Column: The worst idea in the presidential debate: a return to the gold standard

Sen. Ted Cruz (R-Texas), seen from the press room during the CNBC Republican presidential debate on Oct. 28, when he made a pitch to return the U.S. to the gold standard.

The physicist Wolfgang Pauli had a concise retort to a theory or paper that was so fundamentally incorrect that it beggared analysis. Such work, he said, was “not even wrong.”

The judgment could be applied to an economic proposal being floated by Republican presidential candidate Ted Cruz and at least tacitly endorsed in one form or another by his rivals Rand Paul, Ben Carson, Mike Huckabee and Chris Christie: returning America to the gold standard.

As economic policy, a return to the gold standard would be so not right that it’s not even wrong.

The gold standard is one of the few economic nostrums on which progressives and conservatives agree. Neither side likes it. Here, for example, is James Pethokoukis of the conservative American Enterprise Institute: “When GOP presidential candidates talk about the gold standard, I’m not sure if they’re serious or just signaling a certain segment of voters obsessed about inflation and the dangers of ‘fiat money.’ I sure hope they’re not serious and this is just campaign season silliness.”

Freeing themselves from the gold standard enabled countries to regain control of their economic destinies.

— UC Berkeley economist Barry Eichengreen

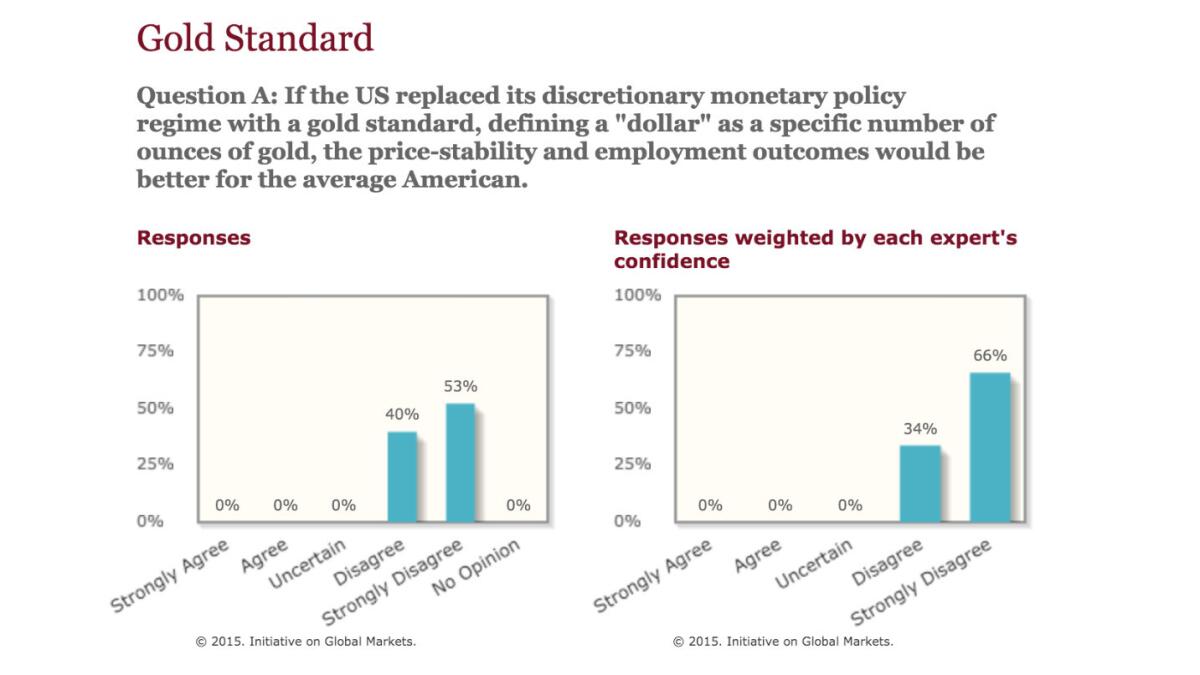

In 2012, the University of Chicago’s business school asked its panel of 51 experts, drawn from the entire spectrum of economic theory, if a return to the gold standard would improve the economic situation for the average American. Not a single one thought so. Franklin Roosevelt temporarily took America off the gold standard in 1933, but it was Richard Nixon, one of the presidents least likely to be mistaken for Franklin Roosevelt, who did so permanently in 1971.

As Pethokoukis observes, modern Republicans’ dalliance with the gold standard is really a dog-whistle aimed at those inclined to think that the federal government is one big conspiracy determined to crush the independent man by manipulating (that is, devaluing) his currency. The attacks on the Federal Reserve by Rand and Ron Paul are a related trope. If you only take the power of inflation away from Washington manipulators, the argument goes, an economic nirvana will follow.

Cruz has come closest among the candidates to stating this directly. “We need sound money,” he said at the Oct. 28 GOP debate hosted by CNBC. “I think the Fed should get out of the business of trying to juice our economy and simply be focused on sound money and monetary stability, ideally tied to gold.”

How many economists endorsed a return to the gold standard in this 2012 poll by the University of Chicago? None.

The notion that a return to the gold standard would mean hobbling the big bad federal government is cherished on the right, which applauded Texas Gov. Greg Abbott in June, when he established a state gold depository to rival Ft. Knox. One libertarian commentator called the move “symbolic in retaining some liberty, similar to gun ownership in this country.” An ostensibly independent campaign spending group calling itself the Lone Star Committee announced before Christmas that it would spend $1 million on campaign ads in New Hampshire supporting Cruz’s “sound money” pledge, bringing the policy full circle.

As economic historians concluded long ago, however, the idea that the gold standard provided stability is a myth. “Far from being synonymous with stability,” Barry Eichengreen of UC Berkeley wrote in “Golden Fetters,” his magisterial 1996 book on the gold standard and the Great Depression, “the gold standard itself was the principal threat to financial stability and economic prosperity between the wars.”

As far back as the 19th century, it was well understood that the “stability” provided by linking currencies and exchange rates to a fixed value of gold benefited only one economic class -- creditors, who desired the returns on their assets to be protected from inflation and to take primacy over every other interest group.

If the economy of one country ebbed relative to another, preserving the gold standard meant that something else would have to give -- laborers thrown out of work or wages brought down. If one sector lagged another -- say falling crop prices endowed city dwellers with cheap food but failed to produce enough income to keep farmers solvent -- there was no mechanism to bring farm prices into “parity” with industrial returns via inflation.

That’s why the bimetallism movement, which advocated linking money to silver as well as gold, gained so much support among wheat and cotton farmers. Its great spokesman was William Jennings Bryan, his clarion call the famous “Cross of Gold” speech at the 1896 Democratic convention, which nominated him for president. Conservative economist Milton Friedman listed as the “hard-money” or gold standard supporters chiefly those with gold-mining interests and “deflationists castigated by the free-silver forces, with some justice, as ‘Wall Street.’”

Another drawback of the gold standard was the constraint it placed on government economic planners during slumps. Upholding the standard in the teeth of the Depression, observed FDR’s second Treasury secretary, Henry Morgenthau, would have meant “a ruinous deflation of our prices, trade, and economic activity.” The Hoover administration, he said pointedly, had stuck to the gold standard even after it was abandoned by Britain and France, “evidently under the impression that that was a proud achievement, when it was obviously economic suicide.”

FDR cannily rebuffed Hoover’s insistence during the 1932 presidential campaign that he commit himself to “sound money,” then as now a euphemism for the gold standard. Soon after taking office he moved to let the dollar float against gold, announcing it to his Cabinet in a meeting at which his budget director, the conservative former Congressman Lewis Douglas, blurted out, “This is the end of Western civilization.”

For several weeks in late 1933 FDR set the day’s price of gold from his bedstead, moving it up and down almost at random to keep currency traders off-balance. John Maynard Keynes labeled this period “the gold standard on the booze.” Eventually FDR set the price at $35 per ounce. But he had established the principle that henceforth U.S. economic interests, not the externality of the gold price, would govern policy.

“Freeing themselves from the gold standard enabled countries to regain control of their economic destinies,” Eichengreen wrote. “It allowed them to print money when money was scarce. It allowed them to support their banking systems. It allowed them to take other steps to end the Depression.”

That flexibility is anathema to Cruz and his fellow gold bugs. The reason isn’t hard to fathom: “Sound money” is still atop the wish list of the creditor class they represent, wealthy bondholders who rail against budget deficits and aim to shrink government until every population sector’s interests but their own are liquidated.

The pre-1933 world in which their word was law is the one that Cruz wants us to return to. But the cry for gold is fundamentally a tantrum. It’s a childish rant that would destroy economic life for almost everyone. It’s not even wrong.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see our Facebook page, or email [email protected].

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.