Column: Consumer choice has suddenly revolutionized the electricity business in California. But utilities are striking back

Nearly 2 million electricity customers in California may not know it, but they’re part of a revolution.

That many residents and businesses are getting their power not from traditional utilities, but via new government-affiliated entities known as community choice aggregators. The CCAs promise to deliver electricity more from renewable sources, such as solar and wind, and for a lower price than the big utilities charge.

The customers may not be fully aware they’re served by a CCA because they’re still billed by their local utility. But with more than 1.8 million accounts now served by the new system and more being added every month, the changes in the state’s energy system already are massive.

Faced for the first time with real competition, the state’s big three utilities have suddenly become havens of innovation. They’re offering customers flexible options on the portion of their power coming from renewable energy, and they’re on pace to increase the share of power they get from solar and wind power to the point where they are 10 years ahead of their deadline in meeting a state mandate.

The pressure they’ve placed on the [investor-owned utilities] has produced a focus on competition that did not exist before.

— J.R. DeShazo, UCLA

But that may not stem the flight of customers. Some estimates project that by late this year, more than 3 million customers will be served by 20 CCAs, and that over a longer period, Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric could lose 80% of their customers to the new providers.

Two big customer bases are currently in play: In Los Angeles and Ventura counties, a recently launched CCA called the Clean Power Alliance is hoping by the end of 2019 to serve nearly 1 million customers. Unincorporated portions of both counties and 29 municipalities have agreed in principle to join up.

Meanwhile, the city of San Diego is weighing two options to meet its goal of 100% clean power by 2035: a plan to be submitted by SDG&E, or the creation of a CCA. A vote by the City Council is expected by the end of this year. A city CCA would cover 1.4 million San Diegans, accounting for half SDG&E’s customer demand, according to Cody Hooven, the city’s chief sustainability officer.

Don’t expect the big companies to give up their customers without a fight. Indeed, battle lines already are being drawn at the state Public Utilities Commission and local communities.

“SDG&E is in an all-out campaign to prevent choice from happening, so that they maintain their monopoly,” says Nicole Capretz, who wrote San Diego’s climate action plan as a city employee and now serves as executive director of the Climate Action Campaign, which supports creation of the CCA.

California is one of seven states that have legalized the CCA concept. (The others are New York, New Jersey, Massachusetts, Ohio, Illinois and Rhode Island.) But the scale of its experiment is likely to be the largest in the country, because of the state’s size and the ambition of its clean-power goal, which is for 50% of its electricity to be generated from renewable sources by 2030.

California created its system via legislative action in 2002. Assembly Bill 117 enabled municipalities and regional governments to establish CCAs anywhere that municipal power agencies weren’t already operating. Electric customers in the CCA zones were automatically signed up, though they could opt out and stay with their existing power provider. The big utilities would retain responsibility for transmission and distribution lines.

The first CCA, Marin Clean Energy, began operating in 2010 and now serves 470,000 customers in Marin and three nearby counties.

The new entities were destined to come into conflict with the state’s three big investor-owned utilities. Their market share already has fallen to about 70%, from 78% as recently as 2010, and it seems destined to keep falling. In part that’s because the CCAs have so far held their promise: They’ve been delivering relatively clean power and charging less.

The high point of the utilities’ hostility to CCAs was the Proposition 16 campaign in 2009. The ballot measure was dubbed the “Taxpayers Right to Vote Act,” but was transparently an effort to smother CCAs in the cradle. PG&E drafted the measure, got it on the ballot, and contributed all of the $46.5 million spent in the unsuccessful campaign to pass it.

As recently as last year, PG&E and SDG&E were lobbying in the legislature for a bill that would place a moratorium on CCAs. The effort failed, and hasn’t been revived this year.

Rhetoric similar to that used by PG&E against Marin’s venture has surfaced in San Diego, where a local group dubbed “Clear the Air” is fighting the CCA concept by suggesting that it could be financially risky for local taxpayers and questioning whether it will be successful in providing cleaner electricity. Whether Clear the Air is truly independent of SDG&E’s parent, Sempra Energy, is questionable, as at least two of its co-chairs are veteran lobbyists for the company.

SDG&E spokeswoman Helen Gao says the utility supports “customers’ right to choose an energy provider that best meets their needs” and expects to maintain a “cooperative relationship” with any provider chosen by the city.

The CCAs have been successful at holding on to their customers because they have several inherent advantages over the incumbent utilities. For one thing, they aren’t saddled with high legacy costs from the construction of big power plants or long-term contracts for renewable power at the high prices that prevailed just a few years ago. They’re not bound to pay dividends to shareholders — instead, those that achieve a surplus can funnel it back to their local communities in the form of job and training programs or other public amenities.

But it’s not clear that they can maintain their price differential over the utilities. State law prohibits the shifting of legacy costs from ratepayers and leaving a utility’s generating service to remaining customers, a concept known as “indifference.”

The principle is enforced through “exit fees,” which are charged to CCA customers to cover the embedded costs of older power plants and power contracts. Without this system, those costs would be shouldered by customers remaining with the utilities, which isn’t fair or economically sustainable. Utilities and some energy experts say the exit fees are too low, giving the CCAs a pricing advantage; the CCAs, for their part, say the utilities have been overcharging their customers.

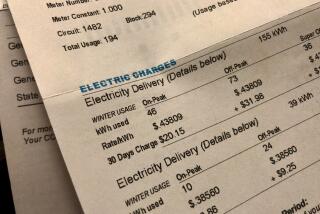

The fight is being waged before the Public Utilities Commission, which is pondering how to refashion its exit-fee calculations to meet the challenge of suddenly proliferating CCAs. A decision, expected within the next few weeks, could help determine whether the CCAs’ price advantage over the utilities is sustainable. (For a Marin CCA customer, the exit fee comes to about 3 cents per kilowatt-hour per month — a household using 400 kwh, for instance, would pay $12 per month.)

Another question is whether a fragmented system of 20 or more local CCAs is really up to the challenge of setting energy policy for the state as a whole.

“In the short term, they’re creating a lot of chaos in the regulatory space,” says Matthew Freedman, staff attorney at the consumer group TURN. “We have big goals in California. We’re committed to this low-carbon grid, and transforming the entire energy sector requires some degree of coordination and long-term planning. No one has figured out what the system’s supposed to look like for overseeing all this.”

The developing relationship between the utilities commission and the CCAs isn’t auspicious. CCAs universally condemned a white paper issued last month over the signature of commission President Michael Picker. The paper said the “splintering” of central decision-making on energy raised the specter of a repeat of the 2000-01 energy crisis, which was caused by hasty deregulation of the state’s energy market.

The paper was “a search for a problem for which it didn’t offer a solution,” said Ted Bardacke, executive director of the Clean Power Alliance, the Los Angeles/Ventura CCA.

Amid the chaos, the advent of CCAs already has transformed California’s electricity market in ways that may well be here to stay.

“The pressure they’ve placed on the [investor-owned utilities] has produced a focus on competition that did not exist before,” says J.R. DeShazo, director of UCLA’s Luskin Center for Innovation and coauthor of a 2016 study of California CCAs. “So a competitive dynamic already has emerged that has been beneficial to consumers.”

That’s correct. Customers of Edison, PG&E, and SDG&E today can ask that 50% or even 100% of their power come from solar, typically at a slightly higher price than standard billing. (At SDG&E, the price might be lower.)

If CCAs didn’t exist, would the utililies still offer these choices at a reasonable price? The betting here is that the answer is no. That’s as good a reason as any to appreciate the changes that CCAs have wrought.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.