that Comcast could win the approval of regulators — the main reason its bid was rejected by Murdoch in December. In the past, regulators have been wary about Comcast’s ownership of major entertainment channels as well as high-speed internet lines that consumers depend on for entertainment and other important tasks, such as schoolwork and applying for jobs.

Comcast also would have to take on heavy debt to finance the two cash acquisitions. Buying Sky and Fox could cost as much as $100 billion — a prospect that has troubled some Comcast investors.

Wall Street analysts have been divided over which company has an edge. Disney also might have to grapple with regulatory issues because the Disney and Fox movie studios combined would claim about 40% of the domestic box office. Disney also owns ESPN and adding Fox’s regional sports channels would give the Burbank giant a tight grip on sports. But last week, the government’s top antitrust regulator said a Disney-Fox combination “might be doable.”

Comcast is betting the battle will boil down to an old-fashioned bidding war. And, so far, Roberts has shown a willingness to write a bigger check.

“This is very personal for Brian,” Burke said. “Comcast is the only company he has ever worked for and the only company he will ever work for. In some ways, the company is his life’s work.”

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.