Must Reads: The crowd-sourced, social media swarm that is betting Tesla will crash and burn

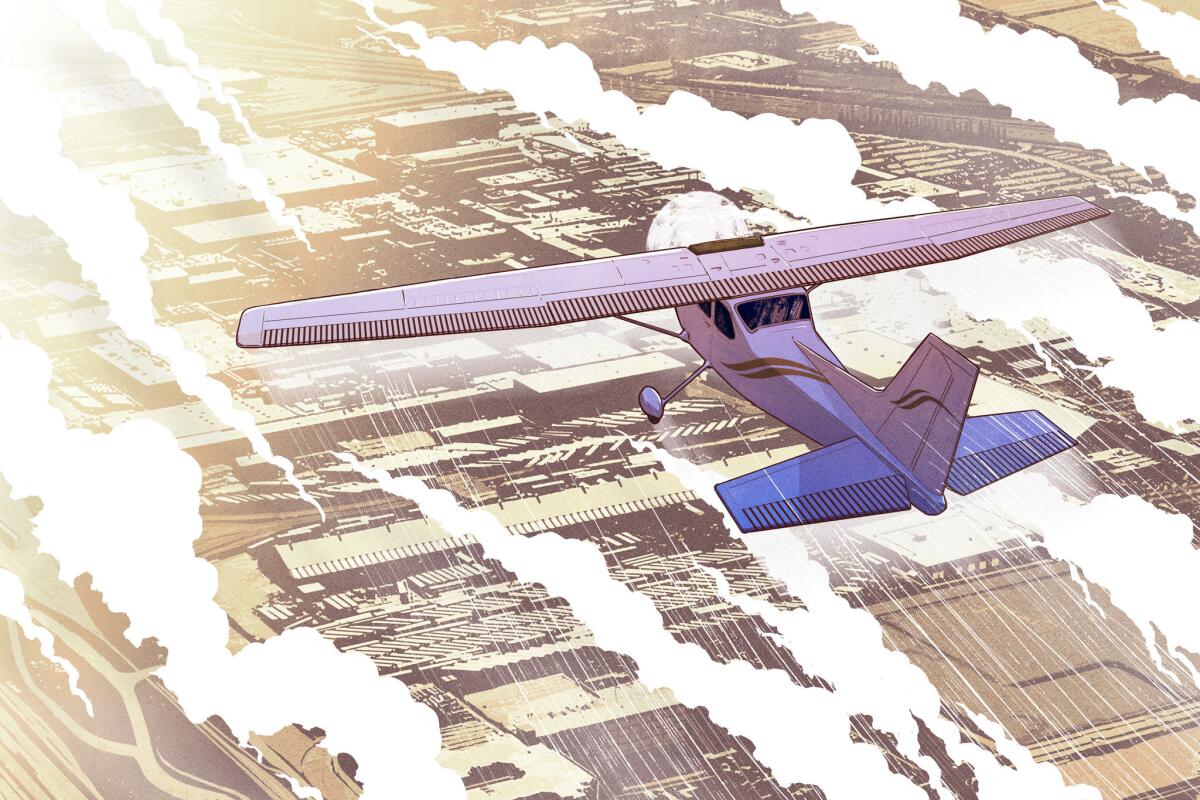

It’s a sunny day in March and “Machine Planet” is flying a single-engine Cessna over Northern California. He’s cruising at 1,500 feet toward a massive lot leased by electric-car maker Tesla. His mission: to burst the Tesla bubble. And make some money doing it.

What he sees today makes his eyes widen: more than 100 car-carrier trailers, the kind you see on highways hauling new cars to dealers. They’re lined up in neat rows. Empty. Idle.

“Ten days left in the quarter, and they’re just sitting there,” said Machine Planet, peering down at the remote landscape outside Lathrop. Tesla bought those trailers to aid what Chief Executive Elon Musk said will be an unprecedented wave of new car deliveries in March. But to Machine Planet — that’s the name he uses on Twitter — the scene just confirms his suspicions that there are lots all around the U.S. filled with unsold Tesla cars. (He and others claim to have counted 52.)

If you spend any time on the Twitter hashtag $TslaQ, you know what this means to Tesla short sellers. They believe the lots full of new Model 3s — and Models S and X vehicles, too — show Tesla has reached a cliff in demand for its vehicles. When the rest of the world finally admits the company’s days as a fast-growth story are numbered, they say, its stock price will crash, creating a bonanza for investors who, like Machine Planet, have bet big that Tesla’s shares are grossly overvalued.

The pilot banks his plane hard to the left and starts snapping pictures with a Canon 6D.

For as long as there have been stock markets, there have been short sellers wagering that companies will fail. Their notoriety stemmed from their dirt-digging tactics. Napoleon supposedly called them “enemies of the state.” Some blamed them for the stock market crash of 1929.

Short seller Jim Chanos took a position against Enron and won when the company was revealed to be an accounting fraud. Bill Ackman claimed Herbalife was a pyramid scheme; he slunk away after five years, the company still intact.

But the war on Tesla is unique. Musk has used Twitter to cultivate a cult-like following as a tech revolutionary. Fittingly, his nemesis is a social media swarm, made up largely of anonymous contributors with made-up names and colorful avatars.

Tesla has said there is no mystery to the car-filled lots — they are distribution points for final delivery to customers. As to the empty trailers, a Tesla spokeswoman said “not all our carriers would be in use at all times. Some might be in maintenance.”

The sidewalk spy

Machine Planet belongs to a large and growing network of Tesla skeptics who connect on Twitter through $TslaQ — Tesla’s stock symbol, followed by Q, a stock exchange notation for a company in bankruptcy. Which Tesla, to be clear, is not. What Tesla is, relatively speaking, is heavily shorted: About 32.7 million of its shares, or 27.7% of those available for trade, have been borrowed by short sellers and then sold. They must be paid back at some point — at a lower price, the shorts hope.

Pronounced Tesla-Q, the channel has emerged as a crowd-sourced stock research platform. Contributors divide up research duties according to personal interest and ability, with no one in charge.

Some use commercial databases to track Tesla-loaded ships from San Francisco to Europe and China. Some are experts at automotive leasing or convertible bonds. Some repost customer complaints about Tesla quality and service. One contributor, whose Twitter handle is TeslaCharts, assembles collected data to offer graphical representations of Tesla’s own reports and $TslaQ’s findings.

And some do reconnaissance, posting photos and videos of Tesla storage lots, distribution centers, even the company’s Fremont assembly plant as seen from above.

A major aim is to change the mind of Tesla stock bulls and the media. The research helps individual short sellers decide when to move in and out of the stock. But it’s clear from the posts that $TslaQ can be just as vitriolic as Tesla fans are adoring.

“I go out of my way to listen to them because I want to hear the worst things people can come up with about stocks I have a position in,” said Ross Gerber, head of Santa Monica portfolio management firm Gerber Kawasaki, who is impressed by much of $TslaQ’s research.

But he’s been subject to personal attacks from some $TslaQ members, and said too much emotion from the short sellers can degrade some of the solid research they offer up.

“A lot of their premise is emotional,” he said. “They hate Musk. They think he’s a fraud; they think he’s a liar.”

Although activist investors have been around for years, the networked nature of this research and publicity campaign is new, said Byoung-Hyoun Hwang, a Cornell University finance professor who’s studied social media’s effect on financial markets. “The diversity of perspectives, not just a diversity of opinions, could be very valuable,” he said.

Most $TslaQ posters try to remain nameless, citing the repercussions faced by some Tesla critics, including death threats to some $TslaQ members and harassment by Musk himself.

On a Hawthorne sidewalk not far from another Musk company, SpaceX, a man raises his iPhone to get a good camera angle.

It’s after dark. Model 3s by the hundreds are parked inside a lighted-up three-level parking garage. The cars are covered in dust. According to the man, some have been in there for months.

“I wanted Tesla to make it,” he says as he taps the big red button. “I’m a car guy, man. The Model S was a great car, especially when they came out with the dual motor.”

The man says he works for a short seller who goes by the Twitter handle Latrilife. In return for scouting out and monitoring Tesla delivery centers and storage sites around L.A., he gets $20 an hour.

Such storage practices are “extremely unusual” in the auto industry, said Bill Hampton, a Detroit veteran who runs AutoBeat Daily, an online industry newsletter.

Tesla doesn’t have traditional dealers, whose lots are filled with Fords, Chevys and Hondas awaiting buyers. That could account for some of Tesla’s scattered inventory, he said.

“But cars shouldn’t be sitting in staging lots for that long under any circumstances,” he said, “unless you have too many cars.”

Tesla declined to discuss the cars in the Hawthorne lot.

Montana Skeptic gets outed

$TslaQ has no leader, but it does have a hero. His name is Lawrence Fossi, a lawyer and New York money manager who contributed to the Twitter hashtag as well as investor site Seeking Alpha under the moniker Montana Skeptic — until he was exposed by Musk.

According to Fossi, after he was outed on Twitter last July, Musk personally called the small investment office he works for. Musk told his boss he wasn’t happy about the online activity and threatened to sue Fossi for defamation. (Tesla doesn’t dispute that Musk contacted the company.)

Meanwhile, Tesla’s public relations department sent emails to the media naming Fossi and encouraging reporters to call his boss — phone number included. The communications executive involved declined to discuss that matter.

“I had never before heard from Tesla or Elon Musk to correct anything I wrote,” Fossi said. “I would have been happy to correct anything that was wrong.”

Fossi said he didn’t take the lawsuit threat seriously, “but I couldn’t afford to drag my boss into this.” So he quit writing for Seeking Alpha and deactivated his Twitter account.

Musk “won the first round,” Fossi said. But $TslaQ gained more visibility and followers in the months that followed. The Tesla short thesis, Fossi said, “is getting a lot more coverage than it would have gotten if Musk had kept his big mouth shut, which is apparently beyond his capacity.”

Musk declined to be interviewed for this story. But the $TslaQ phenomenon clearly vexes him. He calls Twitter a “war zone” and regularly attacks short sellers. His taunts sometimes produce a stock price boost.

Starting last May, Musk amped up his battle with the shorts, promising “the short burn of the century” on Twitter. On July 23, four days after Machine Planet posted photos of hundreds of cars parked at a facility outside Stockton, Musk phoned Montana Skeptic’s boss. And on Aug. 7, Musk issued his infamous “420” tweet, in which he claimed he had “funding secured” to take Tesla private at a premium price — $420 a share.

Some short sellers got burned as the stock price immediately rose by nearly 13%. But so did bull investors who thought the deal was real. It wasn’t, and by Aug. 20, as reality sank in, Tesla shares were down almost $100 a share, or 25% from pre-tweet levels. The episode landed Musk in deep trouble with the U.S. Securities and Exchange Commission. Musk settled fraud charges in September, but the SEC has since asked a federal judge to hold him in contempt of court, saying he violated terms of the agreement with subsequent tweets. Last Thursday, the judge told the SEC and Musk to work out a remedy.

The short thesis gained traction last week when Tesla announced a dramatic drop in deliveries in the year’s first quarter — Model 3 deliveries fell 19% from the previous quarter, and older Models S and X models tumbled 56%.

“The fundamental narrative around Tesla appears more clouded than we have seen in several years,” Morgan Stanley stock analyst and Tesla bull Adam Jonas wrote well before the numbers were released, in a March 20 investment note. Tesla bull Gerber says the numbers were “a bit light” but sees great things ahead for the company.

Tesla insists that U.S. orders for the Model 3 are strong, and that the company simply couldn’t deliver all ordered vehicles in the first quarter. And it says, even with the sharply lower deliveries, the Model 3 was the top-selling midsize luxury sedan.

Tesla’s stock closed at $274.96 on Friday, down from an all-time high of $385 in September 2017. Wall Street sentiment on the company has chilled. Several Wall Street analysts have lowered their stock price targets in recent weeks.

A threatening fax

Citing the case of Fossi, several $TslaQ contributors agreed to talk only if they could remain anonymous.

Contributors to $TslaQ contacted by The Times said they feared retribution from Musk’s most extreme supporters. Some say they have received death threats over Twitter. Paul Huettner, an investment banker in New York City who dares use his real name, said he received a message threatening his family on an old-fashioned fax machine. In the header, it said, “From: Elon Musk.”

Huettner didn’t believe Musk was involved, but he found the message frightening and reported it to the FBI.

Machine Planet is 60 years old, tall and trim. The semiretired marketing executive worked at several well-known Silicon Valley companies. Now he’s a contract consultant, an avid pilot and an investor with an eye for overvalued stocks. He scored well, he said, with big short bets against Bear Stearns and Lehman Bros. in the early days of the Great Recession.

Tesla first attracted Machine Planet’s attention about three years ago, he said, because it seemed as much a cult as a company.

“If you went by media reports, you got the impression that Elon Musk was the only guy who worked there,” he said. “I always see that as a bad sign. I mean, Steve Jobs, all his lieutenants became pretty well known. I put Tesla on my background list.”

In April 2018, laid up after surgery, he listened to a lively conversation about the short case on the irreverent financial markets podcast Quoth the Raven.

“I found there was this whole community of people studying this company. I got sucked in completely over the next two months.”

He started shorting.

He had nothing against Musk at the time. “It was purely financial. My opinion of Musk was very neutral,” he said. “The double landing of SpaceX rockets? I was impressed as anybody else.”

But he noticed car-buyer demand was a big topic on $TslaQ. Contributors posted Google satellite shots of lots in remote locations, far from the company’s Fremont factory, where cars were being stored.

One spot was in Lathrop, not far from Stockton, in an unirrigated section of the Central Valley known as the “dust bowl.” A couple of $TslaQ contributors had spotted an ad for Tesla jobs there. They found what seemed like hundreds or thousands of Model 3s being trucked into a lot through a gate and behind fences. But they couldn’t get a good look inside.

“So I flew to Lathrop,” Machine Planet said. “There was this amazing moment when I realized the entire facility was packed with cars.” More than 3,000, he said.

“That was entirely the moment where we went from kind of believing Elon about demand and not being able to build enough cars to [finding evidence that] the cars are either not sold or not salable.”

The Shorty Air Force is born

Headed back to the airport, he tweeted his findings: “The SAF can confirm thousands of cars at Lathrop. Photos tonight. 7/19/2018 4:31 p.m.”

He got a tweet back. “SAF?”

“Shorty Air Force,” he said. He’d made the name up on the spot.

By the time he’d landed, $TslaQ contributor Zach Hanover had designed a Shorty Air Force shoulder patch logo based on a World War II design.

The flyover nudged others into action.

Latrilife, who says he has “six figures” invested in short bets that Tesla’s stock price will plummet, hired a helicopter to photograph the Hawthorne garage’s top level, the view of which was inaccessible from the public sidewalk. “We don’t trespass,” Latrilife noted.

One man started sending a drone over automobile auction houses, posting videos of Teslas stored there.

A loosely formed Shorty Ground Force began posting pictures of Teslas stored for weeks on lots across the country. Crow Point Partners, an investment firm with a short position in Tesla, periodically posted pictures of Model 3s parked in Norwood, Mass., covered in deep snow. The snow recently melted, but most of the cars are still there, the firm contends.

Just last Tuesday, a $TslaQ contributor posted a video that appeared to show dozens of Teslas parked on the fifth floor of a shopping mall parking garage in Buena Park.

Follow the solar panels

In an age of social media Photoshop fakes, it pays to be leery about anything that appears on Twitter or elsewhere online. So The Times flew with Machine Planet and spent a day in Los Angeles with Latrilife and the man he hired to take photos.

A reporter roamed a public parking lot outside the Crunch Gym in Burbank, where more than 100 Teslas sat. The vehicle identification numbers showed that many were manufactured in 2018.

Machine Planet has created a website called Crowdsourced Tesla Research at tslaq.org, in part to escape the snark and hot takes that infect Twitter. He said readers could draw their own conclusions, but “we think there are at least 10,000 unsold Model 3s out there.”

He backs up his assertion with data from IHS Markit, a market research firm, as reported recently in the New York Times: Tesla said it delivered 245,000 cars in 2018. Most were in the United States. But IHS said only 164,000 were registered nationwide.

An IHS spokeswoman said the timing of reported sales could account for some of the difference, but for the full story, “your questions are best to be addressed to Tesla.”

The shorts say distorted sales claims fit with a long list of hyperbolic and misleading Musk statements:

His 2017 assurance to Wall Street analysts that they should have “zero doubt” Tesla would hit a production level of 10,000 cars a week by the end of 2018. The company has yet to achieve a steady rate of half that number.

Or his 2016 solar tile demonstration, a product that was supposed to revolutionize the residential solar market by embedding solar panels into the roof itself. But the tile he held in his hands turned out to be a nonfunctional mock-up, and more than two years later, the technology isn’t ready for commercial distribution, though Tesla continues to take deposits from customers.

Machine Planet says his interest in Musk is both pecuniary and personal.

“If I didn’t have an opportunity to personally profit from this and cover my expenses, I wouldn’t be here,” he said. But “this guy attacks us. Justice is important too.”

Twitter: @russ1mitchell